The latest data from the Toronto Regional Real Estate Board (TRREB) reveals some interesting trends in the GTA housing market for March 2024.

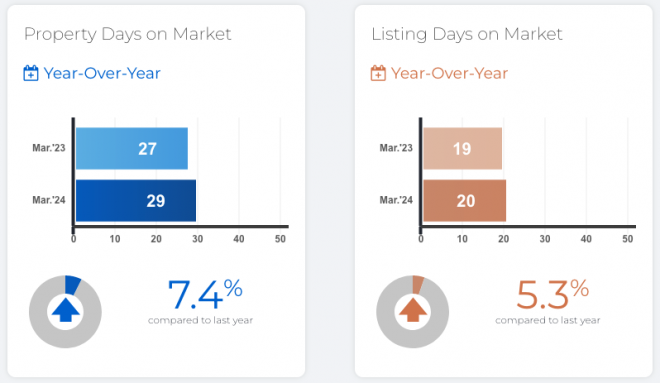

Despite a slight dip in sales compared to March 2023, largely attributed to the timing of Good Friday, the GTA real estate landscape is showing signs of vitality and resilience.

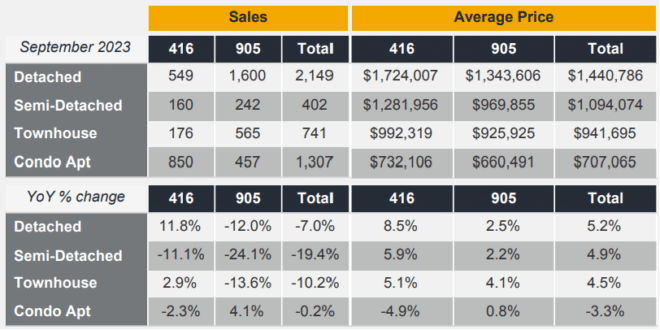

RESIDENTIAL STATS

Key Highlights:

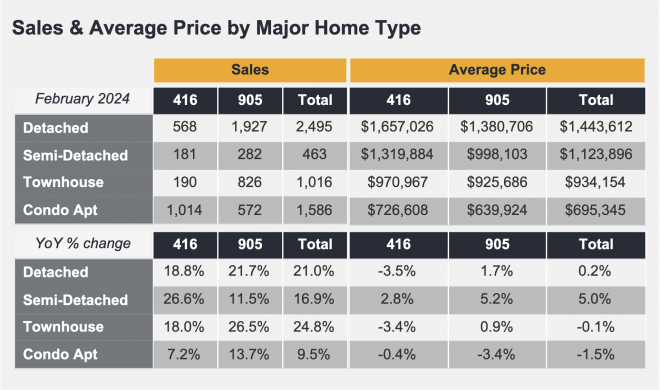

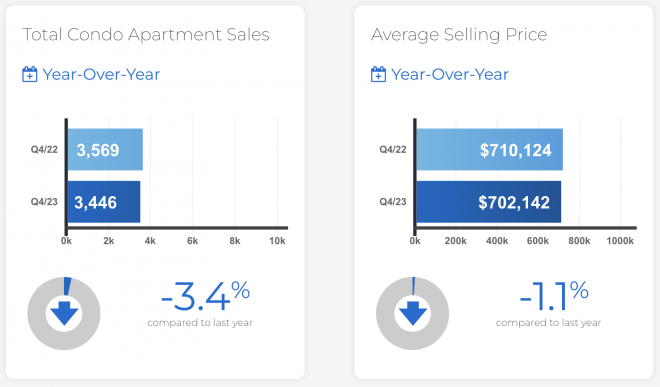

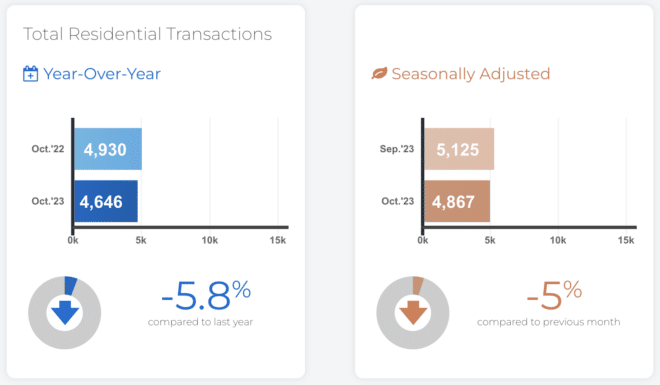

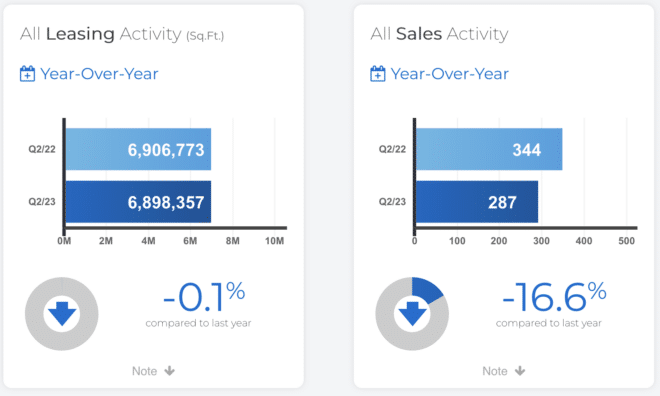

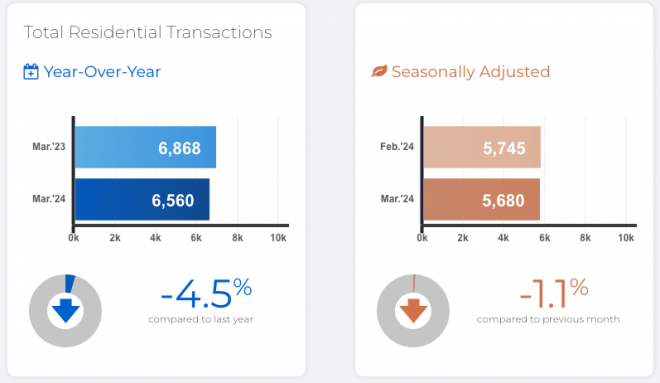

- A total of 6,560 homes were sold in March 2024, marking a modest 4.5% decrease from March 2023.

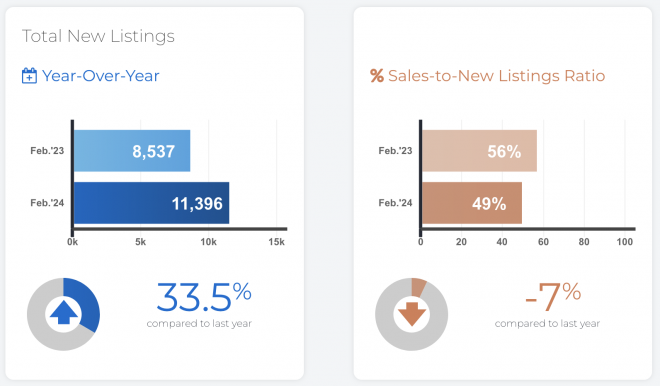

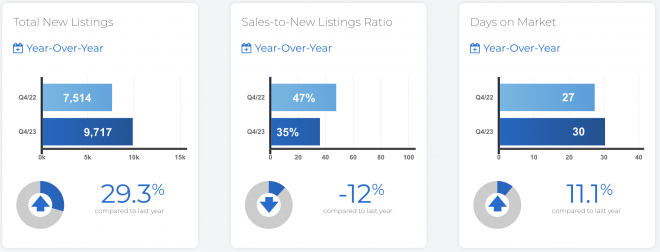

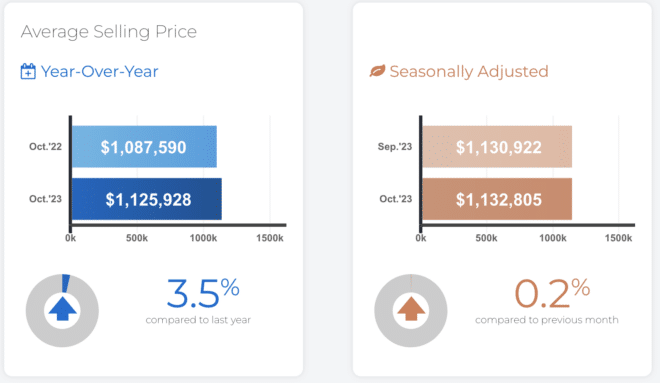

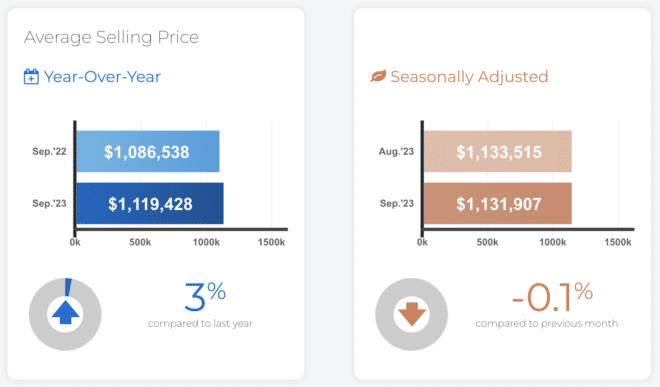

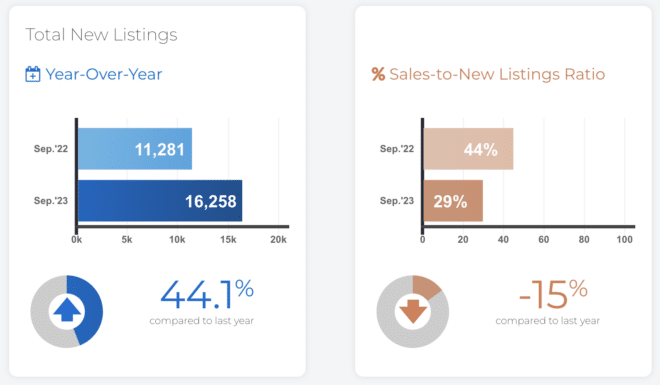

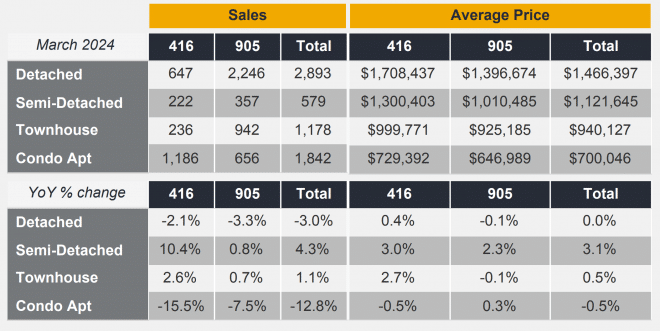

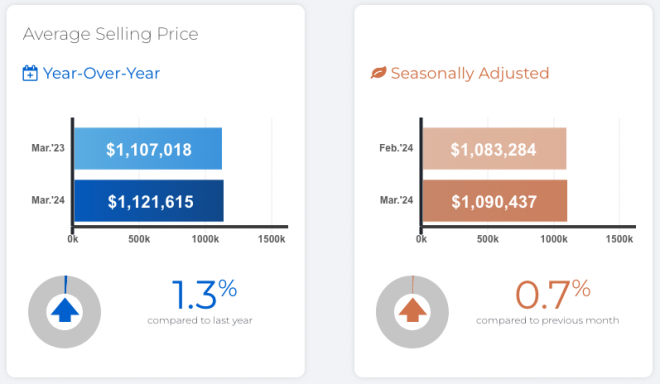

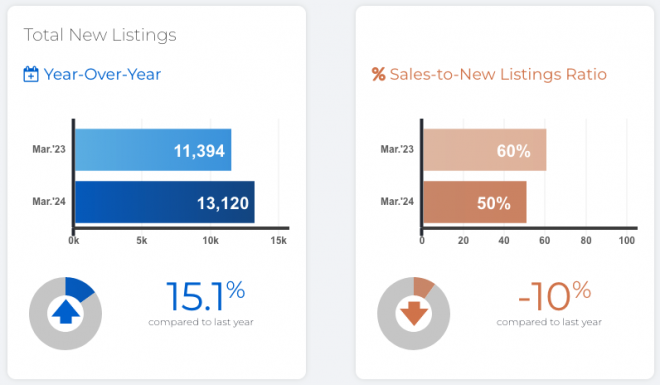

- New listings surged by 15%, indicating a healthier market supply. The average selling price saw a slight increase of 1.3% year-over-year to $1,121,615.

- A noticeable uptick in new listings by 18.3% year-over-year in the first quarter reflects a market ready for spring.

Market Insights:

TRREB President Jennifer Pearce notes, “A gradual market improvement with more buyers adjusting to higher interest rates, and anticipation for a stronger spring market contributed to the significant rise in new listings.”

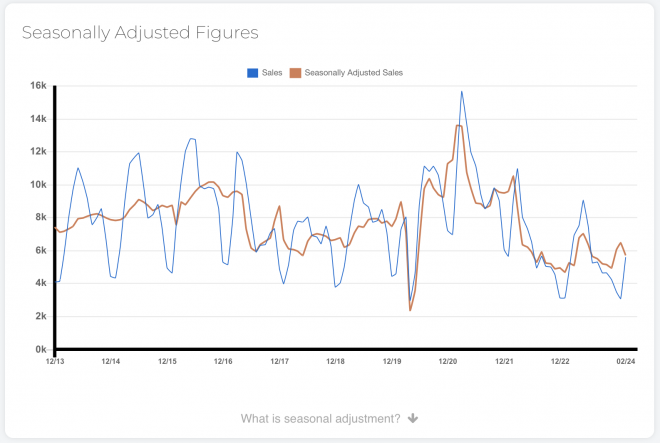

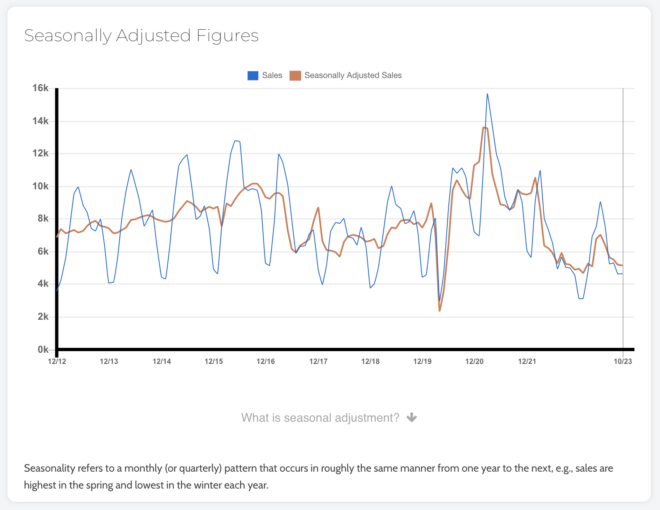

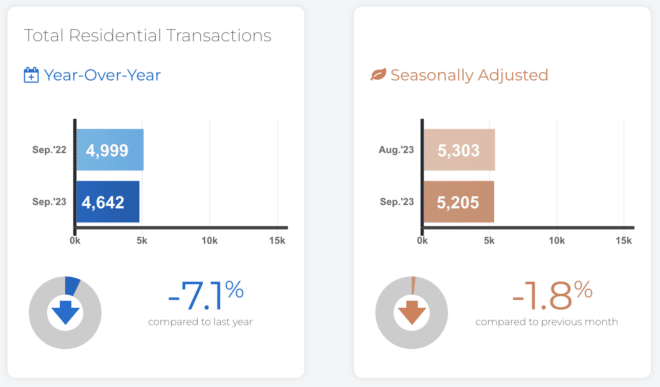

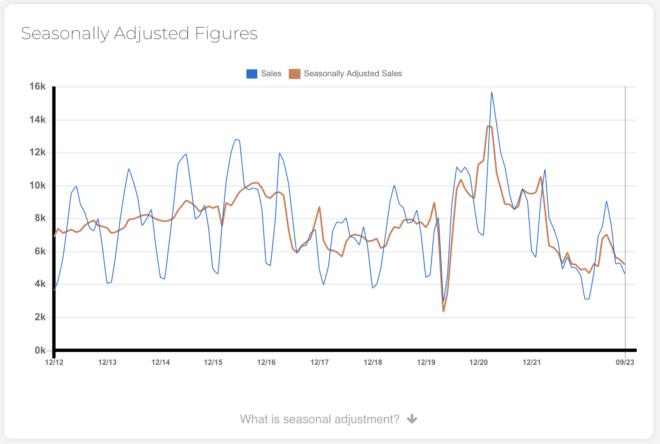

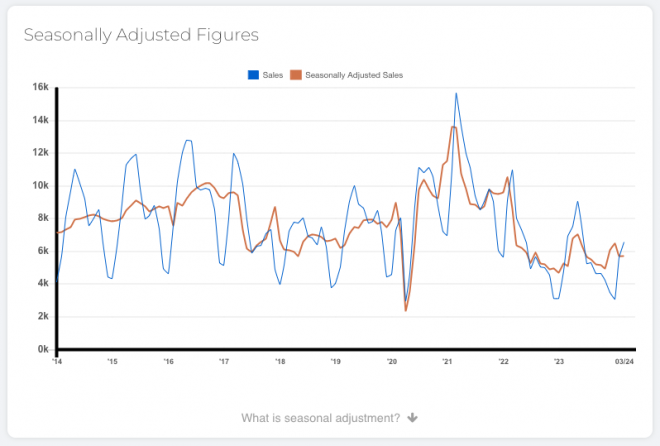

What is seasonal adjustment? Seasonality refers to a monthly (or quarterly) pattern that occurs in roughly the same manner from one year to the next, e.g., sales are highest in the spring and lowest in the winter each year.

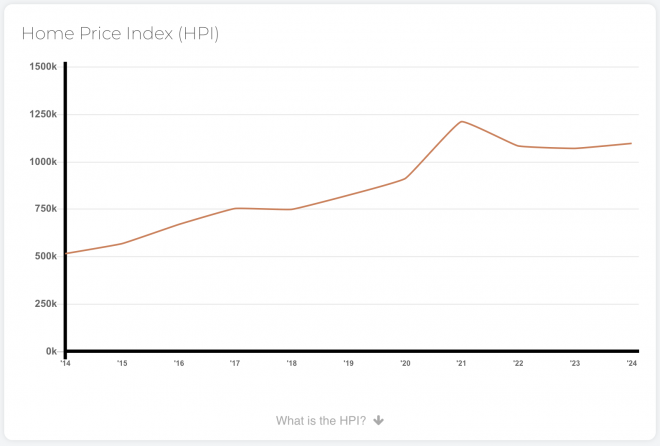

HPI provides a price growth measure for a benchmark home with the same characteristics over time, allowing for an apples-to-apples comparison from one year to the next.

Future Outlook:

Experts predict an acceleration in price growth as the market heads into spring, driven by lower borrowing costs and a tighter market. TRREB Chief Market Analyst Jason Mercer anticipates, “Price growth is expected to accelerate, with sellers’ market conditions emerging in many neighbourhoods.”

A Call for Action on Housing Supply:

As demand for both ownership and rental housing increases, TRREB CEO emphasizes the need for innovative solutions to boost housing supply and affordability. This includes exploring co-ownership models and encouraging gentle density in high-demand areas.

Final Thoughts:

The GTA real estate market is poised for an exciting period of growth and evolution. With anticipated lower borrowing costs and a focus on increasing housing supply, we’re looking forward to seeing how these dynamics will shape the market in the coming months. Stay tuned for more updates and insights into the GTA housing market!

Distinctive Real Estate Advisors Inc., Brokerage is pleased to present a recap of the latest market forecast release and March highlights from the Toronto Regional Real Estate Board (TRREB).

We’d welcome an opportunity to discuss the GTA REALTORS Release March 2024 Stats. If you have any questions about our services, please contact our team.