June Market Update: More Listings, Improved Affordability

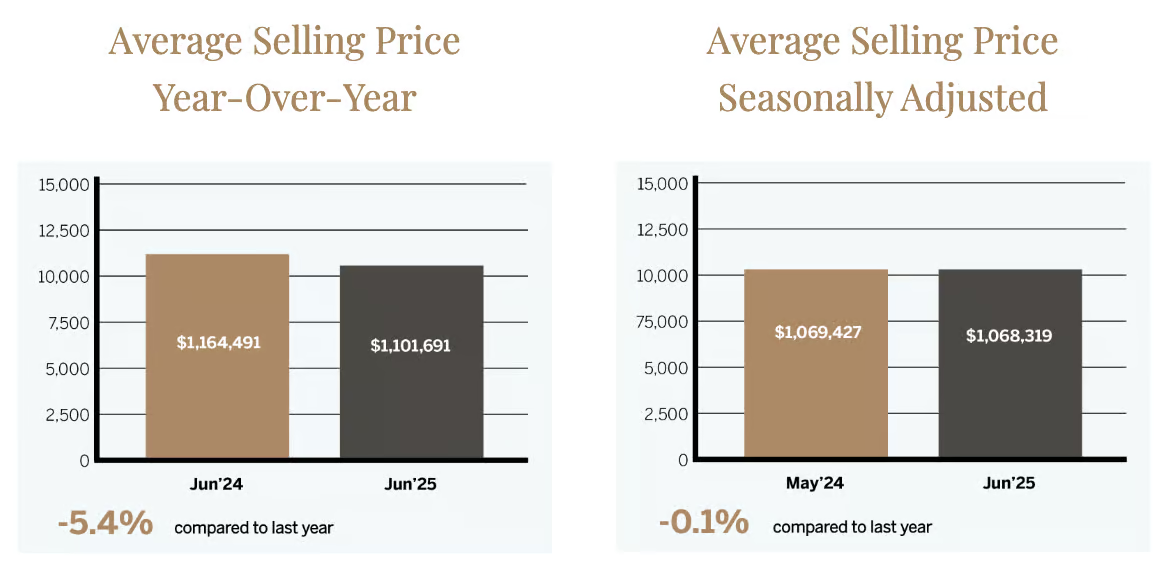

Ownership housing affordability continued to improve in June 2025. Average selling prices and borrowing costs remained lower than last year’s levels. However, despite some month-over-month momentum, many would-be homebuyers remained on the sidelines due to economic uncertainty.

The GTA housing market continued to show signs of recovery in June. With more listings available, buyers are taking advantage of increased choice and negotiating discounts off asking prices. Combined with lower borrowing costs compared to a year ago, homeownership is becoming a more attainable goal for many households in 2025.

Affordability on the Rise Amid Signs of Market Recovery

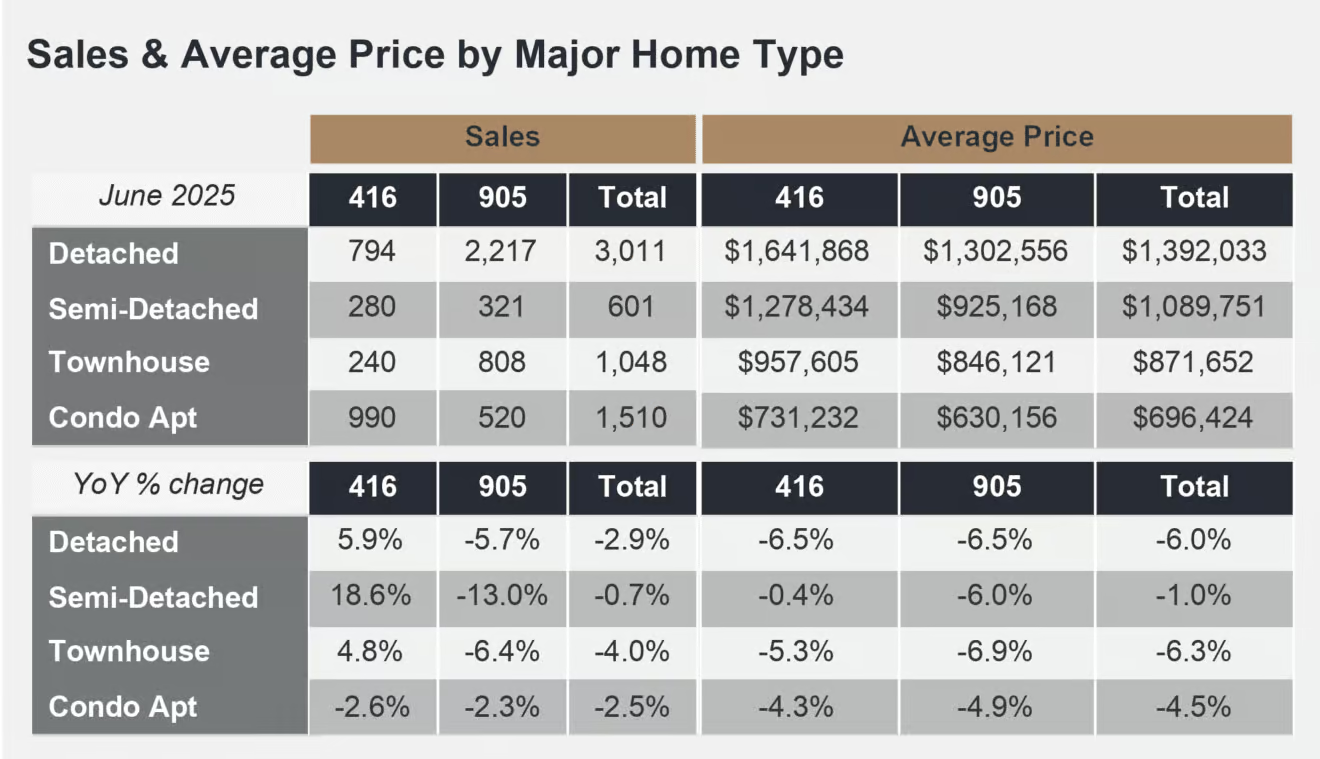

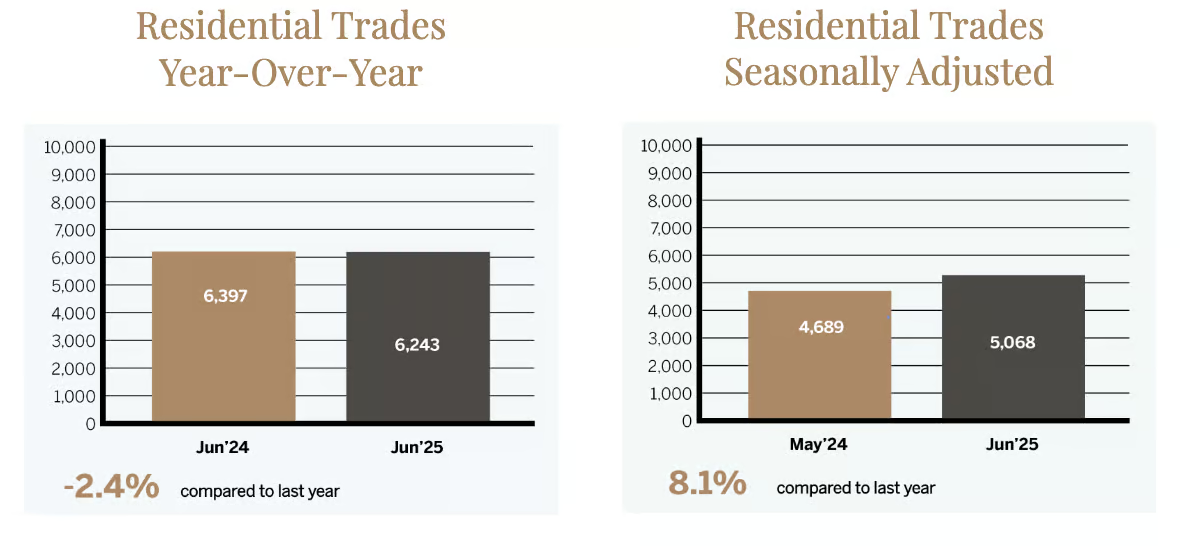

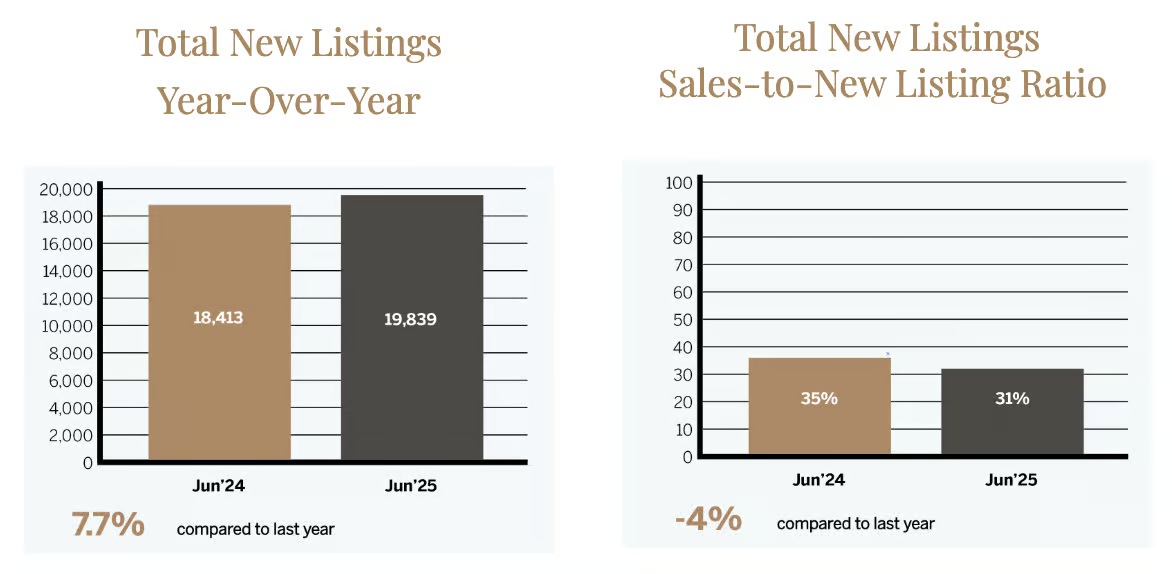

Greater Toronto Area (GTA) REALTORS® reported 6,243 home sales through TRREB’s MLS® System in June 2025 – down by 2.4 per cent compared to June 2024. New listings entered into the MLS® System amounted to 19,839 – up by 7.7 per cent year-over-year.

On a seasonally adjusted basis, June home sales increased month-over-month compared to May 2025. New listings declined compared to May. The monthly increase in sales coupled with the monthly decline in new listings continued the tightening trend experienced during the spring.

Ownership Affordability Improves, but Confidence Still Wavers

In June 2025, the Greater Toronto Area (GTA) housing market continued to recalibrate. GTA REALTORS® reported 6,243 home sales through TRREB’s MLS® System, down 2.4% compared to June 2024, but slightly higher than May on a seasonally adjusted basis. Despite improved affordability from lower borrowing costs and softening prices, many buyers remained cautious, held back by economic uncertainty.

Key Highlights

- Average selling price: $1,101,691 (down 5.4% Year-over-Year)

- Home Price Index: down 5.5% Year-over-Year

- Sales: 6,243 (down 2.4% Year-over-Year)

- New listings: 19,839 (up 7.7% Year-over-Year)

- Active listings: 31,603 (up 30.8% Year-over-Year)

- Average Days on Market: 20

- Average Price-to-List Ratio: 98%.

Market Trends and Buyer Behaviour

Buyers continue to leverage increased inventory and lower financing costs to negotiate below asking prices. The Sales-to-New Listings Ratio (SNLR) fell below 35% in many municipalities, indicating a buyer’s market with continued downward pressure on prices.

The Bank of Canada’s June 2025 rate cut has begun to ease monthly payment burdens, yet uncertainty around GDP growth, U.S. trade relations, and upcoming mortgage renewals remain key concerns for households and investors alike.

What We’re Watching

- Another BoC rate cut in Q3 could spark a mild rebound.

- Homeowners with upcoming renewals face 35–60% payment shocks.

- Federal policy clarity on housing supply and crime response will shape Q4 market tone.

Get Strategic Guidance

Whatever your needs—from navigating the luxury real estate market to solving commercial real estate problems—we guide you with proven strategy and objective advice.