The Greater Toronto Area (GTA) housing market continued to shift in May 2025, offering a clearer picture of the evolving dynamics that homebuyers, sellers, and investors must now navigate.

With significantly more inventory on the market and modestly improving affordability conditions, the pace and tone of the market have changed—though underlying economic uncertainty continues to cast a long shadow.

Is This the Window Buyers Have Been Waiting For?

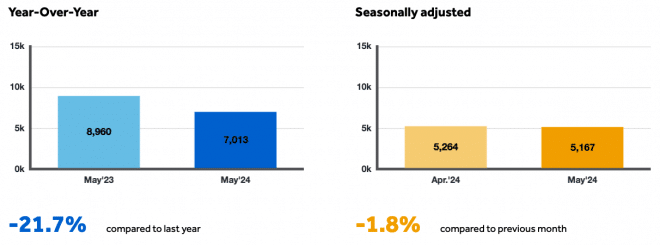

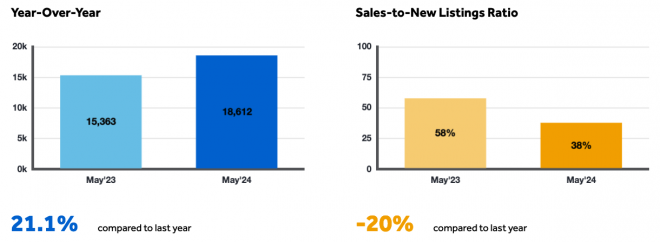

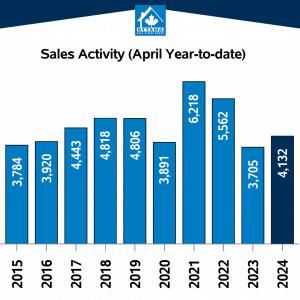

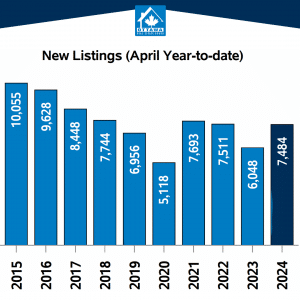

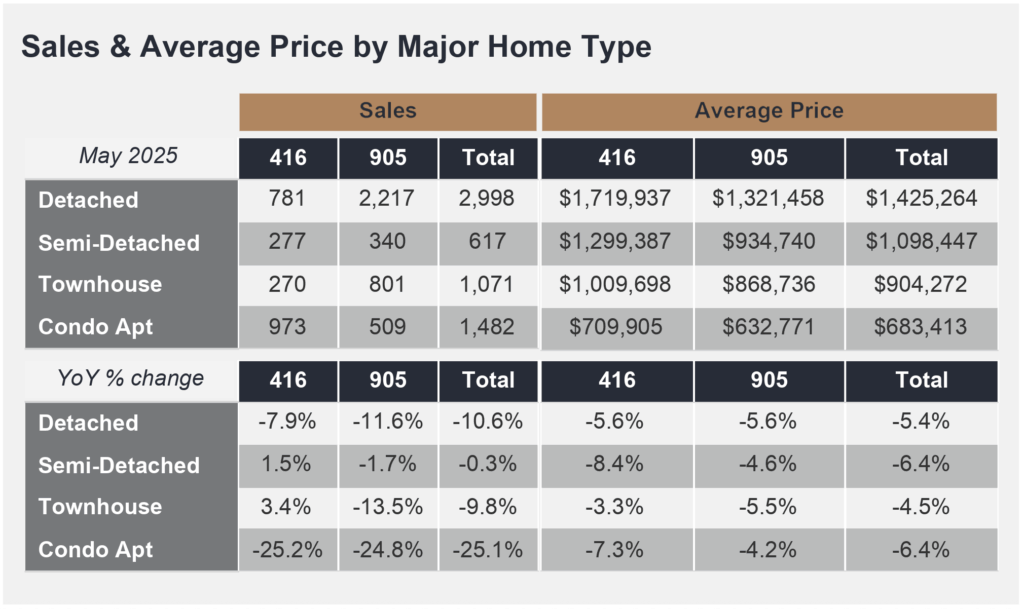

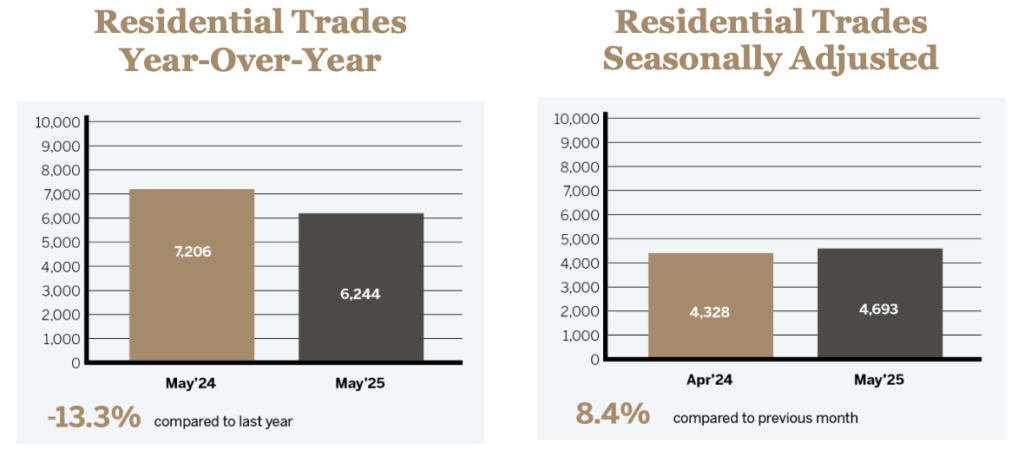

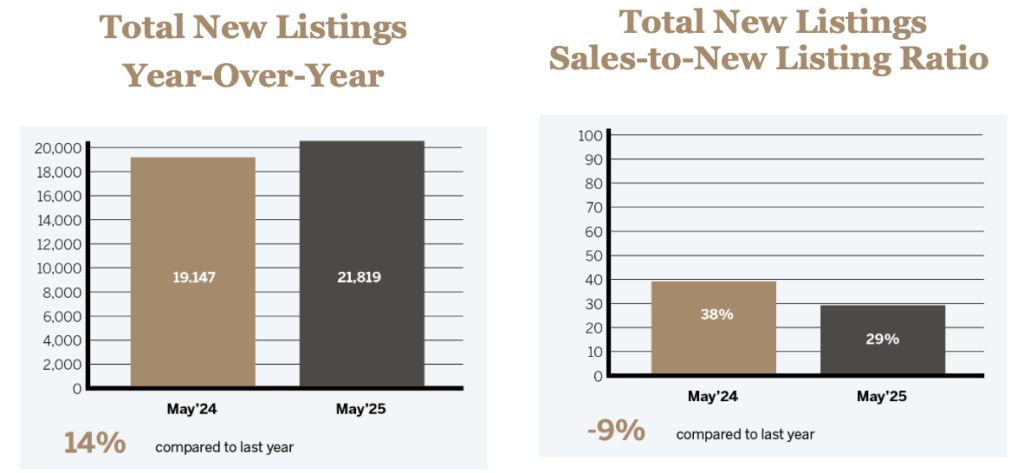

In May 2025, GTA REALTORS® reported 6,244 home sales—down 13.3% compared to the same time last year. At the same time, new listings climbed by 14%, reaching 21,819. This surge in inventory has shifted the balance of power back into the hands of buyers, who are now negotiating in a less competitive, more opportunity-rich environment.

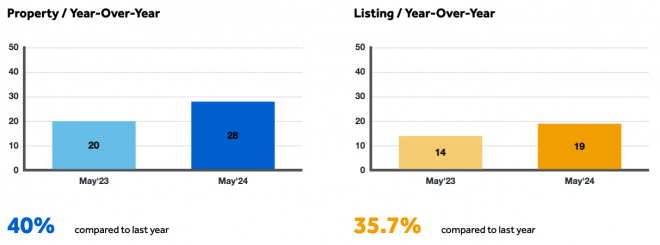

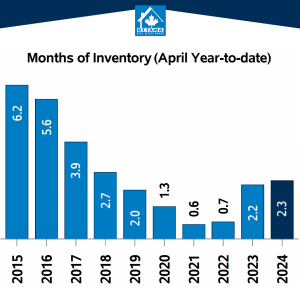

Active listings soared to nearly 31,000, representing a 41.5% increase year-over-year and marking the highest inventory level since 2002. Buyers today are not only facing less pressure to compete but also have more leverage to negotiate pricing, terms, and conditions.

Is the Market Finding Its Pricing Floor?

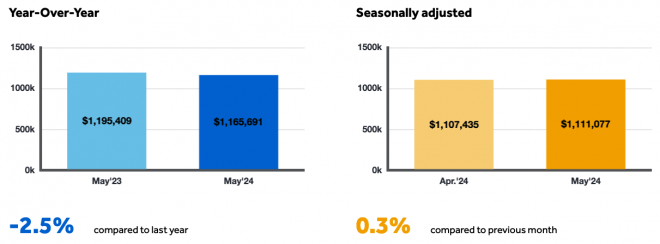

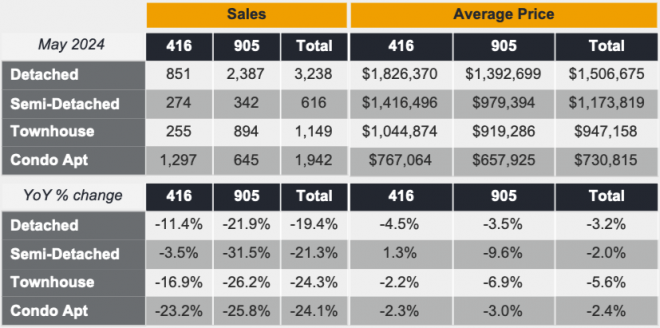

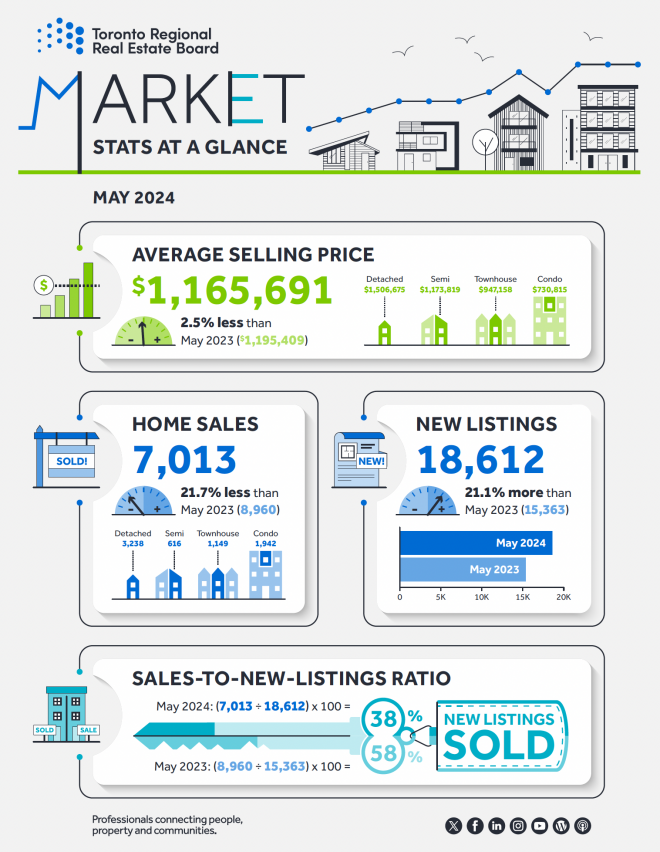

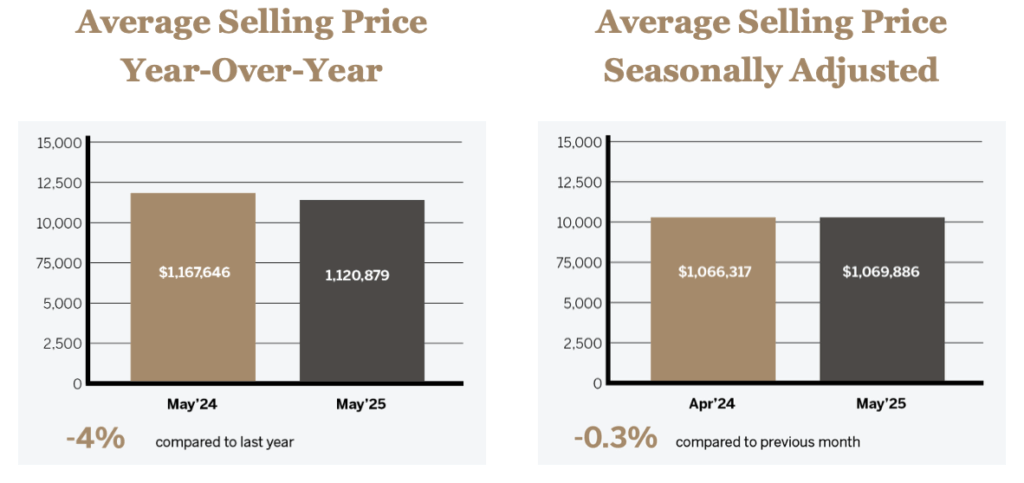

The average GTA home price in May settled at $1,120,879—a decline of 4%compared to May 2024. The MLS® Home Price Index Composite benchmark also fell 4.5% year-over-year.

Month-over-month, however, both the average price and benchmark saw modest gains, suggesting a market that is bottoming out and slowly adjusting to broader economic signals.

Importantly, borrowing costs have eased compared to one year ago, giving prospective buyers a slightly better affordability position, despite ongoing challenges in mortgage qualification and lender scrutiny.

No Rate Cut—Yet: BoC Stays the Course

On June 4th, the Bank of Canada held its overnight interest rate steady at 4.50%, citing encouraging inflation data and early signs of economic cooling. While some anticipated a rate cut to jumpstart housing demand and consumer confidence, the central bank opted for a more cautious stance. It acknowledged that although core inflation is trending downward, wage growth and shelter costs remain elevated, warranting a wait-and-see approach.

For real estate, this means more of the same in the short term: rates that are still restrictive by recent historical standards, but stable enough to encourage cautious re-entry by sidelined buyers.

Renewals and refinances remain a financial pressure point for many households, particularly those facing upcoming mortgage term expiries at higher rates.

Affordability Improves, But Confidence Wanes

Despite the technical improvements in affordability and increased supply, economic confidence remains fragile. Buyers are not rushing in. Trade disputes with the United States, tepid GDP growth, and ambiguity around federal housing policy execution are contributing to consumer hesitancy.

The prevailing mood is one of deliberation. While some well-capitalized buyers are acting on opportunities, many are waiting for either further rate relief or more clarity on the trajectory of home prices and the economy as a whole.

Opportunity Awaits the Informed and Prepared

The spring market has made it clear: this is not a crash, nor is it a boom. It is a recalibration.

The current environment favours buyers with long-term perspectives and access to financing, as well as sellers who price appropriately in light of today’s market realities. Above all, it reinforces the need for informed, strategic decision-making—working with a REALTOR® who understands the neighbourhood, the product type, and the financial landscape has never been more essential.

As we look ahead to the summer and fall markets, the next interest rate decision and broader macroeconomic signals will be pivotal. But for now, the message is clear: inventory is up, affordability is modestly improved, and opportunity exists—for those ready to move with eyes wide open.

Let’s Talk Strategy in a Shifting Market

Have questions about what these latest numbers really mean for you—or how rising U.S. tariffs, economic uncertainty, and rate volatility might affect your next real estate move?

Now more than ever, it’s essential to have informed, strategic guidance rooted in today’s market realities. Whether you’re planning to buy, sell, or simply assess your options, I’m here to provide a clear, confident path forward.