Insolvencies jump, credit card charge-offs rise

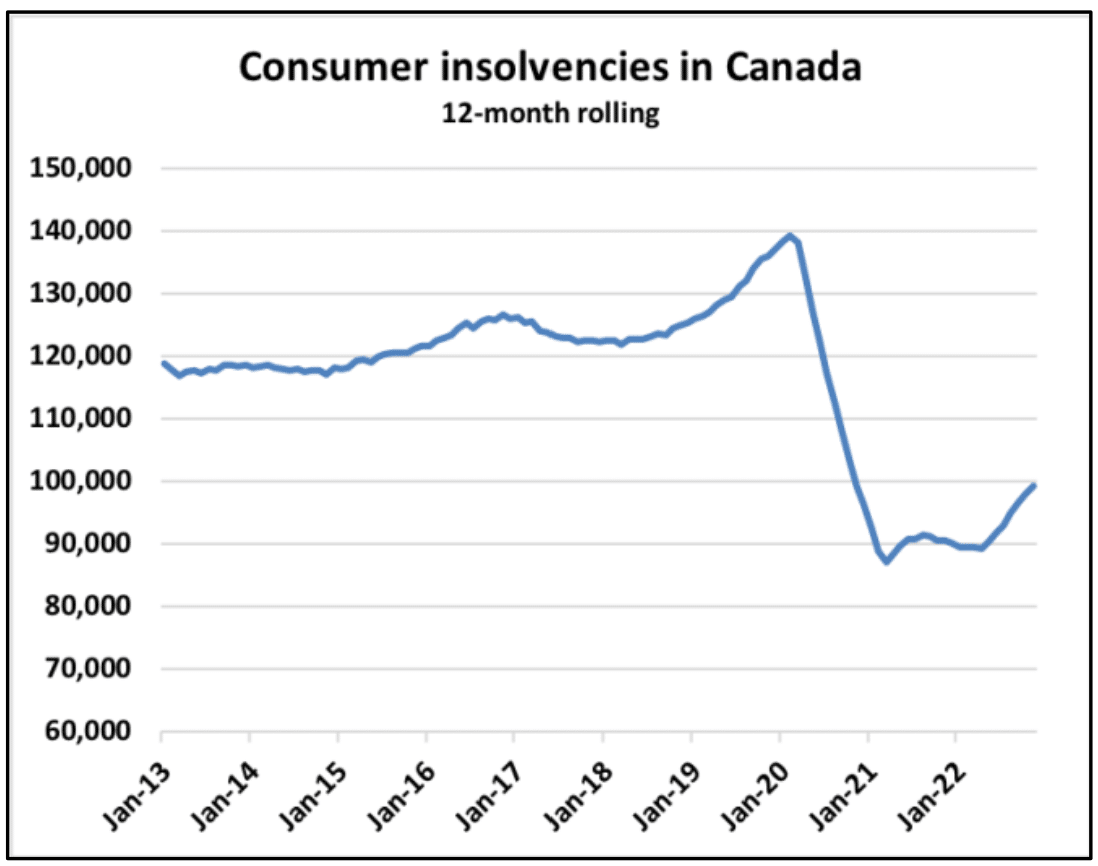

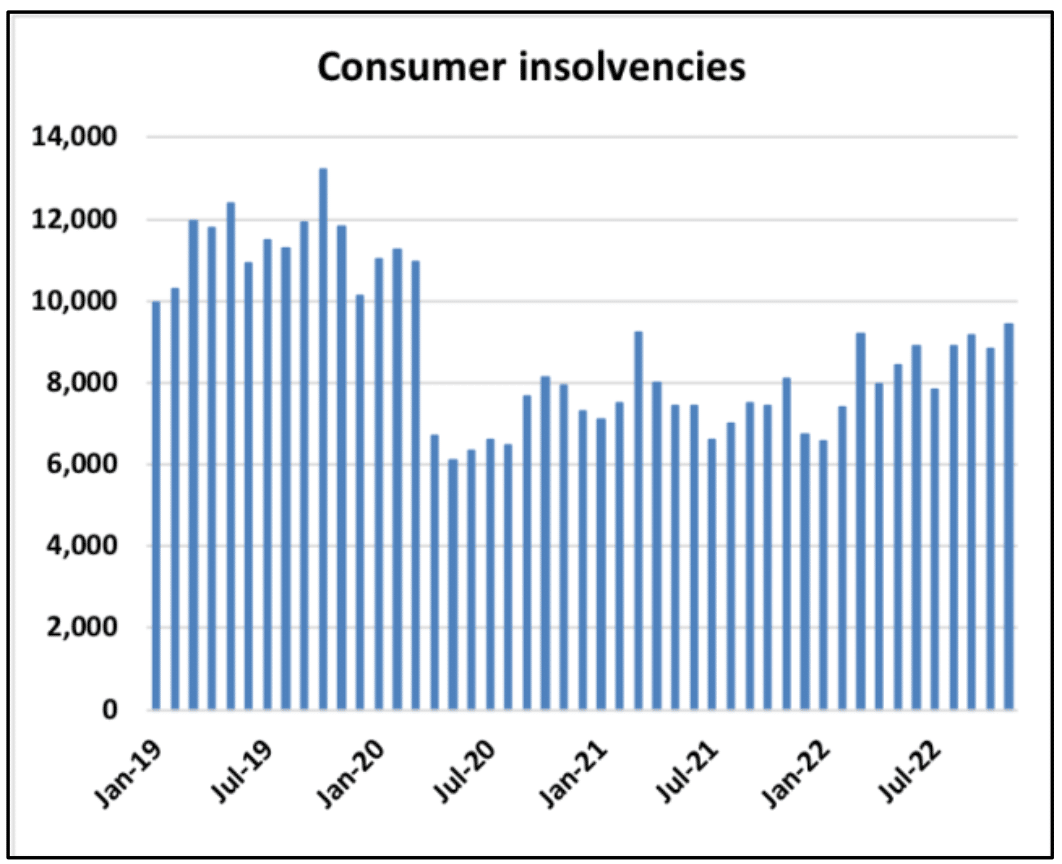

Consumer insolvencies were up 16.3% year over year (“y/y”) in November and posted the highest monthly total since March 2020. We saw a record high in proposal filings (i.e., restructuring of unsecured debts) in Alberta and BC with Ontario just slightly below its highs.

Business insolvencies jumped 58% y/y in November with monthly filings hitting the highest since 2019 led by a 74% increase in the construction sector.

The household effective interest rate has flatlined over the past 3 weeks, business rates continue to make fresh highs and are now nearly 400 bps higher than one year prior.

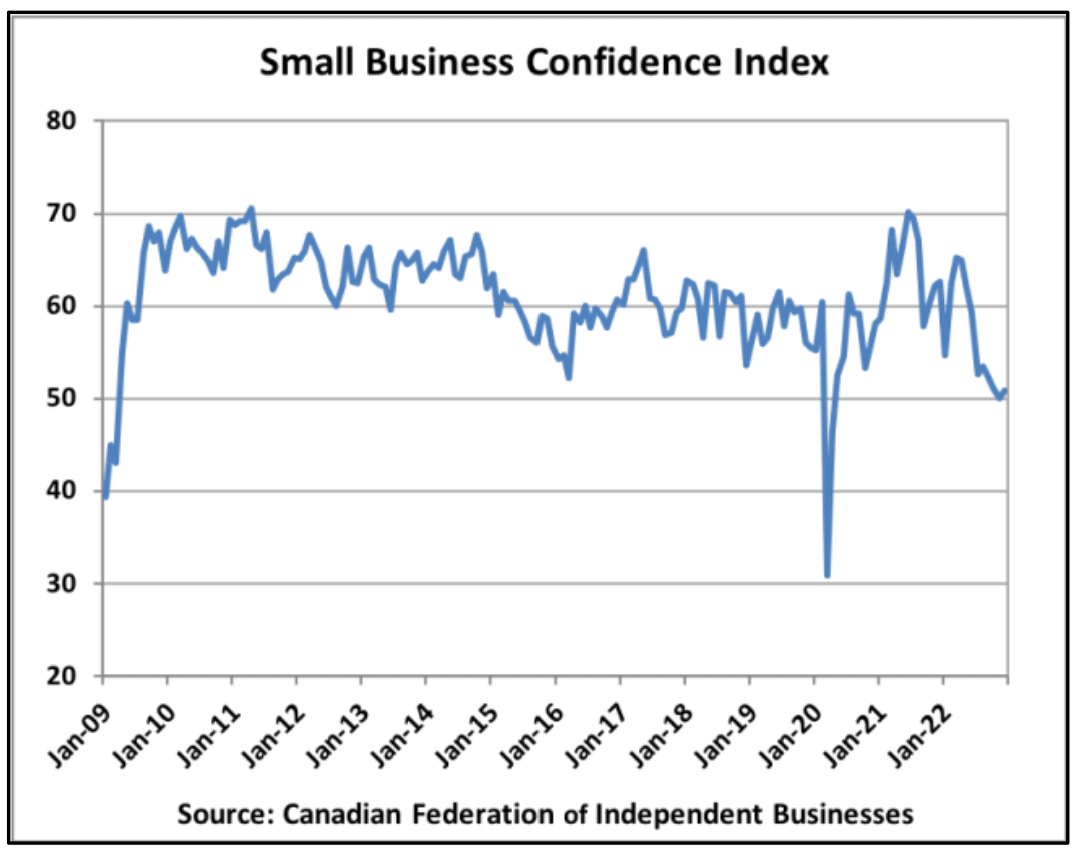

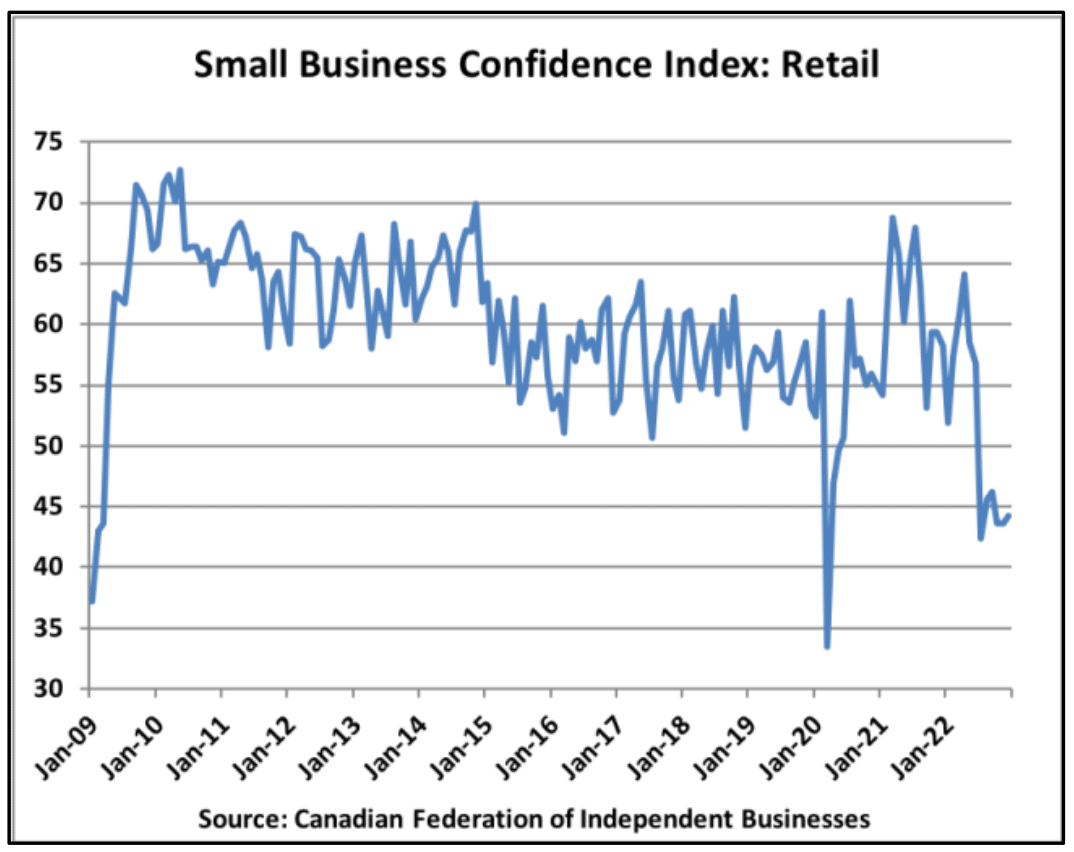

The Canadian Federation of Independent Business’ (“CFIB”) December Barometer showed a slight uptick in business confidence but overall levels remain at recessionary levels with a particularly weak reading among retailers.

Businesses expect slowing wage growth

A sharp deceleration in wage expectations and an uptick in price expectations which pushed expected real wages to -1.2%.

What’s driving weaker wage expectations, the share of businesses reporting a shortage in labour posted the steepest monthly decline since Apr 2020.

Official Statistics Canada data may be reporting a solid labour market, but businesses are seeing otherwise.

We’d welcome an opportunity to discuss the perspectives presented in Consumer & Business Credit impacts on Real Estate Market report. If you have any questions about our services, please contact our team.

Comments