Residential Trades – Steady but Selective

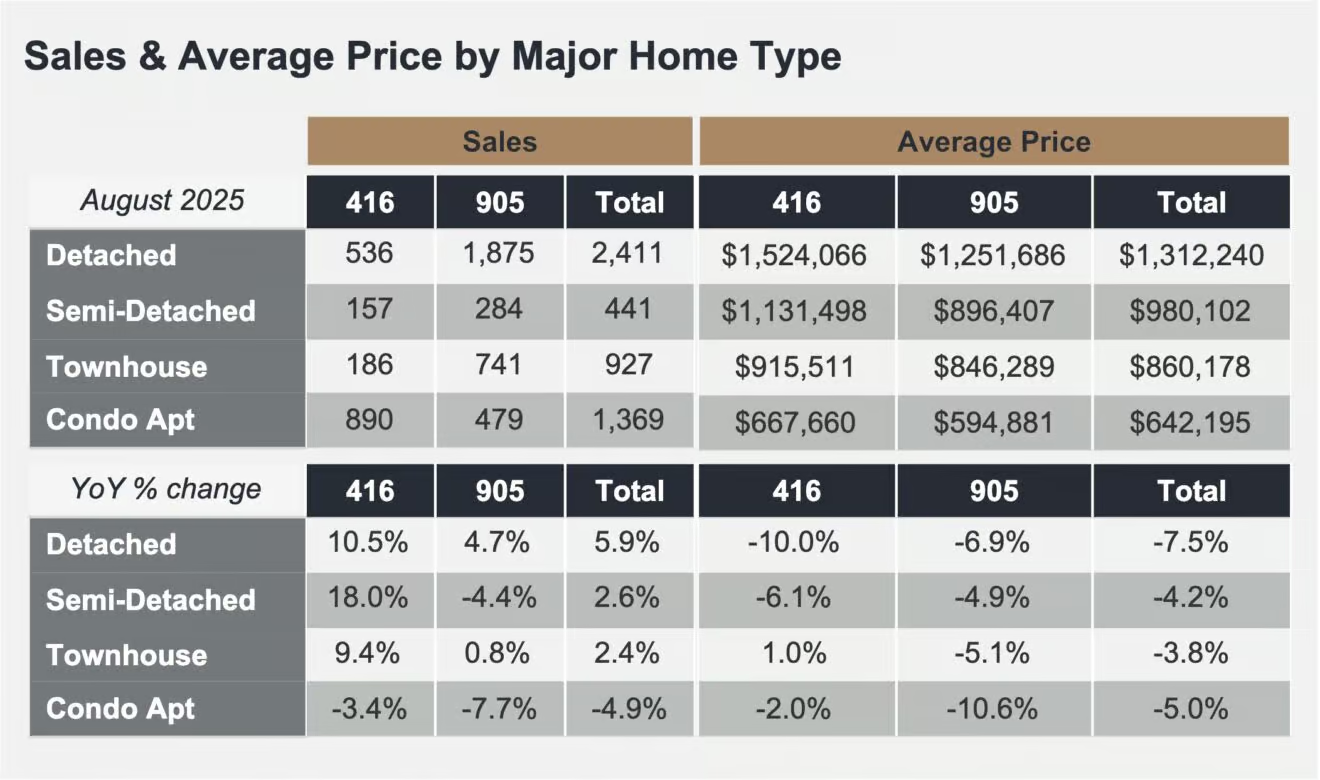

- GTA REALTORS® reported 5,211 home sales in August 2025, representing an increase of 2.3% compared to the same month last year

- August marked the first month-over-month decline in GTA home sales since March, with a drop of 1.8% to a seasonally adjusted 5,633 units

- This modest pullback indicates that while demand persists, buyers are taking a more discerning approach—evaluating pricing and financing more closely before committing

- However, with the Bank of Canada expected to ease rates further in mid-September, the smallest shifts in financing could tip the scales and reactivate sidelined buyers

Listings & Inventory: Supply Rises – Buyers Remain in Control

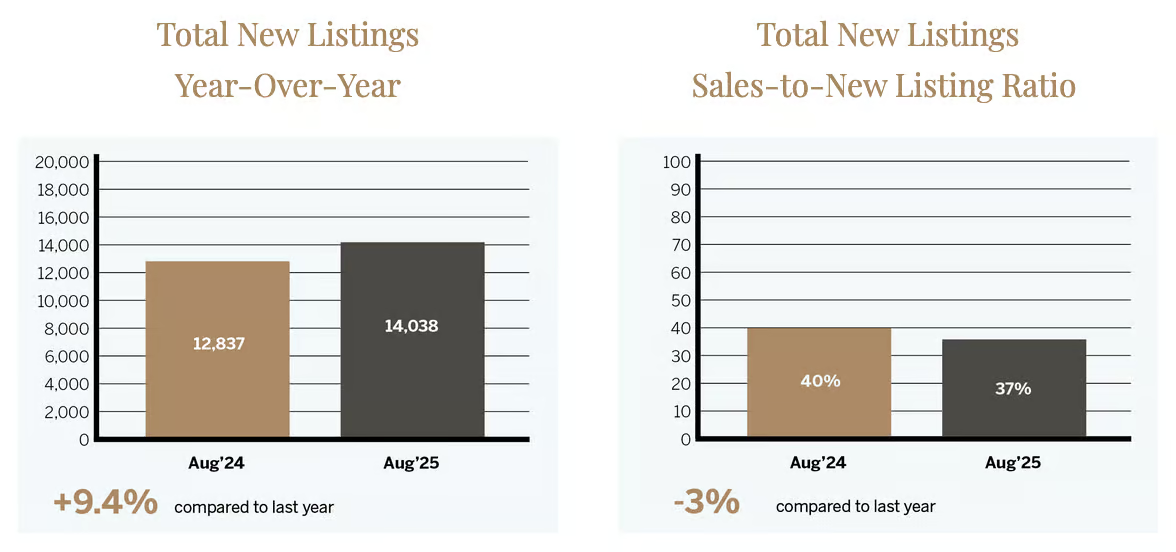

- 14,038 new listings hit the market in August, a 9.4% increase year-over-year

- Active listings reached 27,495, (includes both New and Existing Listings), representing a 22.4% increase compared to August 2024

- With sales growing at a slower pace than new listings, the Sales-to-New-Listings Ratio settled at 37%, keeping the market firmly in buyer’s territory

- The takeaway: supply is outpacing demand, creating an environment where buyers have increased negotiating leverage, and sellers must remain competitive in pricing and presentation

Prices & Affordability: Declines Deliver Opportunity

- The MLS® Home Price Index Composite benchmark fell 5.2% year-over-year in August 2025

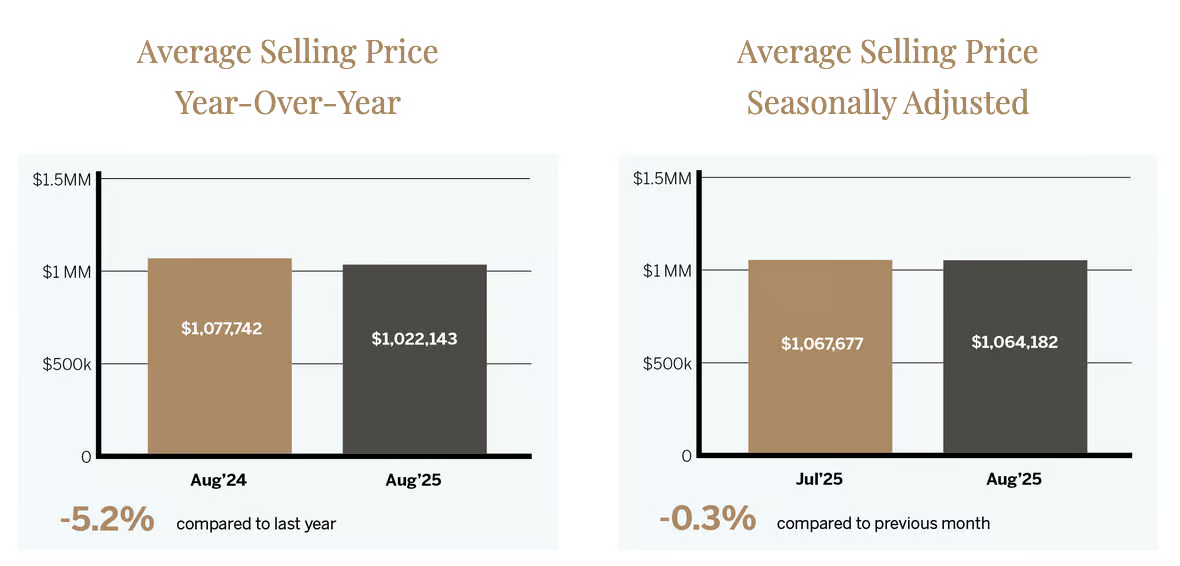

- The average selling price was $1,022,143, also down 5.2% compared to August 2024

- On a seasonally adjusted basis, both the benchmark and the average selling price held steady compared to July, signaling a period of price stability following several months of decline

- Affordability challenges remain, with average household incomes still stretched against carrying costs.

- However, for buyers and investors positioned to act, the combination of lower prices and abundant supply presents a timely opportunity to secure long-term value.

Insights & Interpretation

Improved Affordability is Beginning to Show

- August’s numbers reflect a cautious but steady market. Sales rose modestly year-over-year, but a surge in new listings kept conditions firmly in buyers’ favour.

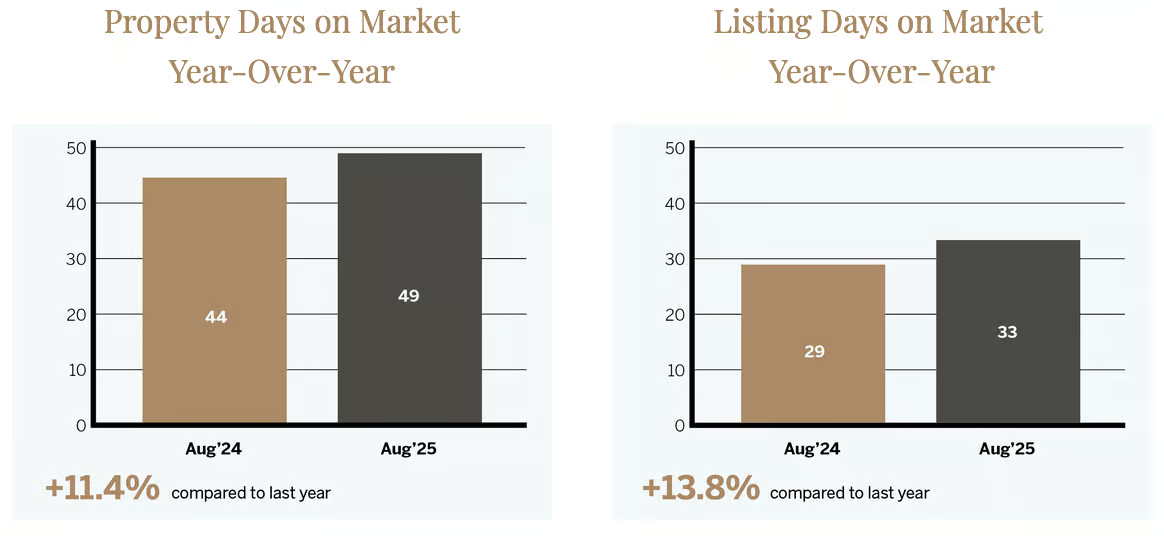

- Prices, both benchmark and average, declined by just over 5% annually but held steady month-over-month, suggesting that price declines may be finding a floor.

- For households positioned to buy, this presents a rare opportunity: more choice, more negotiating room, and a stabilizing price environment.

Policy Tailwinds Could Be Pivotal

- The Toronto Regional Real Estate Board (TRREB) leadership continues to emphasize the link between affordability and policy.

- With inflation easing and the Bank of Canada signaling further rate cuts, borrowing costs are set to improve.

- Even modest relief could prompt sidelined buyers back into the market, supporting not only housing activity but also the broader economy through real estate’s well-documented multiplier effect.

Macro Risks Still Hover

- Despite signs of stability, headwinds remain. The economy is slowing, and trade tariffs have added uncertainty.

- Large-scale infrastructure investments in housing, transit, and industry will be essential to long-term stability.

- In the near term, however, real estate remains one of the most immediate levers for economic recovery, provided financing conditions continue to ease.

Strategic Considerations for our Distinctive Clients

For Buyers: Abundant supply and stabilizing prices make this a window of opportunity. Acting before renewed demand intensifies competition could be advantageous.

For Sellers: Competitive pricing and strong and presentation of your sale property remain critical. With buyers cautious and selective, standing out is essential.

For Investors: Market softness offers entry points with long-term upside, especially in segments supported by population growth and infrastructure investment.

Final Thoughts:

August’s market reflects a period of balance in transition. Sales edged higher than last year, but the surge in new listings has kept conditions firmly tilted toward buyers.

Prices, down just over 5% year-over-year, appear to be stabilizing month-over-month—an early signal that the steepest declines may be behind us.

For buyers, today’s environment delivers both choice and negotiating power—conditions not seen in years. For sellers, success hinges on discipline: competitive pricing, compelling presentation, and adaptability to meet the expectations of a cautious, value-driven buyer pool.

Looking ahead, the Bank of Canada’s next moves on interest rates will be pivotal. Even modest cuts could improve affordability and draw more buyers back into the market. At the same time, broader economic currents—trade pressures, infrastructure spending, and household affordability—will continue to shape sentiment.

Whether buying, selling, or investing, those who act decisively—and do so with the guidance of experienced, knowledgeable real estate advisors—will be best positioned to capitalize as market conditions shift in the months ahead.

Get Strategic Guidance

Whatever your needs—from navigating the luxury real estate market to solving commercial real estate problems—we guide you with proven strategy and objective advice.