Market Momentum: Strongest in Four Years

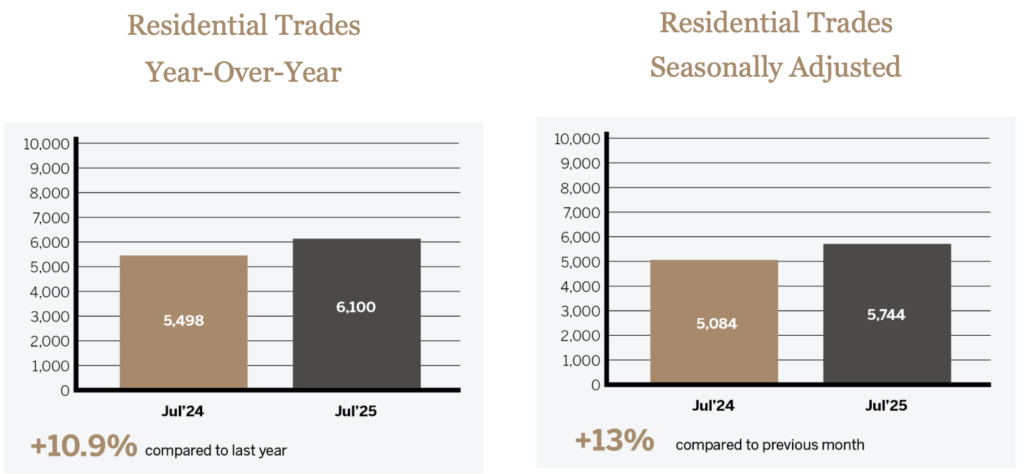

- GTA REALTORS® recorded 6,100 home sales in July 2025 – 10.9% higher than July 2024 – the strongest July result since 2021.

- On a seasonally adjusted basis, sales rose 13% month-over-month, marketing the strongest lift since October 2024.

Listings & Inventory: Supply Rises – but Sales Still Outpace

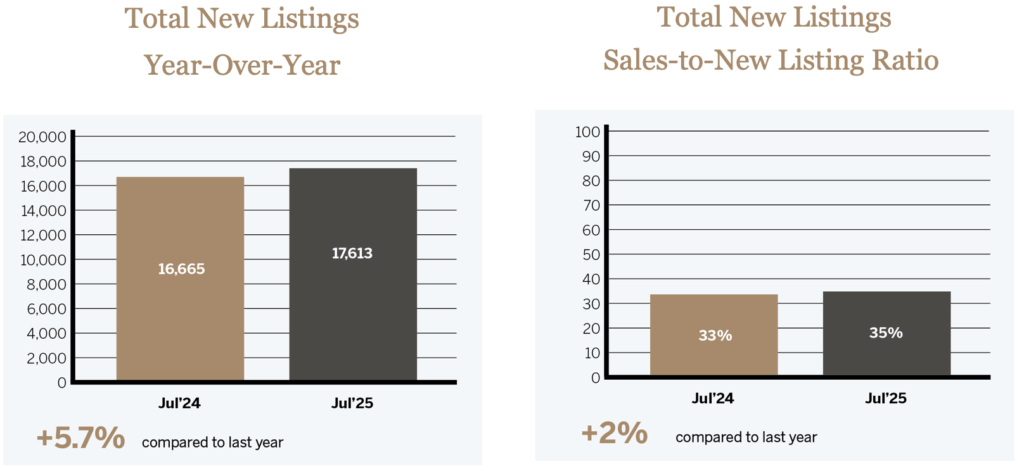

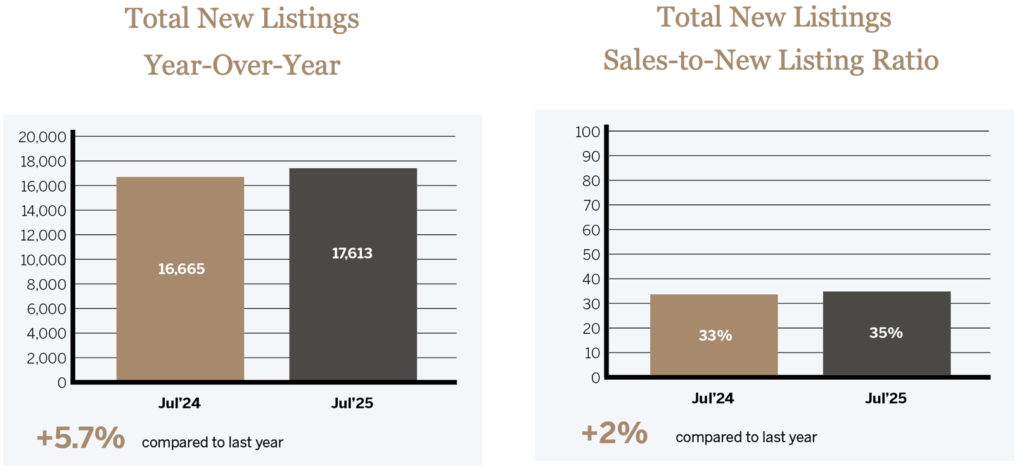

- 17,613 new listings were added in July – up 5.7% year-over-year.

- Active listings climbed to around 30,215 units, a 26.2% rise from this time last year.

- Despite inventory growth, the sharper increase in sales versus listings indicates a modest market tightening.

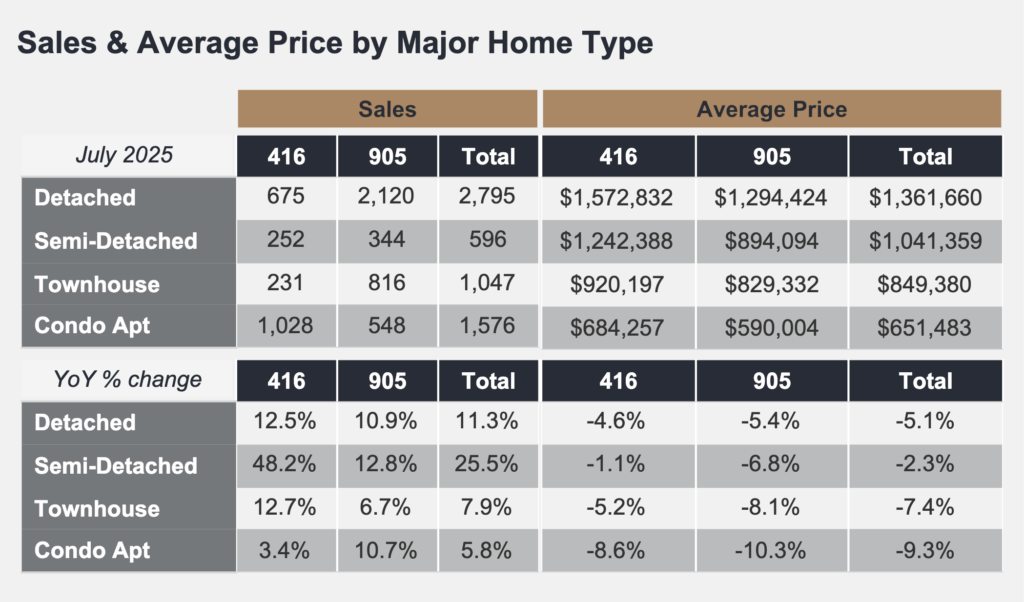

Prices & Affordability: Declines Deliver Opportunity

- The MLS® Home Price Index Composite benchmark dropped 5.4% year-over-year in July.

- The average selling price came in at $1,051,710 – 5.5% lower than July 2024.

- Month-over-month price movement was flat on a seasonally adjusted basis for both the benchmark and the average price.

Insights & Interpretation

Improved Affordability is Working

Lower prices plus earlier interest?rate cuts are starting to filter into household budgets. Toronto Regional Real Estate Board (“TRREB”) President Elechia Barry?Sproule noted this is clearly helping more buyers re?enter the market, although borrowing costs still need further relief to sustain momentum.

Macro Risks Remain

TRREB CIO Jason Mercer cautioned that Canada’s economy is “treading water,” weighed down by U.S. trade uncertainty. He emphasized housing as a vital economic engine—additional rate cuts would accelerate home sales, boosting regional spending and job.

Meanwhile, the Bank of Canada today left the policy rate at 2.75%, noting inflation pressures and external trade risks but signaling that future cuts may be warranted.

What Lies Ahead: Truthful Forecast & Strategic Advice

More Price Relief, Maybe, Not Guaranteed

While July’s data shows some stability, unless interest rates come down further or economic confidence returns, price declines may plateau but not reverse this fall. As noted by brokers, the fall market may be muted—nothing dramatic unless the macro picture shifts.

Buyer Sentiment: Point of Decisive Action

Many households delayed spring buying amid uncertainty. July appears to mark the shift—buyers seem to accept that volatility has become the norm and are moving forward.

This could translate into steady demand heading into autumn, particularly if mortgage financing stays accessible and rates ease.

Strategic Considerations for our Distinctive Clients

For Buyers:

- Improved affordability has opened doors. Now is the time to act before further competition pushes prices up.

- Those still waiting for a major price crash may miss the current window.

For Sellers:

- Home prices remain below last year’s peak. Pricing competitively and leveraging improving conditions could yield favorable results.

- Listing strategies tailored to rising buyer demand — especially in semi-detached and detached segments — can set your listings apart.

What Distinctive Advisors Clients Should Know

| Metric | July 2025 | Change vs. July 2024 |

| Home Sales | 6,100 units | +10.9% |

| Seasonal Sales | ~5,744 units | +13% (MoM) |

| New Listings | 17,613 | +5.7% |

| Active Inventory | ~30,215 units | +26.2% |

| Avg. Selling Price | $1,051,719 | -5.5% |

| Benchmark HPI | Composite Index | -5.4% |

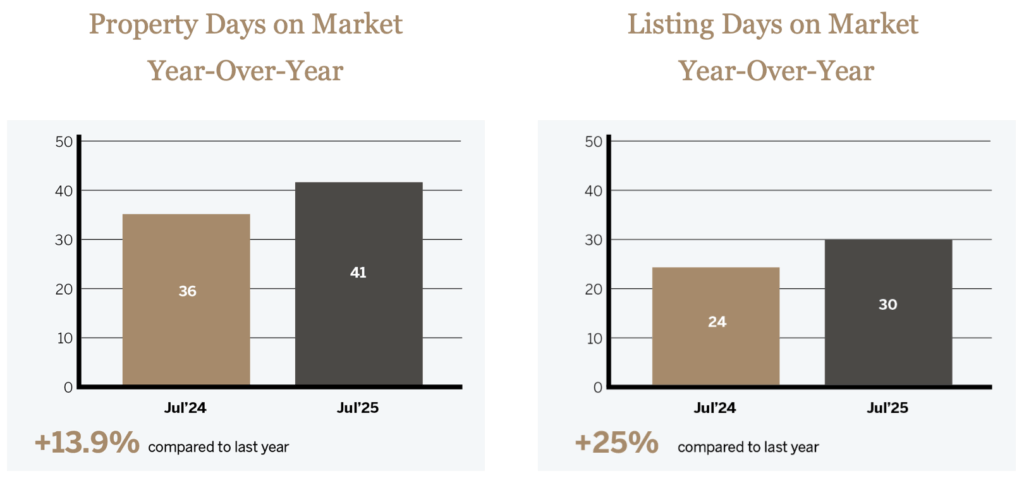

July’s rebound in sales, combined with stabilizing prices and still-manageable inventory, signals renewed buyer interest—but major economic undercurrents remain. Borrowing costs are key: further cuts from the Bank of Canada would amplify the market’s recovery, while stagnation prolongs the current balance.

July 2025 Sparks a Market Revival

—But the Road Ahead Demands Precision

July marked the GTA’s strongest performance in four years, with sales surging, inventory rising, and prices holding steady. Improved affordability is clearly bringing more buyers back into the market, though macroeconomic uncertainties remain. In this environment, thoughtful, informed action—not waiting—is the smart move.

As we move into August and September, we will closely monitor potential Bank of Canada policy shifts, trade developments, and changes in buyer and seller sentiment. Distinctive Advisors’ clients can expect continued updates tailored to their property type and goals.

If you’d like a deeper analysis by property segment—such as condos versus detached homes, by region, or by price range—we can provide a detailed breakdown specific to your needs.

Final Thoughts: July delivered welcome energy to the GTA housing market, with rising sales, easing price declines, and improving affordability. However, it remains a balancing act—the market’s readiness depends on sustained momentum and supportive financial conditions.

Let’s Talk Strategy

Whether you’re considering a sale, planning a purchase, or evaluating a strategic hold, the market today demands informed, proactive decision-making. At Distinctive Advisors, we combine market intelligence with deep transactional experience to guide you with confidence

Comments