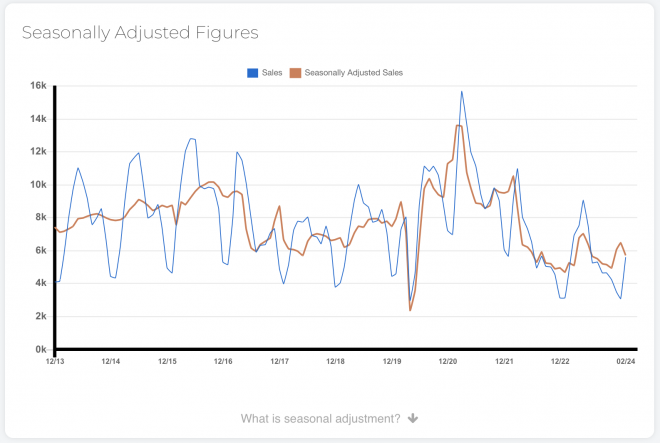

May home sales continued at low levels, especially in comparison to last spring’s short-lived pick-up in market activity. Home buyers are still waiting for relief on the mortgage rate front.

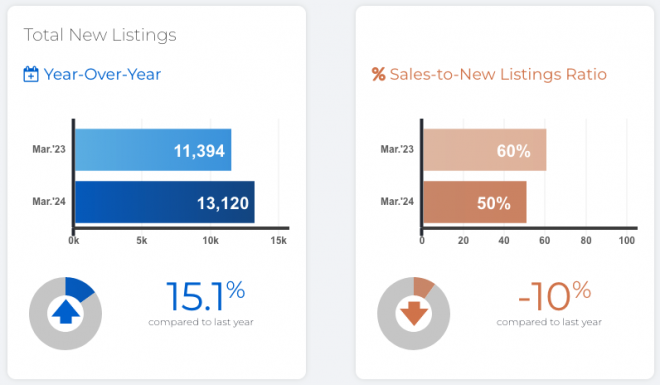

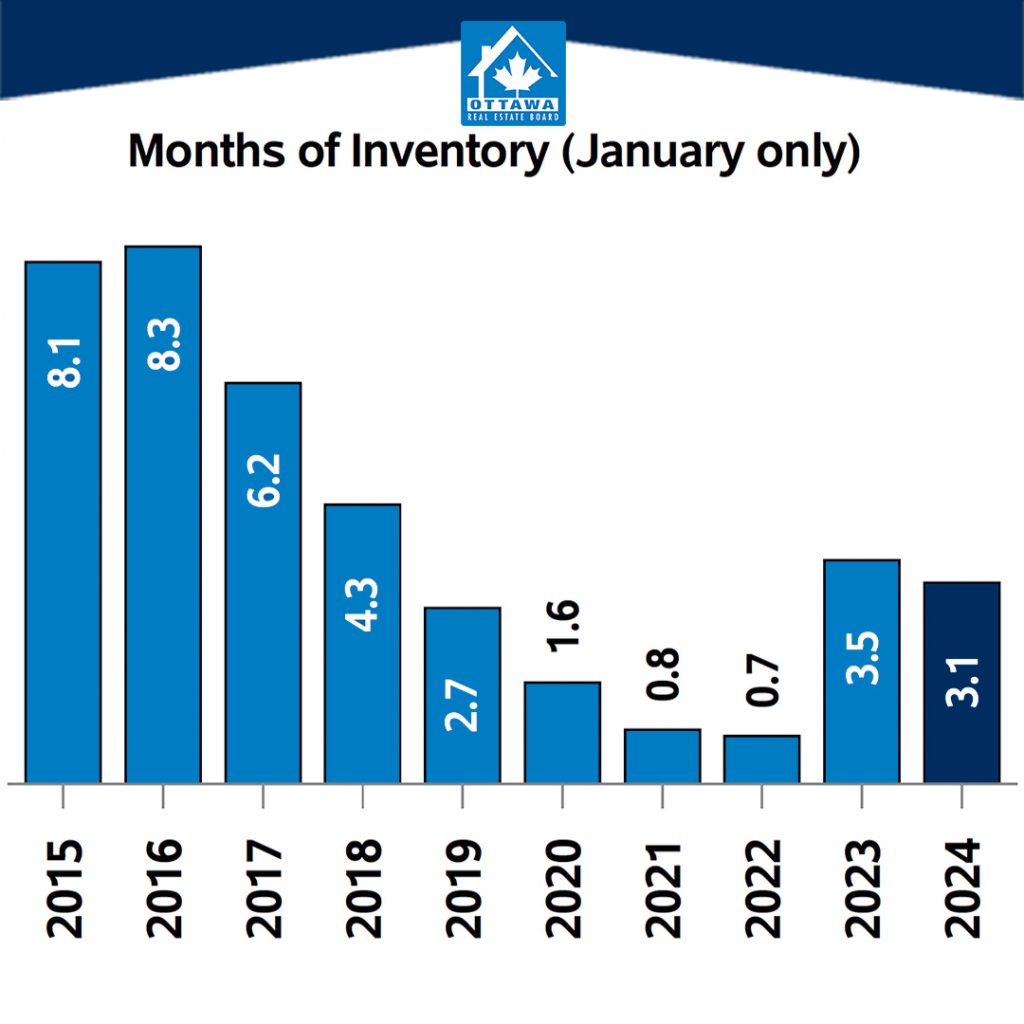

Existing homeowners are anticipating an uptick in demand, as evidenced by a year-over-year increase in new listings. With more choice compared to a year ago, buyers benefited from more negotiating room on prices.

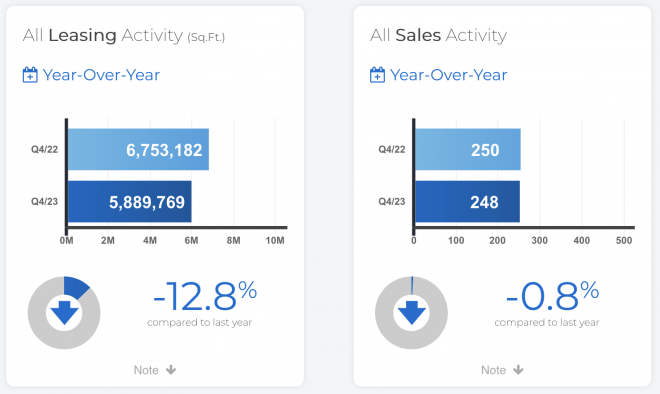

Recent polling from Ipsos indicates that home buyers are waiting for clear signs of declining mortgage rates. As borrowing costs decrease over the next 18 months, more buyers are expected to enter the market, including many first-time buyers. This will open up much needed space in a relatively tight rental market.

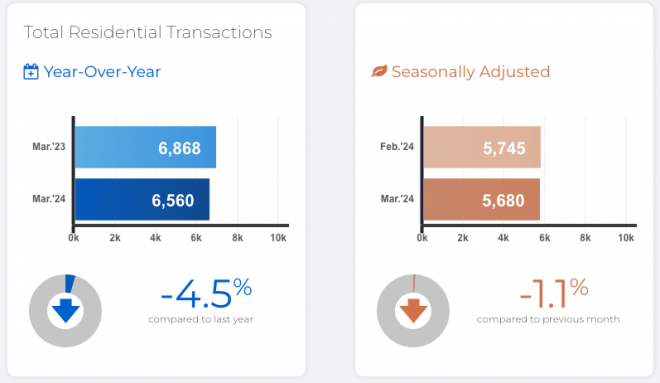

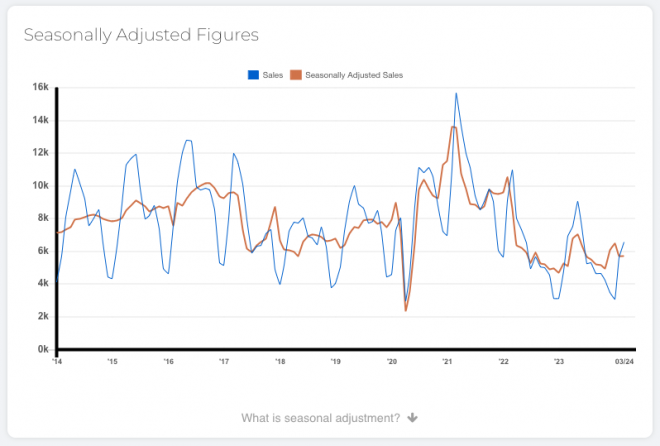

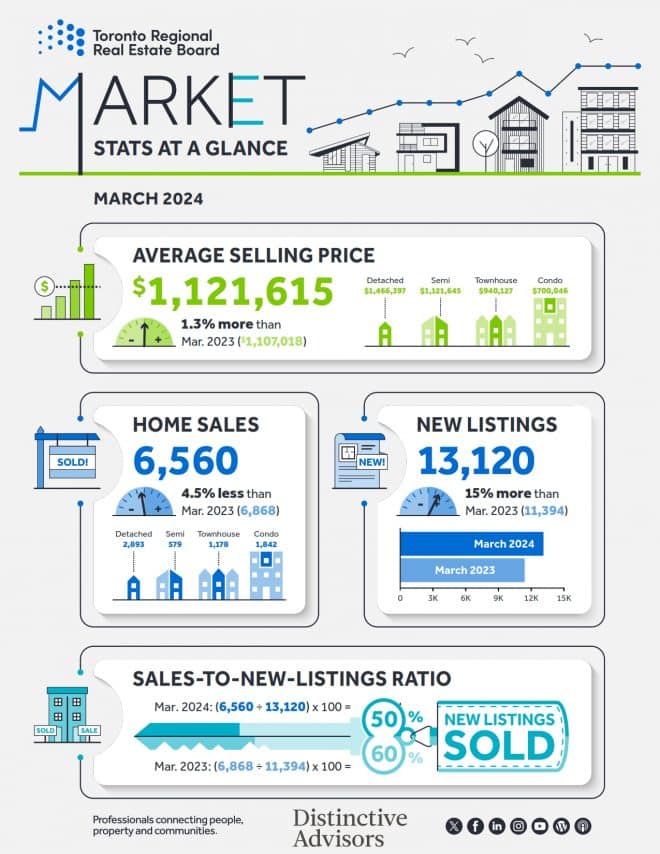

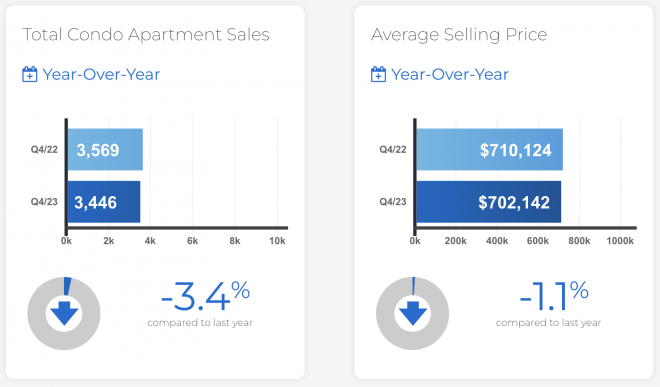

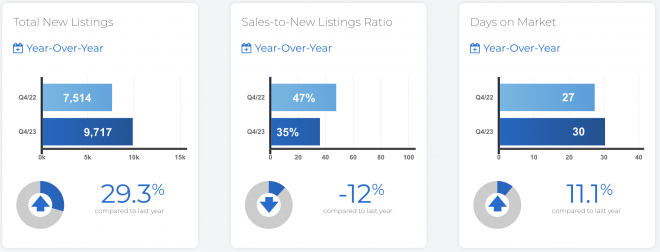

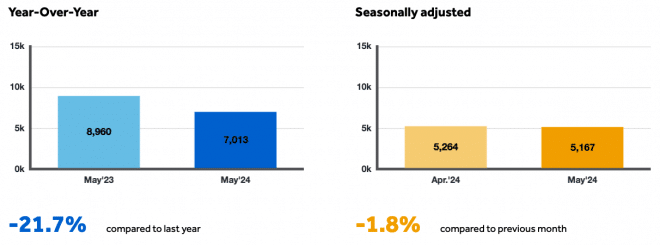

TOTAL RESIDENTIAL TRANSACTIONS

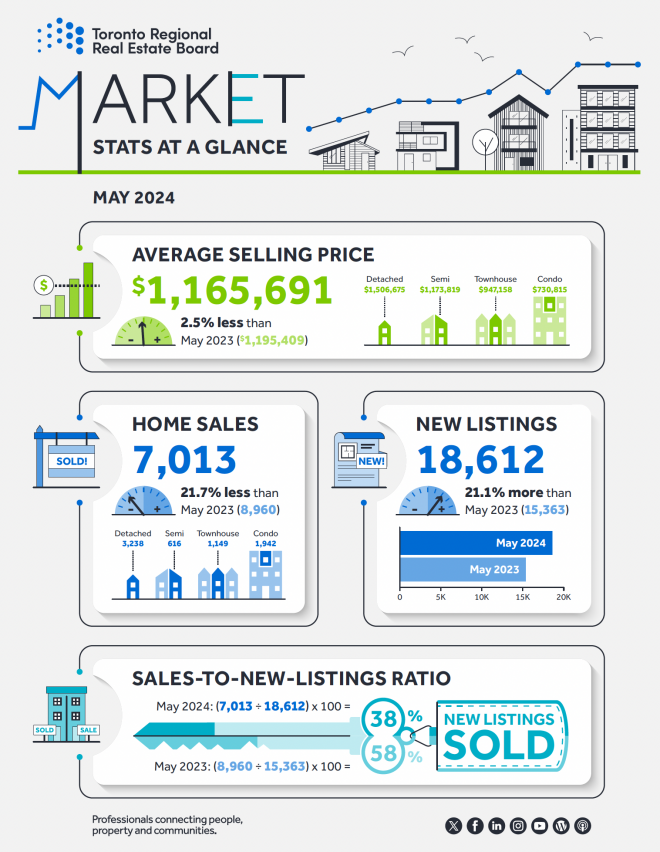

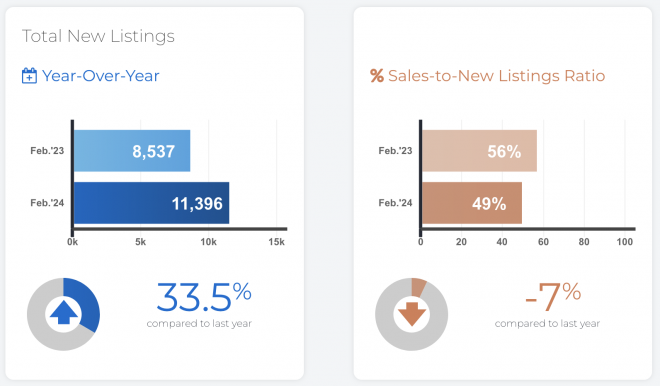

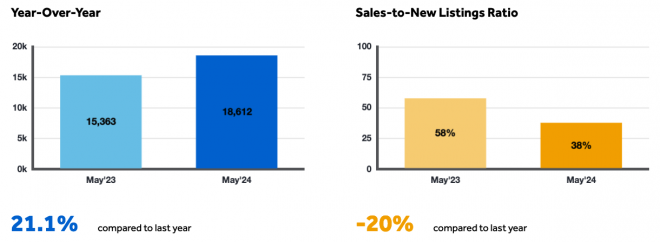

In the Greater Toronto Area, 7,013 home sales were reported through TRREB’s MLS System in May 2024 – a 21.7 per cent decline compared to 8,960 sales reported in May 2023. New listings entered into the MLS System amounted to 18,612 – up by 21.1 per cent year-over-year.

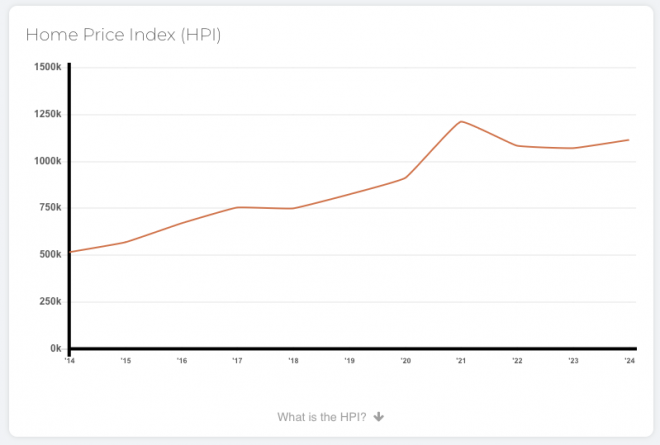

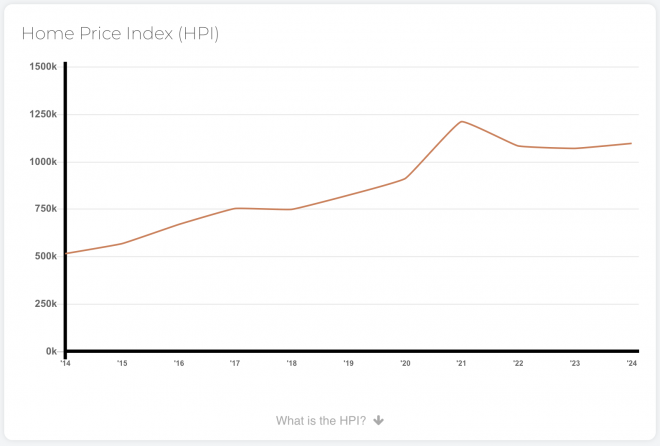

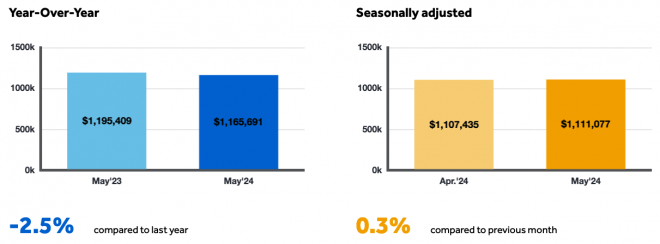

AVERAGE SELLING PRICE

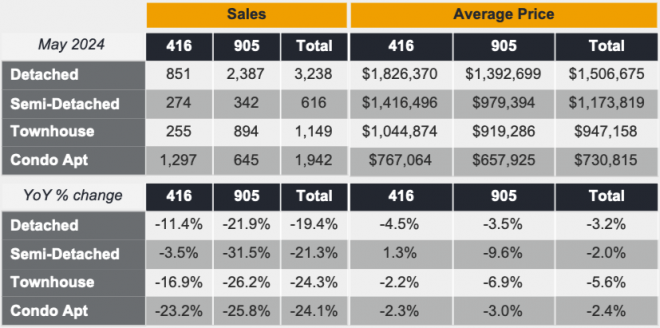

The MLS® Home Price Index Composite benchmark was down by 3.5 per cent on a year-over-year basis in May 2024. The average selling price of $1,165,691 was down by 2.5 per cent over the May 2023 result of $1,195,409. On a seasonally adjusted monthly basis, the average selling price edged up slightly compared to April 2024.

TOTAL NEW LISTINGS

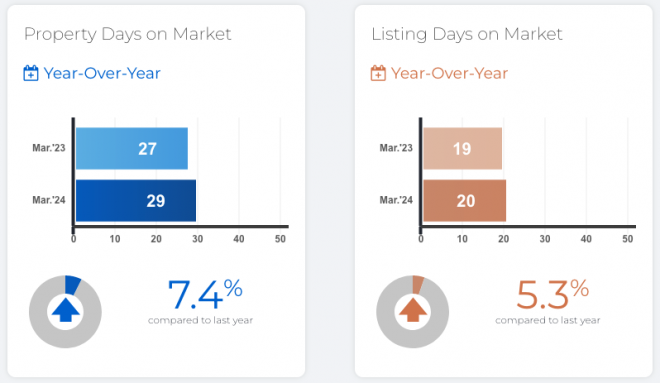

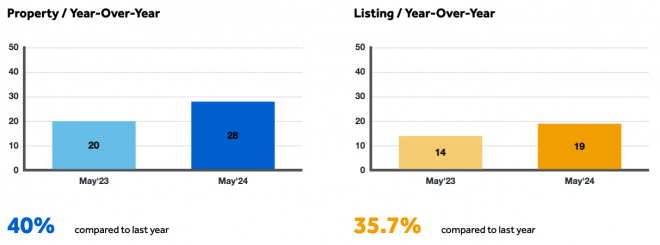

AVERAGE DAYS ON MARKET

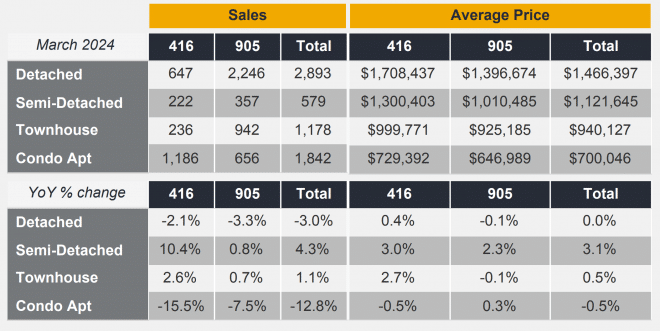

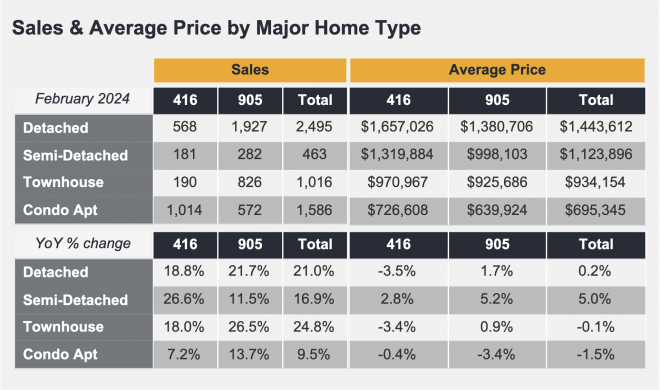

SALES & AVERAGE PRICE BY MAJOR HOME TYPE

Final Thoughts:

While interest rates remained high in May, home buyers did continue to benefit from slightly lower selling prices compared to last year. We have seen selling prices adjust to mitigate the impact of higher mortgage rates. Affordability is expected to improve further as borrowing costs trend lower. However, as demand picks up, we will likely see renewed upward pressure on home prices as competition between buyers increases.

In order to have an affordable and livable region over the long term, we need to see a coordinated effort from all levels of government to alleviate our current housing deficit and to provide housing for new population moving forward.

On top of this, governments need to ensure the delivery of infrastructure to support our growing population. The economic health and livability of our region depends on the timely completion of public transit projects including better transparency and clear timelines on the completion of the Eglinton Crosstown LRT.

Distinctive Real Estate Advisors Inc., Brokerage is pleased to present a recap of the latest market forecast release and May highlights from the Toronto Regional Real Estate Board (TRREB).

We’d welcome an opportunity to discuss A Slow May in Toronto Real Estate more. If you have any questions about our services, please contact our team.