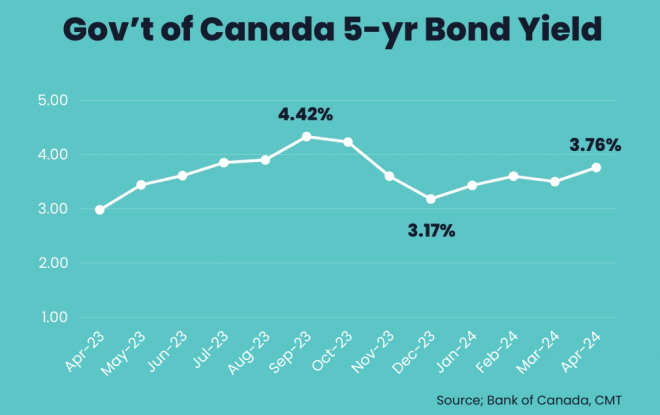

In a financial landscape where variable-rate mortgage holders are keenly awaiting the Bank of Canada’s potential rate cut, their fixed-rate counterparts are witnessing a contrasting scenario. Despite a significant decrease in Government of Canada bond yields last autumn, fixed mortgage rates are now on an upward trajectory.

After a sharp 125 basis point fall from their peak in early October to a low in early January, bond yields have rebounded by about 60 basis points, with a notable 25 basis point increase occurring in the past three weeks. This resurgence in yields is compelling fixed mortgage rates to ascend concurrently, much to the dismay of prospective homeowners who now face escalating borrowing costs.

Deciphering the Economic Signals

Ron Butler, a prominent figure at Butler Mortgage, notes that this recent surge in 2- to 5-year fixed mortgage rates—rising between 15 to 30 basis points across various lenders—is largely driven by potent economic data from the U.S., particularly in employment, GDP, and inflation figures. The U.S. CPI inflation saw a 0.4% rise month-over-month and 3.5% on an annualized basis in March, prompting some economists to delay their forecasts for U.S. rate cuts to later this year or even next year. U.S. Federal Reserve Chair Jerome Powell recently reinforced this outlook by stating that interest rates would stay higher “for as long as needed” to combat inflation challenges.

In Canada, despite GDP growth and employment figures performing better than anticipated, fixed mortgage rates have continued their upward climb, detached from the trajectory of the anticipated Bank of Canada rate cuts possibly commencing in June or July.

Forecasting Future Rate Movements

Mortgage broker Ryan Sims, known for his accurate predictions, believes fixed rates have room to increase further, potentially by an additional 20 to 30 basis points. The average deep-discount 5-year fixed rate is currently about 4.79%, but Sims predicts it could rise to around 5.29%. He attributes the gap between fixed and variable rates and the bond market’s overly optimistic pricing in of rate cuts, which he thinks won’t occur as soon as anticipated.

Moreover, Sims highlights a potential wildcard: fixed rates might continue to rise even as the Bank of Canada lowers its benchmark rate. He argues that Canada’s fiscal challenges could push government bond yields—and by extension, mortgage rates—higher regardless of the central bank’s actions. Sims warns that premature rate cuts might be perceived negatively by international markets as a “panic move,” which could exacerbate the risk premium on Canadian bonds.

As we navigate these uncertain waters, it’s evident that both variable and fixed-rate mortgage holders need to stay vigilant and well-informed about the influences shaping the economic environment. The months ahead will be pivotal in determining Canada’s fiscal direction and the strategic financial decisions of many Canadians eyeing the housing market.

In Conclusion: Navigating Uncertain Waters

While variable-rate mortgage holders look towards potential relief from rate cuts, the reality for fixed-rate borrowers appears starkly different with rates poised to climb. As economic resilience tests fiscal policies, borrowers will need to be astutely aware of both domestic and international economic indicators. The dynamic and volatile nature of these rates demands a cautious yet proactive approach to mortgage planning.

Navigating the financial landscape requires a discerning eye and a robust understanding of market forces. Keep a close watch, plan strategically, and you might just weather the shifting tides of mortgage rates. We’d welcome an opportunity to discuss Rising Tides: The Unpredictable Surge of Fixed Mortgage Rates, if you have any questions about our services, please contact our team.

Comments