While the overall demand for housing remained buoyed by record immigration in 2023, more of this demand was pointed at the rental market. The number of Greater Toronto Area (GTA) home sales in 2023 came in at less than 70,000 due to affordability issues brought about by high mortgage rates.

High borrowing costs coupled with unrealistic federal mortgage qualification standards resulted in an unaffordable home ownership market for many households in 2023. With that said, relief seems to be on the horizon. Borrowing costs are expected to trend lower in 2024. Lower mortgage rates coupled with a relatively resilient economy should see a rebound in home sales this year.

RESIDENTIAL STATS

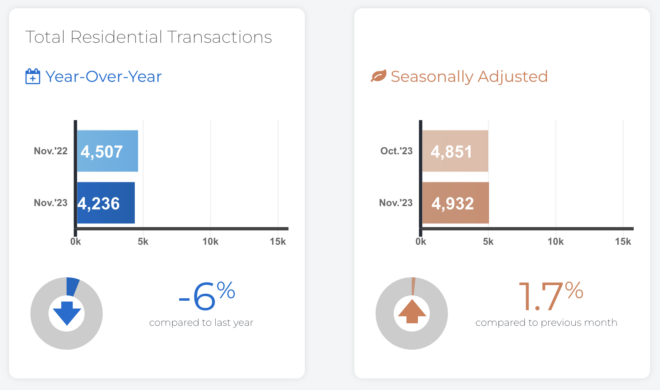

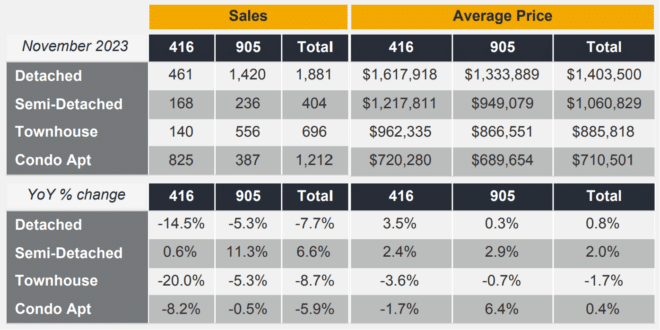

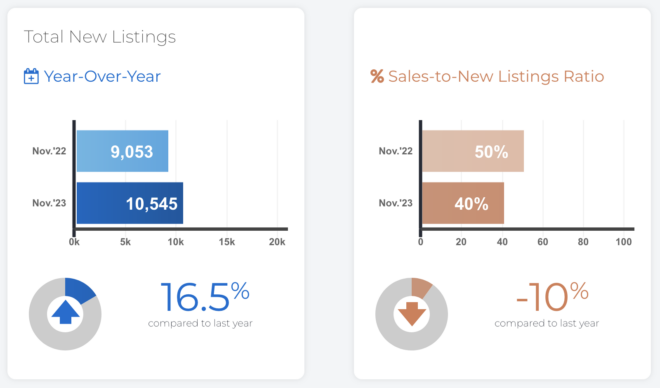

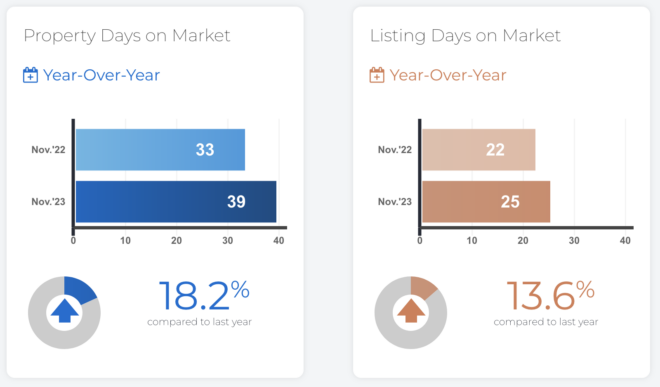

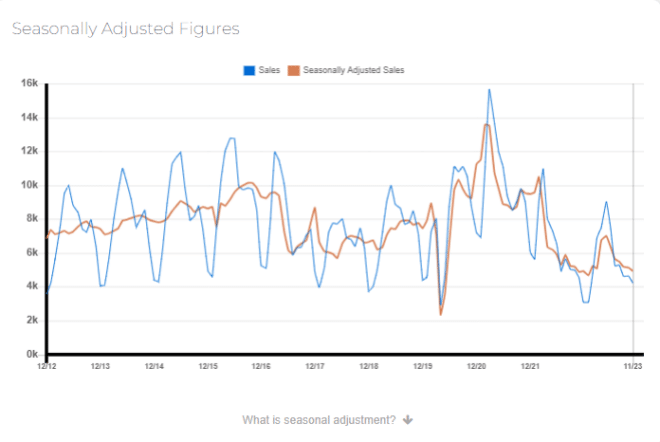

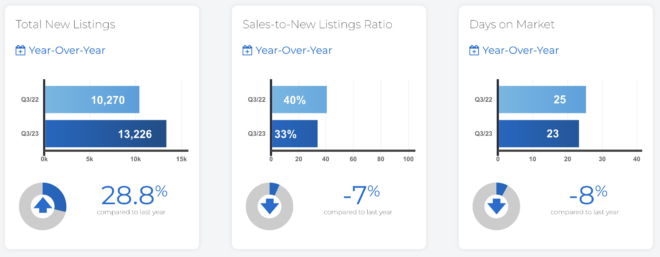

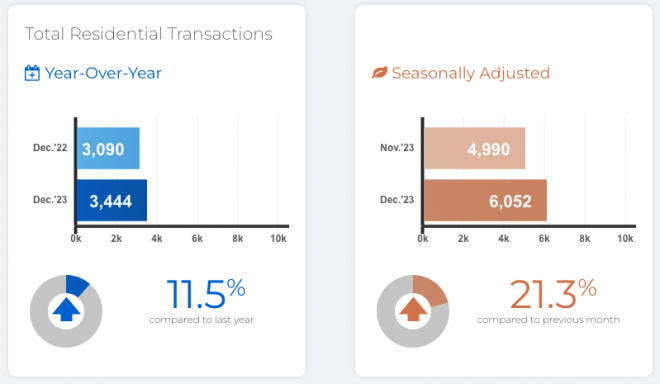

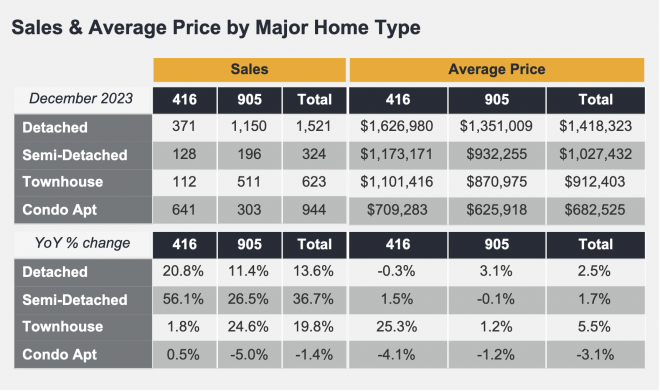

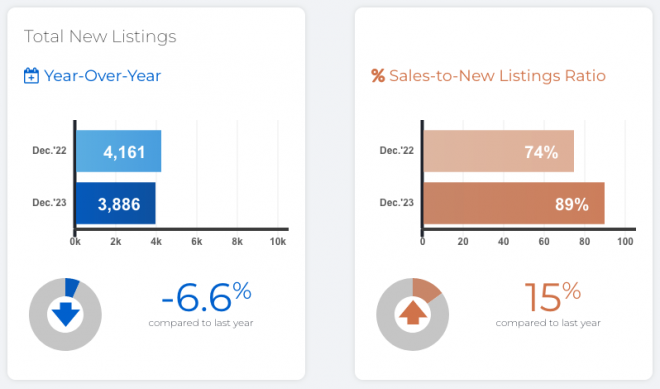

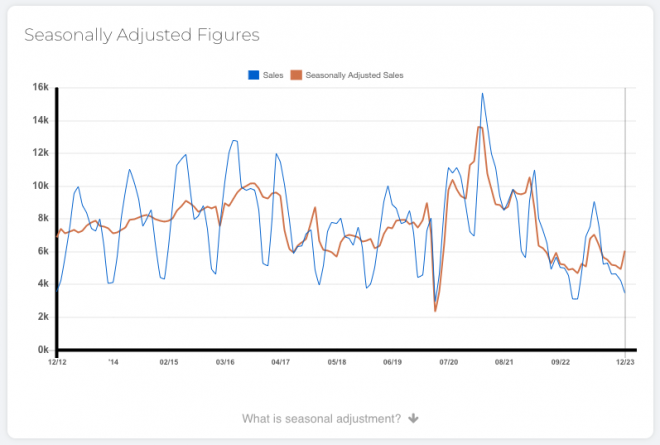

There were 65,982 home sales reported through TRREB’s MLS® System in 2023 – a 12.1 per cent dip compared to 2022. Despite an uptick during the spring and summer, the number of new listings also declined in 2023. The trend for listings has been largely flat-to-down over the past decade, which is problematic in the face of a steadily growing population. On a seasonally adjusted monthly basis, sales increased compared to November, while new listings declined for the third straight month.

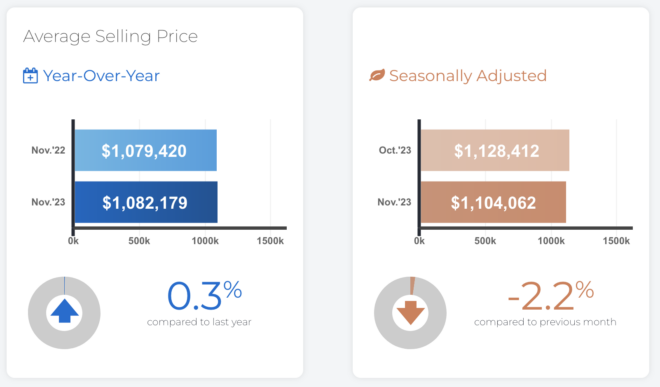

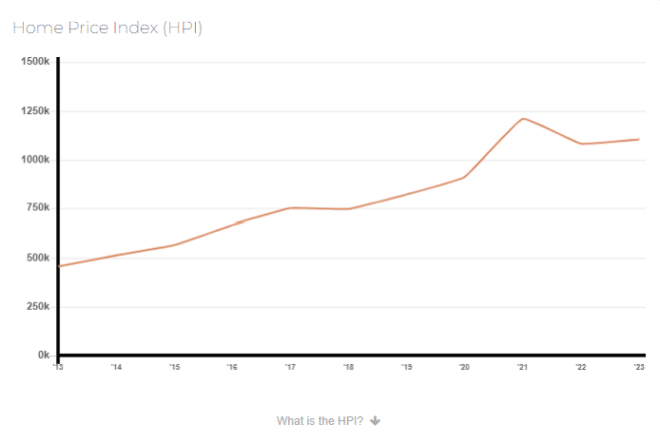

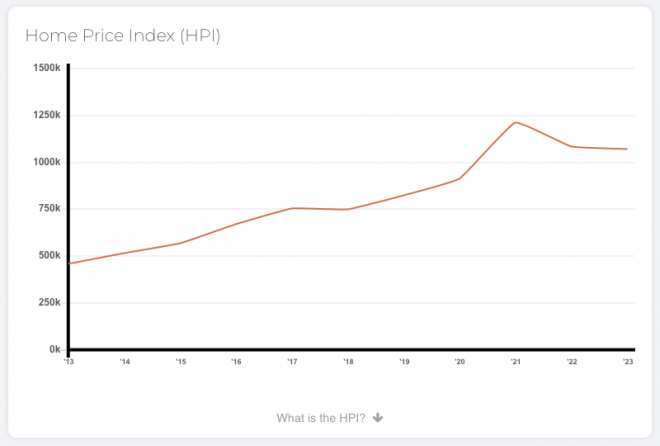

The average selling price for all home types in 2023 was $1,126,604, representing a 5.4 per cent decline compared to 2022. On a seasonally adjusted monthly basis, the average selling price edged higher, while the MLS® Home Price Index Composite edged lower.

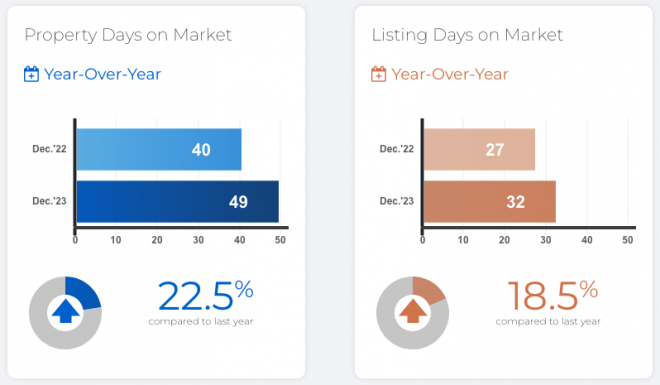

Buyers who were active in the market benefitted from more choice throughout 2023. This allowed many of these buyers to negotiate lower selling prices, alleviating some of the impact of higher borrowing costs. Assuming borrowing costs trend lower this year, look for tighter market conditions to prompt renewed price growth in the months ahead.

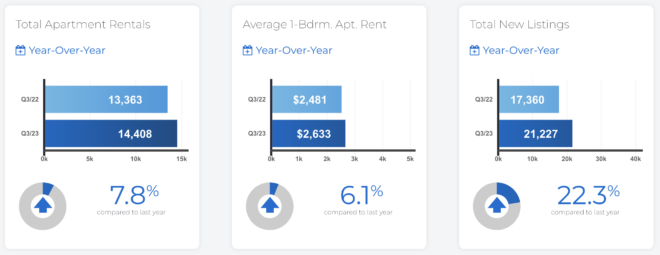

Record immigration into the GTA in the coming years will require a corresponding increase in the number of homes available to rent or purchase. People need to have comfort in knowing that they can plan their lives and future with the certainty that they will have the stability of an affordable place to live.

What is seasonal adjustment? Seasonality refers to a monthly (or quarterly) pattern that occurs in roughly the same manner from one year to the next, e.g., sales are highest in the spring and lowest in the winter each year.

What is seasonal adjustment? Seasonality refers to a monthly (or quarterly) pattern that occurs in roughly the same manner from one year to the next, e.g., sales are highest in the spring and lowest in the winter each year.

What is seasonal adjustment? Seasonality refers to a monthly (or quarterly) pattern that occurs in roughly the same manner from one year to the next, e.g., sales are highest in the spring and lowest in the winter each year.

HPI provides a price growth measure for a benchmark home with the same characteristics over time, allowing for an apples-to-apples comparison from one year to the next.

HPI provides a price growth measure for a benchmark home with the same characteristics over time, allowing for an apples-to-apples comparison from one year to the next.

HPI provides a price growth measure for a benchmark home with the same characteristics over time, allowing for an apples-to-apples comparison from one year to the next.

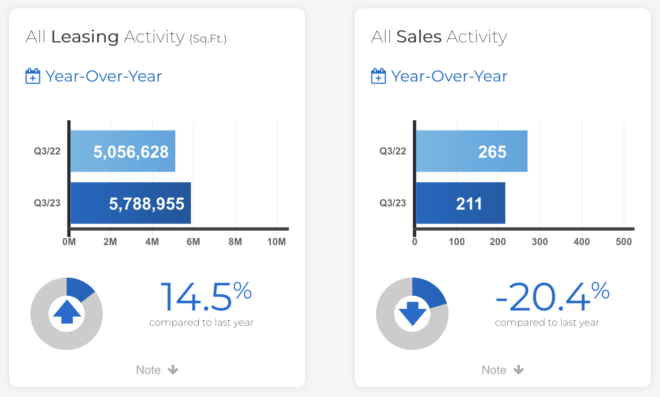

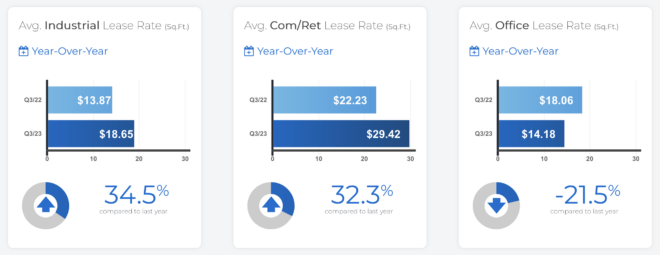

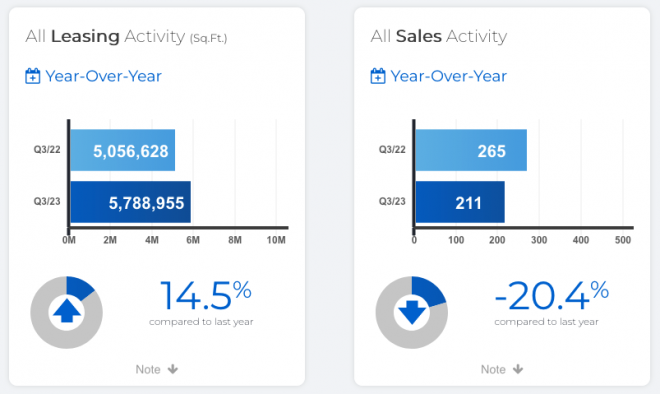

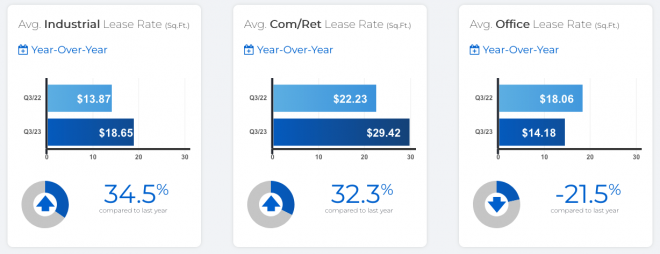

COMMERCIAL STATS

The “All Leasing Activity (Sq. Ft.)” chart summarizes total industrial, commercial/retail and office square feet leased through Toronto MLS® regardless of pricing terms.

The “All Sales Activity” chart summarizes total industrial and commercial/retail and office sales through Toronto MLS® regardless of pricing terms.

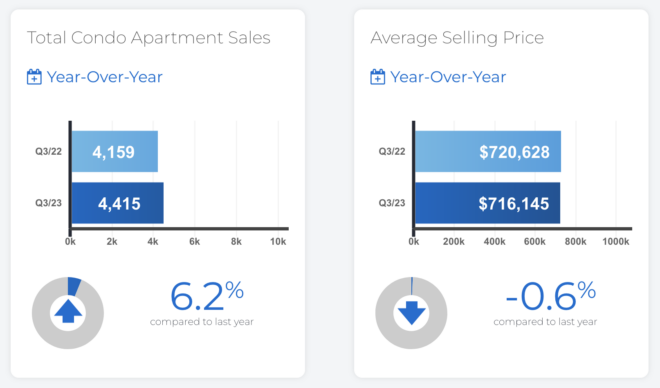

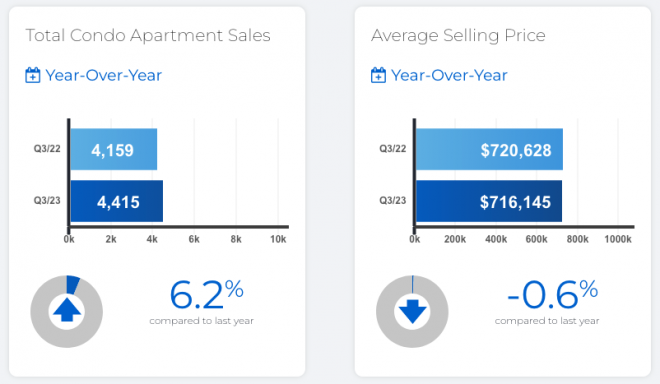

RESIDENTIAL CONDOMINIUM SALES STATS

RESIDENTIAL CONDOMINIUM SALES STATS

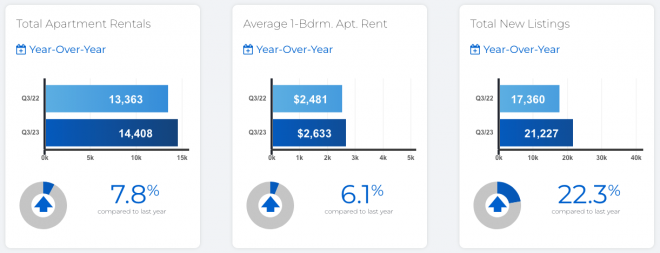

RESIDENTIAL CONDOMINIUM RENTAL STATS

In conjunction with the Toronto Regional Real Estate Board (TRREB) redistricting project, historical data may be subject to revision moving forward. This could temporarily impact per cent change comparisons to data from previous years.

Distinctive Real Estate Advisors Inc., Brokerage is pleased to present a recap of the latest market forecast release and December highlights from the Toronto Regional Real Estate Board (TRREB).

We’d welcome an opportunity to discuss the GTA REALTORS Release December and Year-End 2023 Stats. If you have any questions about our services, please contact our team.