The close of 2025 brings a market shaped less by demand and more by sentiment. Buyers have not disappeared—they’re simply waiting for confidence to return.

TRREB’s latest Market Watch makes that clear: sales fell 15.8% year-over-year, and new listings were also down 4%, reinforcing that even potential sellers are taking a wait-and-see approach.

Yet beneath the surface, the data and broader economic signals tell a different story—one of pent-up demand, improving fundamentals, and a market quietly repositioning itself for renewed activity in 2026.

Market Performance at a Glance

Sales & Listings

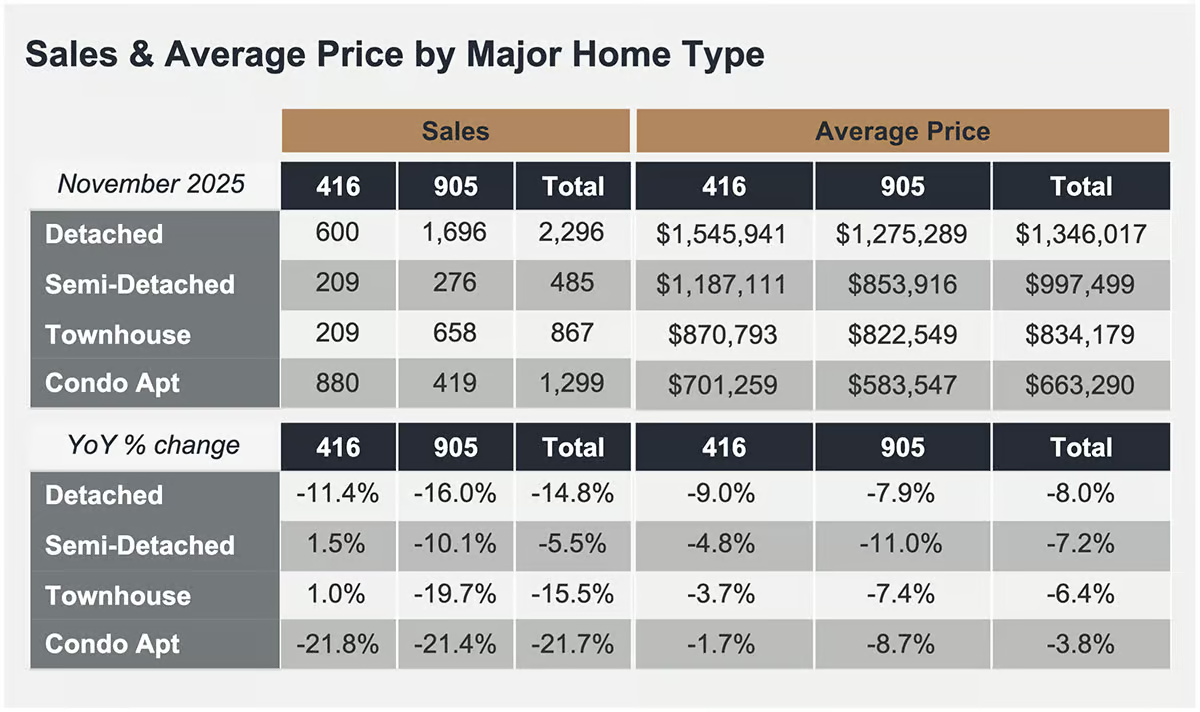

- 5,010 sales in Nov 2025, down from 5,947 the year prior (-15.8%).

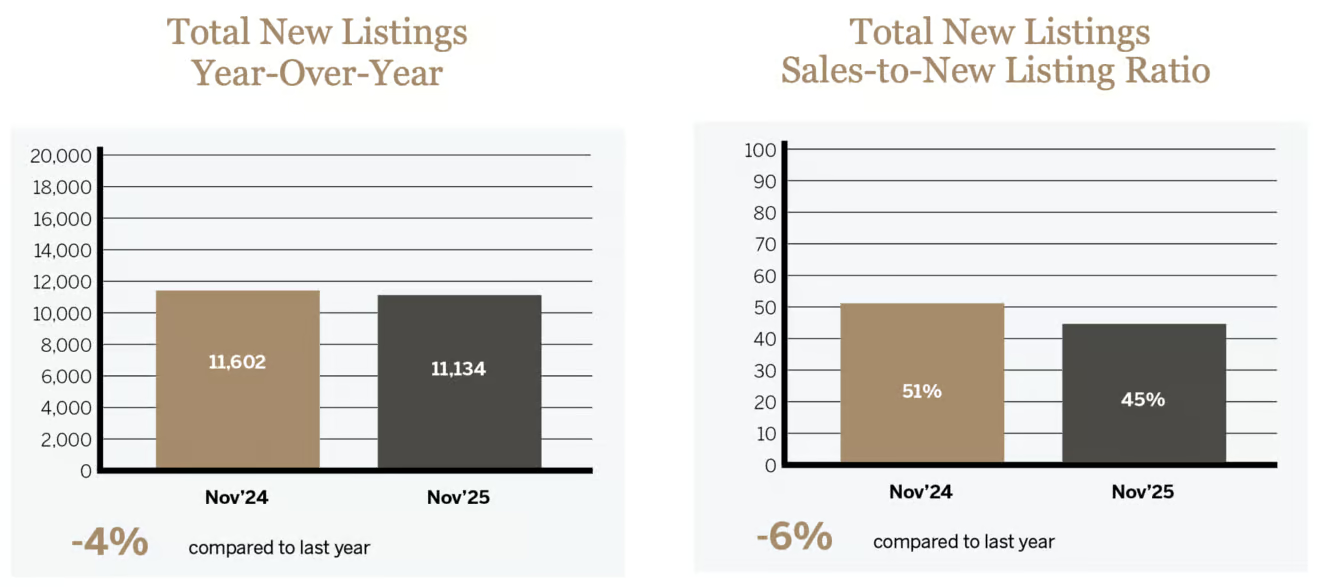

- New listings dipped to 11,134, modestly lower at -4% Year over Year (YoY), but still elevated compared to historic norms.

- The Sales-to-New Listings Ratio (SNLR) held near 45%, confirming a balanced-to-soft buyer’s market—one that rewards those who act while others wait.

Average Price Trends

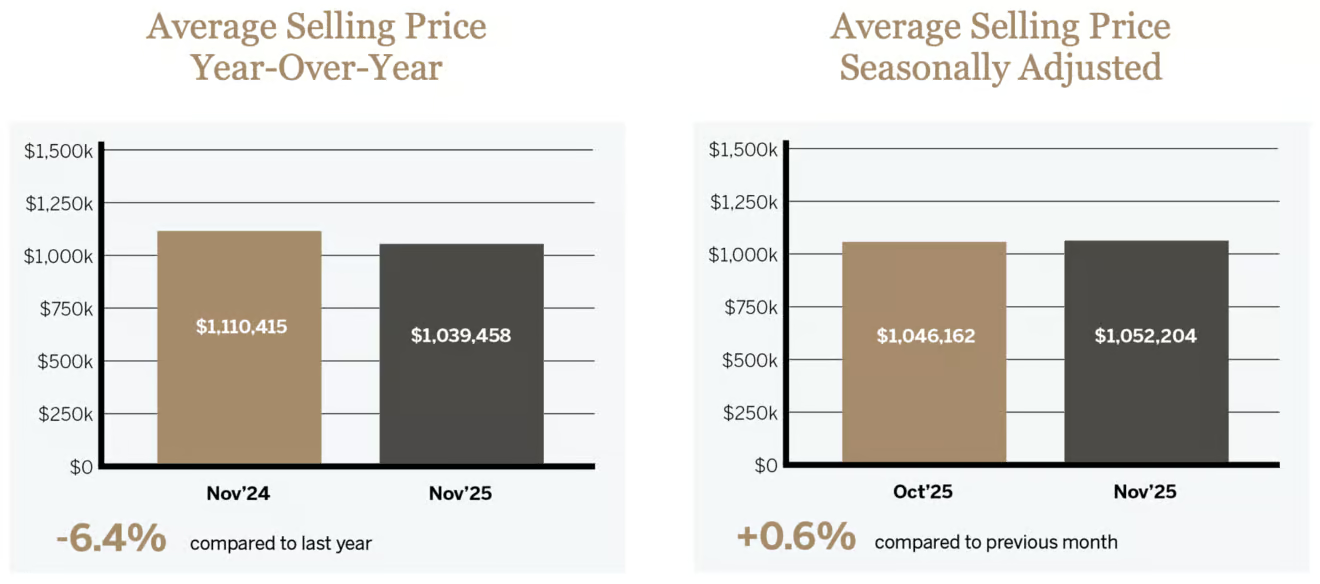

- The average GTA sale price declined 6.4% YoY to $1,039,458, yet remained relatively stable month-over-month, up 0.6% from October.

- Detached prices fell 8% YoY, semi-detached 7.2%, townhomes 6.4%, and condos 3.8%—all signs that the correction is nearing maturity.

Days on Market

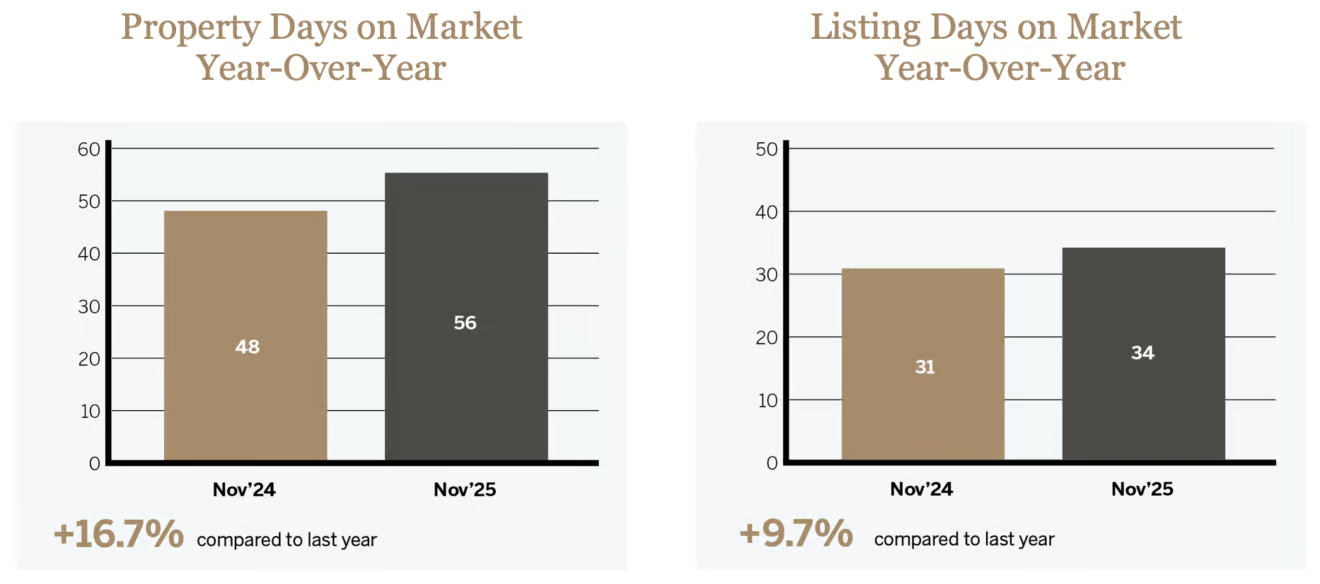

- Average property DOM increased from 48 to 56 days, an increase of 16.7% YoY—meaning buyers have more time, and sellers must position their listings with strategy, precision, and professional execution.

- Listing DOM increased by 9.7% YoY, indicating listings are lingering without the right pricing or value narrative.

Why Market Confidence Matters — And Why It’s Poised to Improve

Employment data is turning a corner

According to Canadian Mortgage Trends, Canada posted 53,600 new jobs in November, marking a third consecutive month of unexpected gains. This is precisely the kind of trend that historically precedes housing market recovery, because stability in employment is the #1 driver of buyer confidence.

The Toronto Regional Real Estate Board’s (TRREB) own commentary echoes this:

“Many GTA households want to take advantage of lower borrowing costs and more favourable prices. What they need most is confidence in their long-term employment outlook.” —TRREB President Elechia Barry-Sproule

Interest rates: stability now, potential relief ahead

Recent coverage from Canadian Mortgage Trends indicates:

- The Bank of Canada has announced it is holding the policy rate

- Markets are pricing in potential cuts from the U.S. Federal Reserve, which traditionally influence Canadian rate expectations.

- Bond yields have stabilized, and lenders continue making selective downward adjustments on fixed-rate products.

Long-term forecasts now suggest:

- No rate hikes in early 2026, and

- Potential easing as early as late 2026, depending on employment strength and inflation moderation.

This aligns with the Ontario MLP (Ontario Mortgage Lenders Partnership) analysis emphasizing that renewed consumer confidence—not price drops alone—is the key to re-igniting housing momentum.

First-Time Buyers: The Demand Is There—They Just Need Trusted Guidance

A recent Scotiabank poll shows:

- 68% of first-time buyers feel overwhelmed by affordability pressures

- 70% say they need more trusted, professional guidance before making a move

- Nearly half believe waiting for “the perfect rate” is holding them back—yet they still intend to buy

This tells us two things:

- The desire to purchase is strong, but

- Buyers are afraid of making the wrong decision in a volatile market.

The opportunity for 2026 is clear:

Buyers who receive structured, grounded, data-driven guidance will re-enter the market first.

Those are the clients who will capture the best-priced opportunities before broader confidence returns.

The Hidden Opportunity: Inventory Will Tighten Again

While today’s inventory feels comfortable, TRREB cautions that:

“As this inventory is absorbed, new construction is required to fill the housing pipeline.” —TRREB CEO John DiMichele

This is a critical warning.Pre-construction starts have already slowed dramatically due to:

- elevated construction costs

- tightened development financing

- absorption challenges in the condo sector

By 2027–2028, Ontario is expected to face a structural supply shortage, especially in the “missing middle” categories—townhomes, semis, and entry-level single detached.

Which means: Today’s window of choice will not last. When confidence returns, inventory will tighten quickly—and so will prices.

For Sellers: It’s Time to Act with Discipline, NOT Delay

With prices down 6–8% YoY, some homeowners believe waiting will deliver a higher sale price later.

But the data does not support that assumption—yet.

Today’s sellers succeed when they:

- price strategically, not aspirationally

- prepare and position their homes professionally

- understand that buyers are comparing value more rigorously than ever

- leverage time-tested marketing fundamentals to stand out in a crowded market

Homes that follow these fundamentals still sell—and sell well.

Homes that ignore them extend their DOM and ultimately invite price reductions.

For Buyers: This is a Quiet Window of Power – Use it Before it Closes

There is less competition, more inventory, longer DOM, and flexibility in negotiations.

When confidence returns, the advantage flips—permanently.

Buyers who move now benefit from:

- softer pricing

- more conditional opportunities

- stronger negotiating position

- early access to long-term appreciation once conditions shift

Consumers who wait for interest rates to fall often unknowingly wait right into a price rebound.

What to Expect as We Enter 2026

Based on TRREB data, national employment gains, lender behaviour, and consumer sentiment research, the early 2026 outlook is shaping up as follows:

Short-Term (Dec 2025 –Mar 2026)

- Transaction volume remains muted

- Prices stabilize at current levels

- Buyers continue to wait for confidence cues: job stability and rate guidance

Spring 2026

- Increased buyer inquiries and early market re-engagement

- More first-time buyers seeking structured guidance

- Stabilization in fixed mortgage rates as bond markets settle

Late 2026 – Early 2027

- Potential rate relief

- Inventory compression

- Return of competitive segments—especially freehold and well-located townhomes

Let’s Talk Strategy

1. Request Your 2026 Strategic Market Plan

- A personalized plan that aligns your goals with where the market is heading—not where it has been.

2. Book a Pre-Spring Pricing & Positioning Consultation

- Essential for sellers considering listing between February and June 2026.

3. First-Time Buyer Roadmap: Unlock Your Path to Ownership

- Designed for buyers seeking clarity, confidence, and trusted guidance.

If you’d like a custom neighbourhood-level snapshot, a mortgage review, or insights specific to your property or goals — reach out today. I’m ready to provide you with clarity, strategy, and a steady hand through these shifting conditions.

Get Strategic Guidance

Whatever your needs—from navigating the luxury real estate market to solving commercial real estate problems—we guide you with proven strategy and objective advice.