Reading the Signals

Welcome to your September 2025 GTA Market Update. After a relatively quiet summer, the data suggests fresh momentum returning to the Greater Toronto Area’s residential market.

That said, nuance matters: stronger sales are competing with persistent price pressureand affordability headwinds.

In this edition, I’ll walk you through what’s changed, what’s holding firm, where to watch, and what it means for buyers, sellers, and investors as we head into the final quarter.

Market Activity Rebounds – Sales Are Up

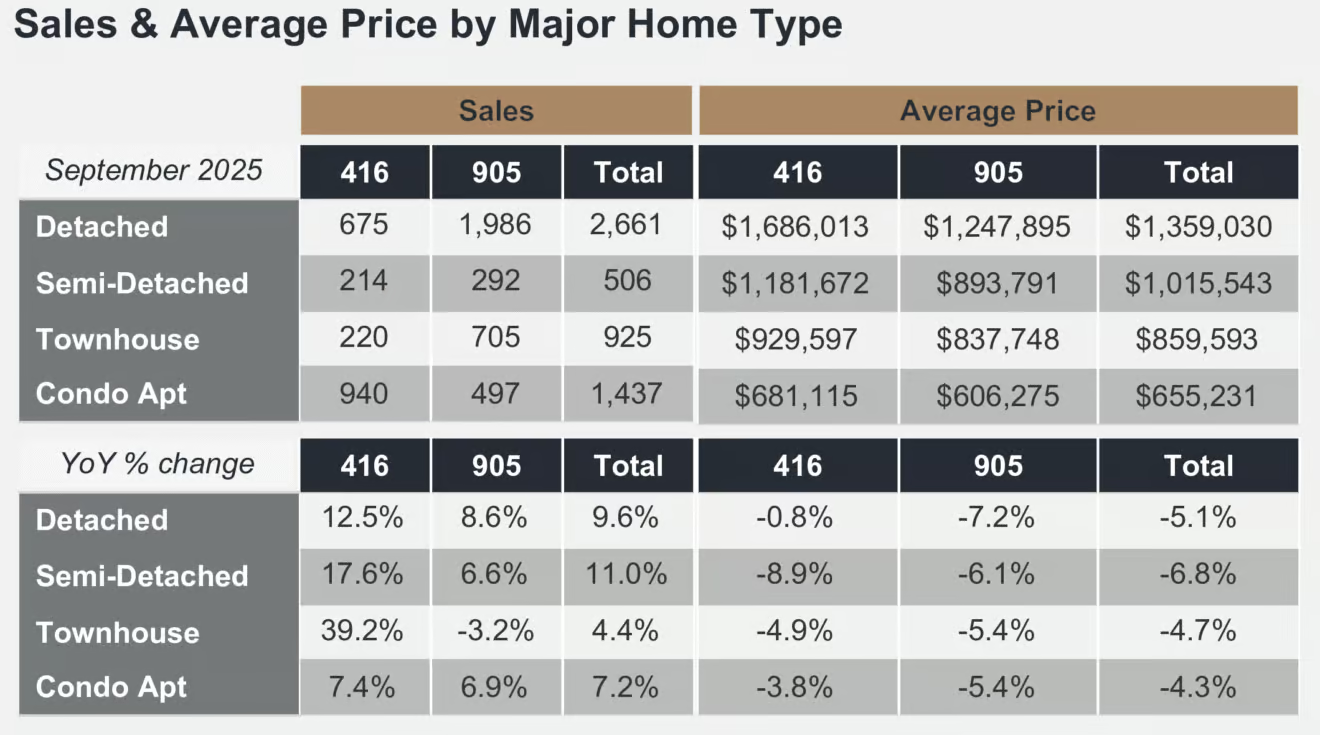

- Sales increase: GTA REALTORS® reported 5,592 home sales through TRREB’s MLS® System in September 2025 as buyers continue to respond to substantial choice in the marketplace.

- Year-over-year strength: Relative to September 2024, sales rose by 8.5%, reflecting renewed buyer willingness to transact in a cooling market.

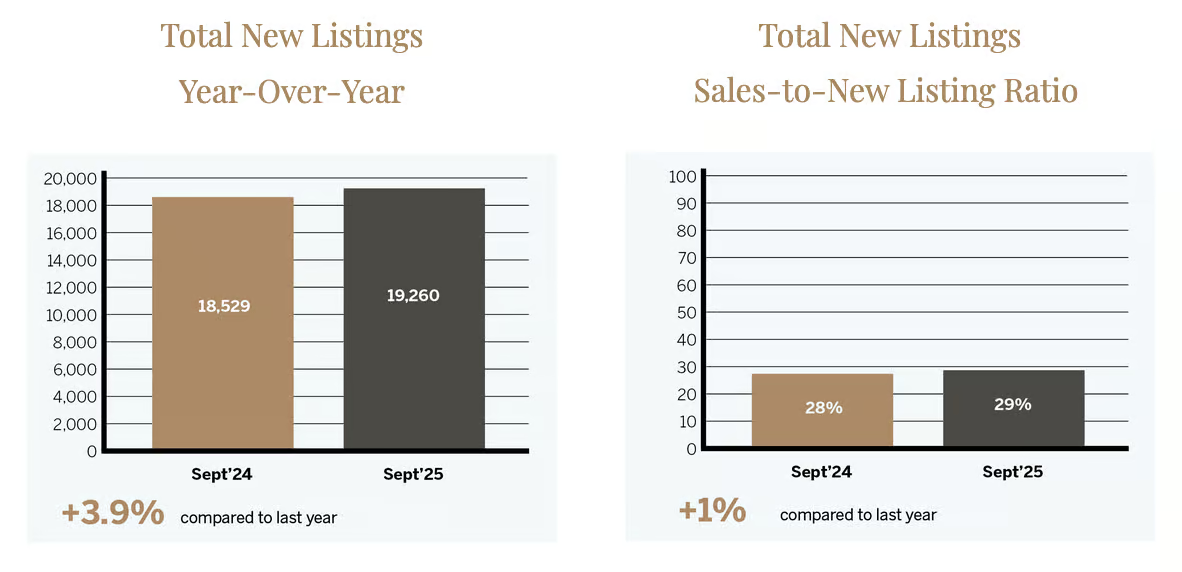

- Listings also increasing: New listings in September grew by about 4% year-over-year, putting more choice in the hands of buyers.

Takeaway: The rebound in transactions is healthy — as long as we don’t see a flood of supply outpace demand. In many neighbourhoods, moderate tightening may begin to emerge.

Price Pressure Persists — Softening Across the Board

- Benchmark down month-over-month: The MLS® Home Price Index (HPI) Composite declined 0.5% on a seasonally adjusted basis from August to September.

- Year-over-year decline: On an annual basis, the HPI Composite is down 5.5%, and the average selling price fell 4.7% to approximately $1,059,377.

- Stability in recent months: Though the price trend remains broadly down, the month-to-month changes have moderated, indicating that the market might be finding a floor.

Interpretation: Buyers are enjoying negotiating power, particularly in segments where inventory is high. Sellers must balance patience with realism — aggressive pricing or strong value propositions will win attention.

Inventory, Days on Market & Market Balance

- Elevated inventory: The ongoing supply of listings continues to be a defining factor. More choice = more leverage for buyers.

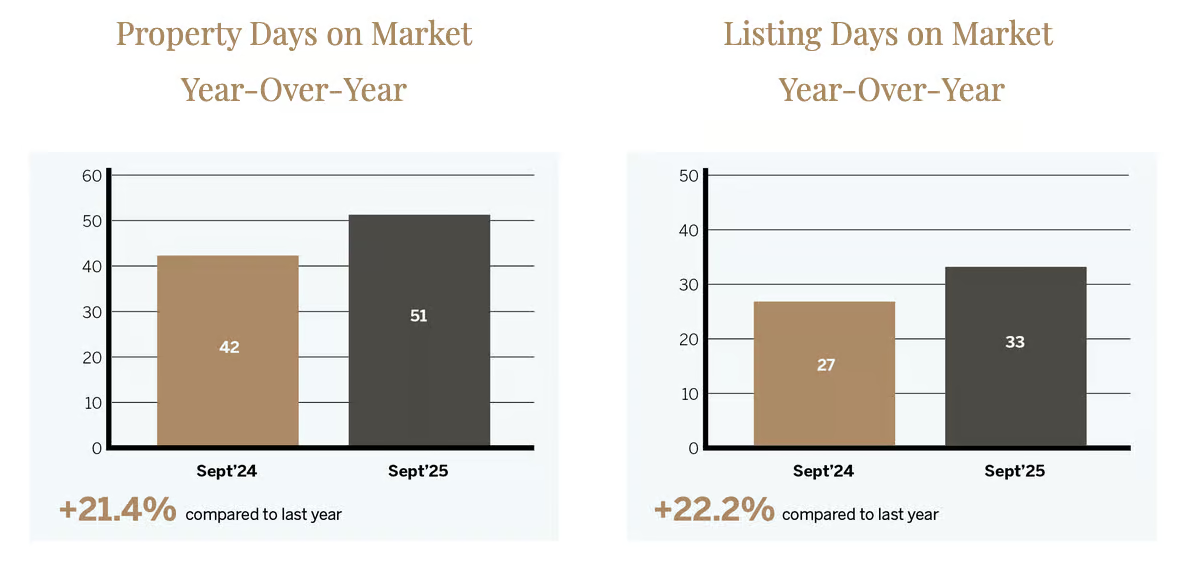

- Days on market (DOM): While DOM data is more volatile by neighbourhood, expect modest lengthening in some segments as competing listings vie for attention.

- Sales-to-new listings ratio (SNLR): The ratio remains soft by historical standards, though improving. We’re seeing early signs of a more balanced market, particularly in mid- to lower-tier property classes.

Bottom line: It’s not a seller’s market currently — but it’s slowly shifting toward equilibrium in select pockets. Those who price smart will still attract strong offers.

Macro & Mortgage Movements — The Bigger Forces

- Bank of Canada stance: The central bank is currently holding its policy rate steady at 2.75%.

- Rate outlook cautious: RBC’s latest forecasts suggest a “no change” baseline through 2026, barring inflation surprises.

- Affordability rebound: Canada’s housing affordability is the strongest it’s been in three years, driven by easing homeownership costs.

- Forecast mix: RBC projects modest national home price gains (+1.4% in aggregate) in 2025, but warns that Ontario and British Columbia may face downward pressure into 2026.

- Risk factors to monitor: Trade tensions, job market cooling, and global volatility remain key downside risks flagged by economists.

Implication for local market: The prevailing interest rate environment is supportive, but additional stimulus is not guaranteed. Buyers should weigh locking better rates now vs. staying nimble for future cuts.

What to Watch — Turning Points on the Horizon

- Rate reductions: A single cut could shift psychology and unlock latent demand.

- Inventory shifts: If listings surge, pressure resumes. If supply consolidates, price floor strengthens.

- Segment divergence: Entry-level, townhomes, and semis may outperform detached or luxury as affordability tightens.

- Neighbourhood-level data: Microtrends will matter. Streets and subareas with strong fundamentals or transit access may lead recovery.

Strategic Considerations for our Distinctive Clients

For Sellers

- Price competitively from the start; don’t overshoot hopes.

- Hire a Realtor that can really make your listing shine (staging, presentation, AI driven social media, client market updates).

- Be ready to act swiftly when strong offers emerge.

For Buyers

- Leverage the current inventory — you have choices.

- Lock in good mortgage terms early (if you’re comfortable) before rates firm further.

- Focus on longer‑term value (location, future infrastructure, resale potential).

Let’s Talk Strategy

As we head into the final quarter of 2025, the GTA market is awakening — cautiously but with renewed purpose. The interplay of sales momentum, price discipline, and macro stability will determine who comes out ahead. My goal is to help you interpret where yourproperty or buying goal fits into this evolving landscape.

If you’d like a custom neighbourhood-level snapshot, a mortgage review, or insights specific to your property or goals — reach out today. I’m ready to provide you with clarity, strategy, and a steady hand through these shifting conditions.

Victoria L. Joly

Broker of Record

victoria.joly@distinctiveadvisors.com

Mobile: 416.500.1238

Get Strategic Guidance

Whatever your needs—from navigating the luxury real estate market to solving commercial real estate problems—we guide you with proven strategy and objective advice.