The number of homes sold through the MLS® System of the Ottawa Real Estate Board totalled 565 units in December 2023. This was an increase of 7.6% from December 2022.

Home sales were 16% below the five-year average and 11.9% below the 10-year average for the month of December.

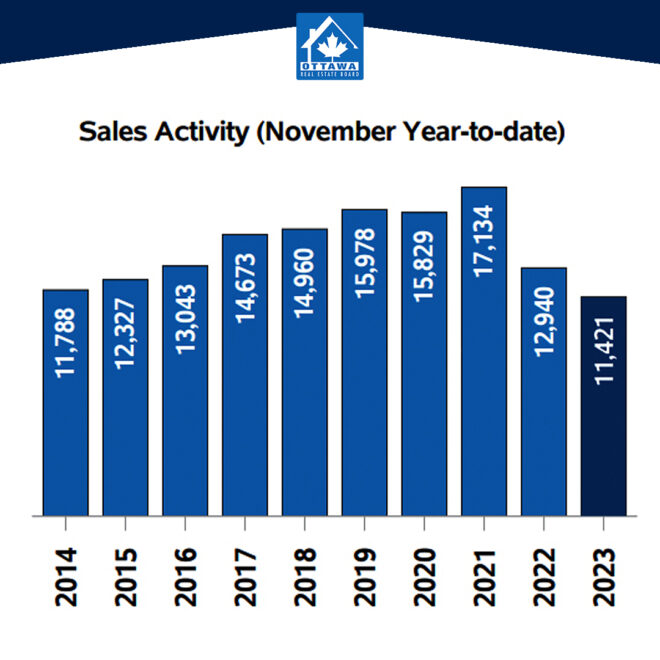

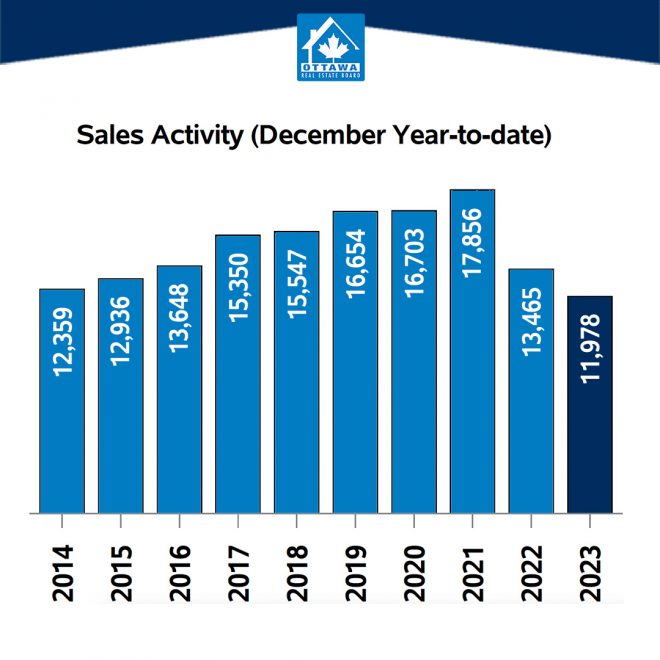

On a year-to-date basis, home sales totalled 11,978 units in all of 2023 — a decline of 11.0% from 2022.

“Ottawa’s resale market closed out the year in a steady, balanced state,” says OREB President Curtis Fillier. “This could be an early indication that consumer confidence is returning. We likely won’t see the full impact of rate stabilization until the second half of 2024, but December’s activity bodes well for a strong year ahead in Ottawa.”

“It hasn’t been the easiest market,” says Ken Dekker, OREB’s Past-President. “And while we probably won’t return to the peak levels seen in 2022, Ottawa’s market is poised to recover any ground lost in the past year. Both buyers and sellers need extra patience right now, but solid opportunities are there.”

By the Numbers – Prices:

The MLS® Home Price Index (HPI) tracks price trends far more accurately than is possible using average or median price measures.

- The overall MLS® HPI composite benchmark price was $623,900 in December 2023, a modest gain of 2.7% from December 2022.

- The benchmark price for single-family homes was $704,900, up 2.7% on a year-over-year basis in December.

- By comparison, the benchmark price for a townhouse/row unit was $481,100, up 4.2% compared to a year earlier.

- The benchmark apartment price was $417,200, up 2.1% from year-ago levels.

- The average price of homes sold in December 2023 was $632,487, increasing 1.7% from December 2022. The more comprehensive year-to-date average price was $667,794, a decline of 5.5% from 2022.

- The dollar value of all home sales in December 2023 was $357.3 million, up 9.4% from the same month in 2022.

OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

By the Numbers – Inventory & New Listings

- The number of new listings saw a major decrease of 12.4% from December2022. There were 523 new residential listings in December 2023. New listings were 4% below the five-year average and 16.1% below the 10-year average for the month of December.

- Active residential listings numbered 1,844 units on the market at the end of December, a gain of 3.0% from the end of December 2022.

- Active listings were 55.5% above the five-year average and 17.2% below the 10-year average for the month of December.

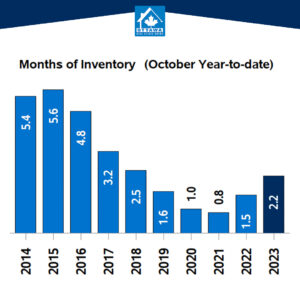

- Months of inventory numbered 3.3 at the end of December 2023, down from the 3.4 months recorded at the end of December 2022. The number of months of inventory is the number of months it would take to sell current inventories at the current rate of sales activity.

In conjunction with the Ottawa Real Estate Board (OREB), historical data may be subject to revision moving forward. This could temporarily impact per cent change comparisons to data from previous years.

Distinctive Real Estate Advisors Inc., Brokerage is pleased to present a recap of the latest market forecast release and December highlights from the Ottawa Real Estate Board (OREB).

We’d welcome an opportunity to discuss the Ottawa MLS® December Home Sales Close Out Year in Steady State. If you have any questions about our services, please contact our team.