By the end of 2025, the GTA housing market had become more affordable. Buyer caution and higher inventory shifted negotiating power toward purchasers, easing prices and borrowing costs and setting the stage for renewed activity once economic confidence improves.

Recap of GTA 2025 Market Fundaments:

- 62,433 home sales were reported through TRREB’s MLS® System, down 11.2% from 2024

- 186,753 new listings were recorded, up 10.1% year-over-year

- The average selling price for 2025 was $1,067,968, a 4.7% decline from $1,120,241 in 2024

The combined effect of higher inventory and lower prices materially improved affordability across most housing types.

December 2025 GTA Market Performance at a Glance

GTA December Sales & Listings

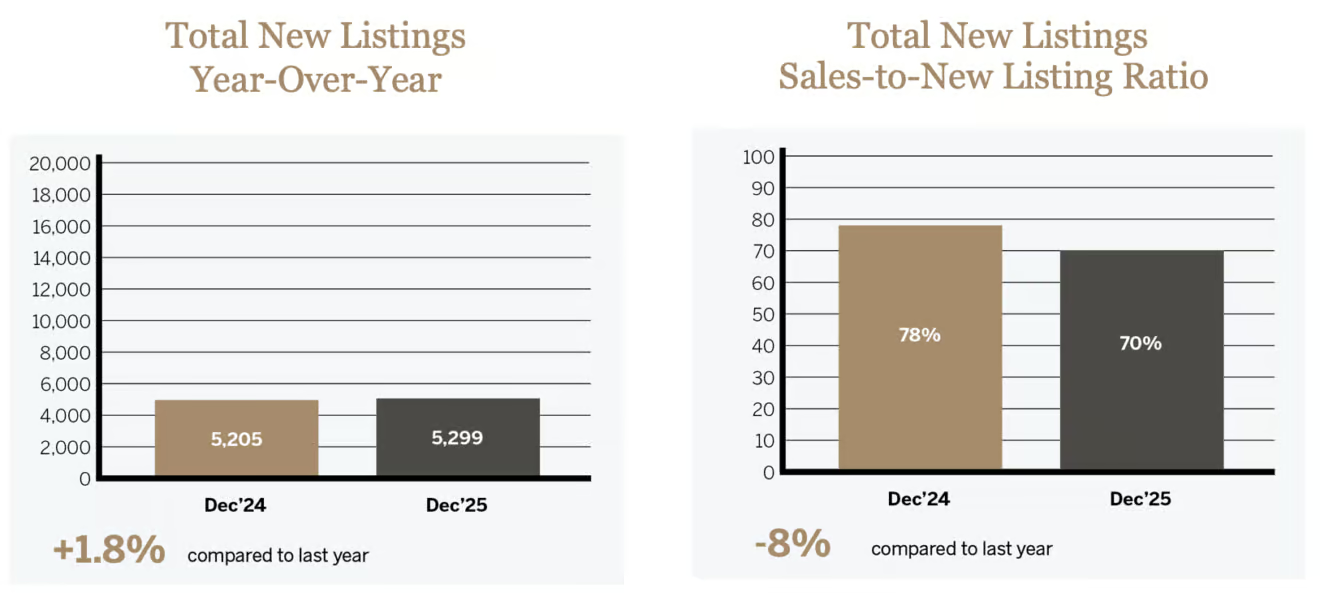

- 3,697 GTA home sales were reported in December 2025, down 8.9% year-over-year.

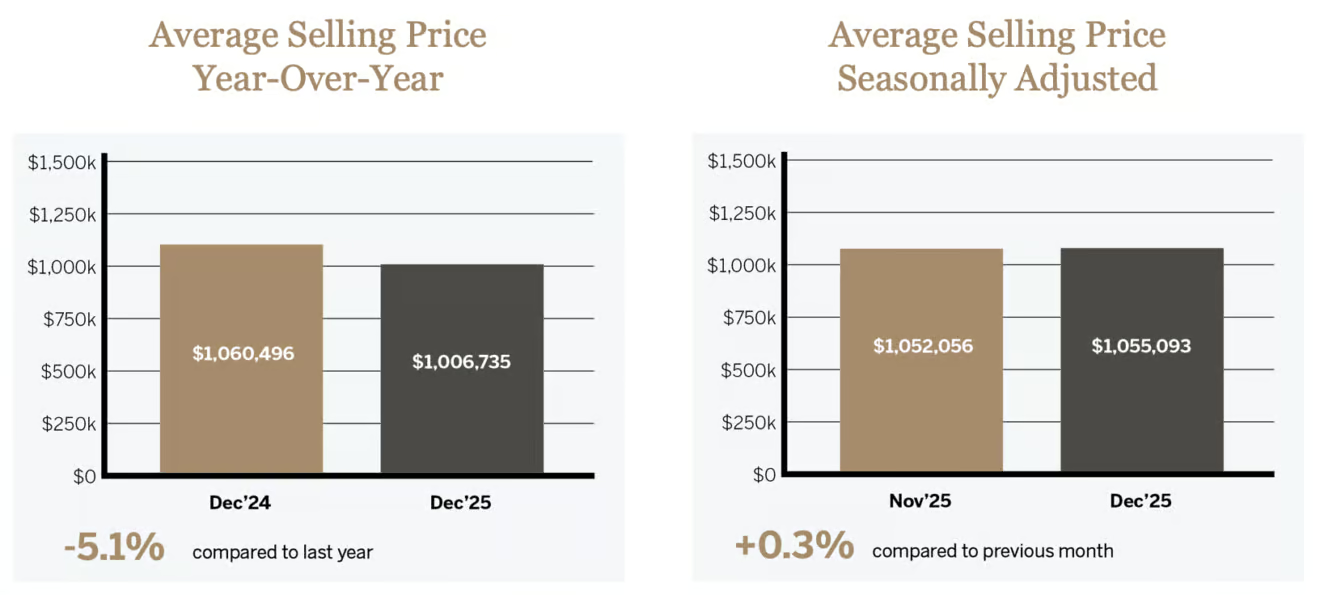

- New listings increased modestly to 5,299, up 1.8% YoY, keeping inventory elevated relative to sales activity.

- The Sales-to-New Listings Ratio (SNLR) remained in balanced-to-soft territory, reinforcing a buyer-favourable environment.

This combination — fewer sales but steady listing flow — continues to relieve upward price pressure and expand buyer choice.

Price Trends

- The average GTA selling price in December was $1,006,735, down 5.1% YoY.

- The MLS® Home Price Index (HPI) composite declined 6.3% YoY, continuing a controlled, data-consistent correction rather than a disorderly drop.

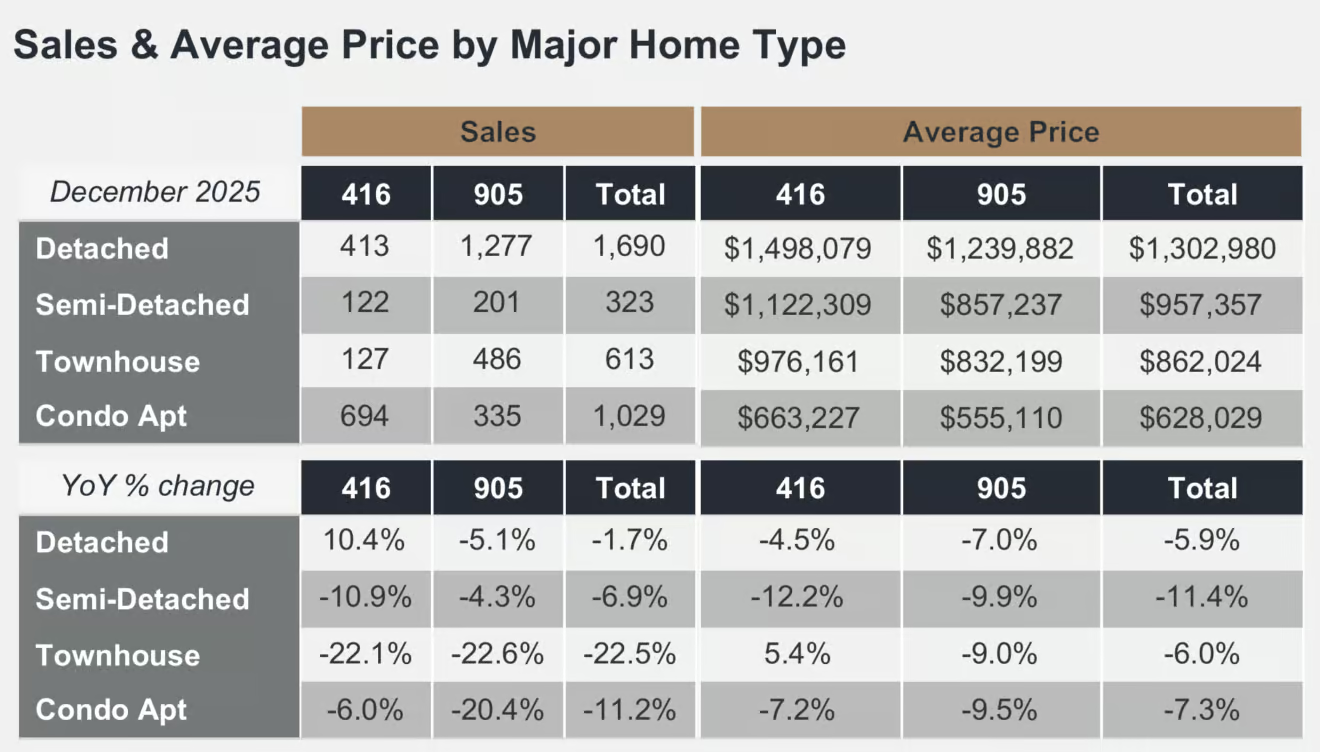

By Housing Type:

- Detached homes: prices down approximately 7–9% YoY

- Semi-detached & townhomes: declines in the mid-to-high single digits

- Condominiums: down ~4–6% YoY, with greater dispersion by location, age, and investor concentration

The takeaway is not weakness — it is normalization.

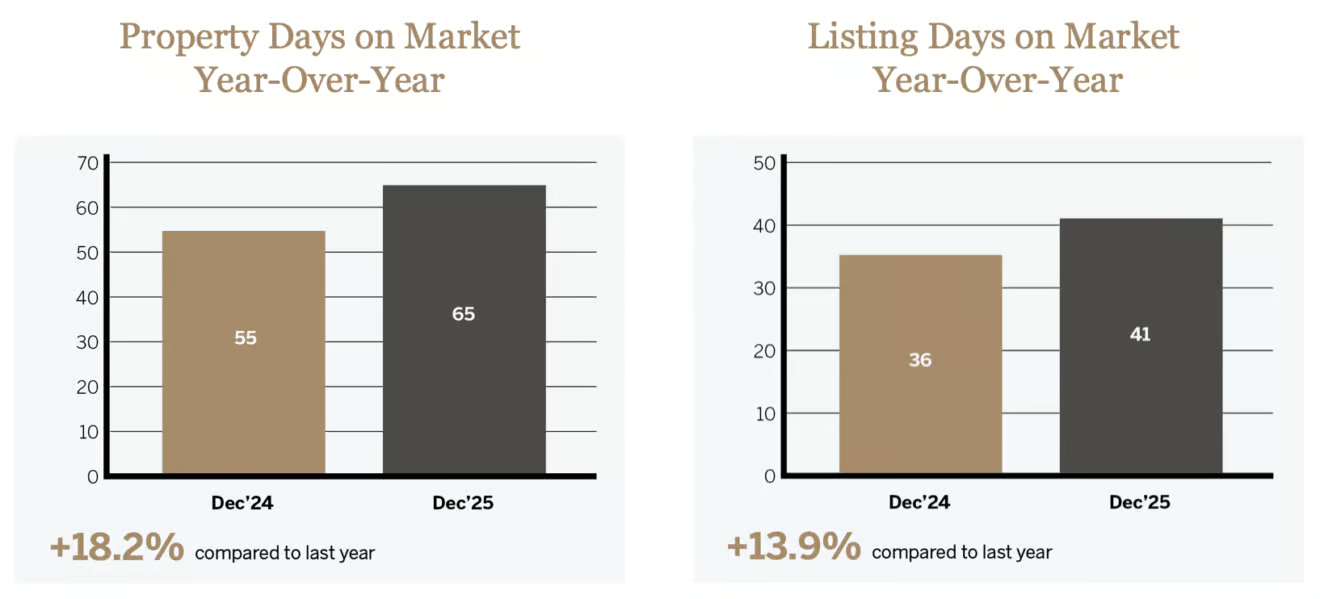

Days on Market

- Average Property Days on Market (PDOM) increased for the year into the mid‑50‑day range, up materially from last year.

- Listings that are mispriced or poorly positioned are lingering, while well-prepared homes continue to transact.

Time, leverage, and conditionality remain on the buyer’s side — for now.

Why Confidence Matters — and Why the Outlook Is Improving

Employment: The First Domino

National employment data turned meaningfully positive late in 2025, with multiple months of job gains. Historically, employment stability is the single most important precursor to housing re‑engagement.

Households are increasingly aware of improved affordability — but confidence in employment remains the final hurdle. That hurdle is lowering.

Interest Rates: Stability Before Relief

- The Bank of Canada held its policy rate through year‑end.

- Bond yields stabilized, allowing select fixed‑rate mortgage pricing improvements.

- Forward guidance increasingly suggests no rate hikes in early 2026, with potential easing later in the year, contingent on inflation and labour data.

Markets move before headlines. Buyers who wait for perfect clarity historically re‑enter alongside renewed competition.

First-Time buyers: Willing, Watching and Waiting:

Bank Survey data continues to show:

- Strong desire to buy

- Elevated anxiety around timing

- A reliance on trusted, data‑driven guidance to act.

This cohort does not need perfect rates. It needs structure, clarity, and confidence.

The Condo Market: Oversupply Today, Scarcity Tomorrow

The condominium segment remains the softest part of the market:

- Elevated inventory levels

- Reduced investor participation

- Slower absorption, particularly in investor

- Heavy downtown projects

At the same time:

- New construction starts have fallen sharply

- Development financing has tightened

- Pre‑construction pipelines are shrinking

This creates a familiar paradox: near‑term pressure followed by structural undersupply. History suggests today’s excess becomes tomorrow’s shortage — especially once population growth and employment momentum reassert themselves.

For Sellers: Discipline Outperforms Delay

Waiting alone is not a strategy. Successful sellers in this market are those who:

- Price to today’s buyer — not yesterday’s peak

- Prepare thoroughly and present professionally

- Understand that buyers are comparing value more rigorously than at any point in the past decade.

Homes that respect these fundamentals continue to sell. Homes that do not invite reductions — and time erosion.

For Buyers: A Quiet Window of Leverage

Conditions currently favour buyers willing to act decisively:

- Less competition

- Longer decision timelines

- Greater negotiating flexibility

- Improved affordability relative to peak pricing

This window historically closes before rate cuts appear in headlines.

Why Fewer REALTORS® Can Be Good News for Buyers and Sellers

In 2025, the GTA housing market shifted meaningfully. Fewer homes sold, more listings came to market, and prices adjusted downward — improving affordability and restoring balance.

At the same time, the number of new REALTORS® entering the industry dropped sharply. This isn’t a coincidence.

When markets slow, success depends less on momentum and more on experience, pricing accuracy, and negotiation skill. As a result, many casual or short-term entrants step back, while seasoned professionals remain active.

That’s good news for consumers.It means today’s market is increasingly served by REALTORS® who act as trusted advisors, not just transaction facilitators — professionals focused on strategy, risk management, and long-term outcomes.As confidence returns and activity picks up, buyers and sellers will be entering a market that is not only more affordable, but better served.

Let’s Talk Strategy

1. Request Your 2026 Strategic Market Plan

- A personalized plan that aligns your goals with where the market is heading—not where it has been.

2. Book a Pre-Spring Pricing & Positioning Consultation

- Essential for sellers considering listing between February and June 2026.

3. First-Time Buyer Roadmap: Unlock Your Path to Ownership

- Designed for buyers seeking clarity, confidence, and trusted guidance.

If you’d like a custom neighbourhood-level snapshot, a mortgage review, or insights specific to your property or goals — reach out today. I’m ready to provide you with clarity, strategy, and a steady hand through these shifting conditions.

Get Strategic Guidance

Whatever your needs—from navigating the luxury real estate market to solving commercial real estate problems—we guide you with proven strategy and objective advice.