Key Highlights at May 2022:

- Unemployment hit the lowest on record and all while not seeing significant wage growth. With inflation still increasing, it’s a matter of time before it starts to take a toll on households.

- The highest industry in job loss was construction and real estate. Job loss in both sectors are now the highest since 2018.

- Toronto is currently in a full-blown 2017 moment with troubled residential sales weighing on pricing.

Jobs market still remarkably strong

- Housing data may potentially begin to shift but the broader economy is still sky rocketing for now.

- Wage growth continues to deteriorate which damages consumers and households a lot given how high inflation is currently.

- Wages slowed to just 3.4% year over year (y/y) in April, which puts them sharply negative in real terms.

Business is looking to Hire

- The Canadian Federation of Independent Business (CFIB)’s latest Barometer continues to display that businesses are planning to increase prices much faster than wages over the next year.

- Job vacancies are at a record breaking high. There were 826,000 job openings in February, up 300,000 from one year earlier and up by 500,000 since early 2019.

- Business hiring intentions are now the strongest they’ve been since 2014.

Toronto house prices slip, sales tumble

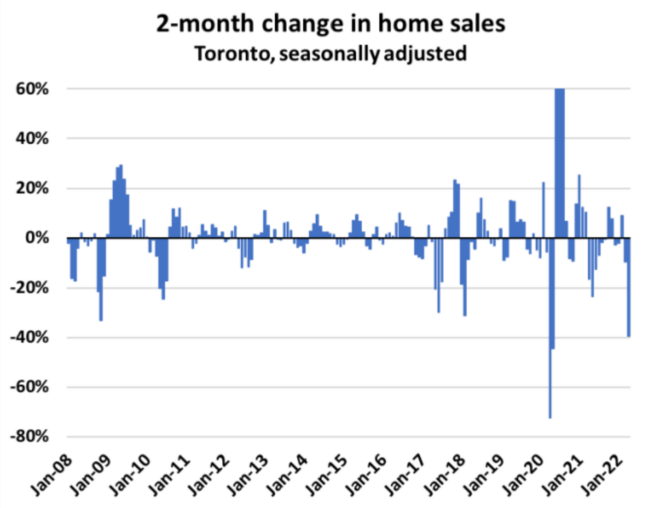

- The latest Toronto sales data confirmed this steep slowdown in demand. Seasonally adjusted sales plunged 26% month over month (m/m) and have now fallen 40% in the past 2. Not even during the Financial Crisis did we see demand erode that rapidly.

Toronto house prices slip, sales tumble

- The latest Toronto sales data confirmed this steep slowdown in demand. Seasonally adjusted sales plunged 26% month over month (m/m) and have now fallen 40% in the past 2. Not even during the Financial Crisis did we see demand erode that rapidly.

Prices Soften

- April saw the second largest monthly decline in seasonally adjusted average house prices since at least 2005.

- Detached home sales plunged 45% y/y and were down 26% sequentially. The only other April that ever had a monthly decline that steep was 2020 during the lockdowns.

- Condo sales fell 34% y/y in Toronto. The market clearly peaked in February. Condo sales in April were lower than in February for only the second time on record.

We’d welcome an opportunity to discuss the perspectives presented in this Job Market and Economic Insight on Current Housing Trends across the Greater Toronto Area. If you have any questions about our services please contact our team.

Comments