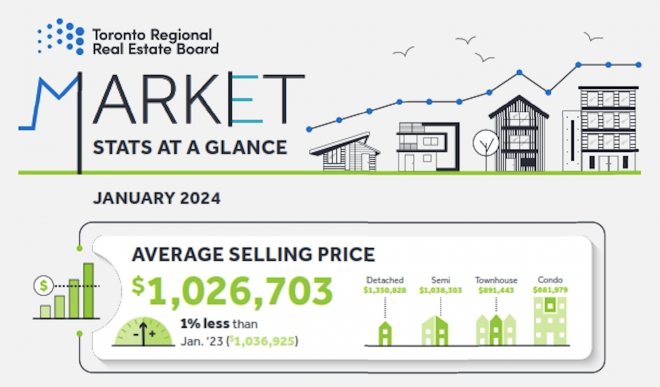

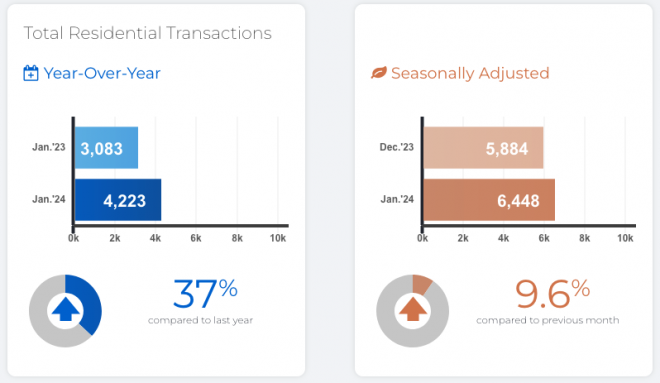

Home sales in January 2024 increased compared to January 2023, driven by lower borrowing costs for fixed-rate mortgages. This surge, along with a rise in new listings, indicates tighter market conditions and potential for price growth into the spring.

TRREB President Jennifer Pearce credits this positive start to expectations of decreasing inflation and interest rates, boosting buyer confidence, especially for first-time buyers challenged by high rents.

RESIDENTIAL STATS

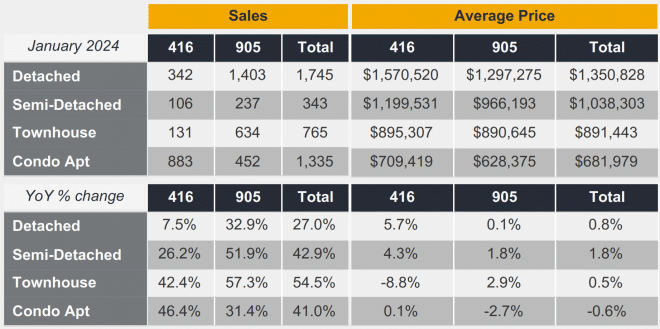

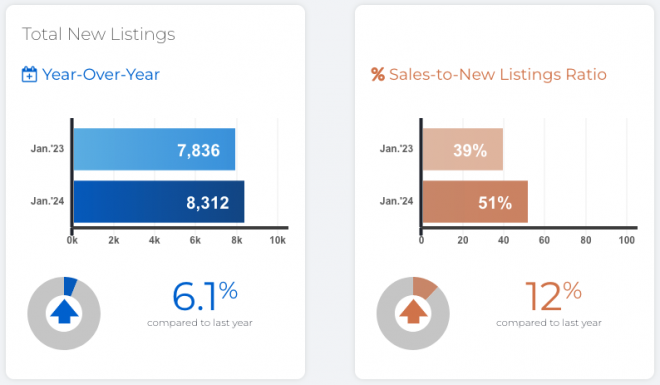

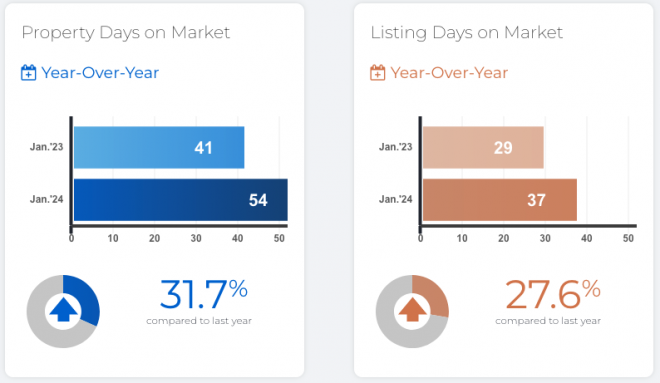

January saw 4,223 sales through TRREB’s MLS® System, a significant jump from the previous year, with sales growth outpacing new listings. This tightening of market conditions suggests increased competition and potential price increases in the coming years.

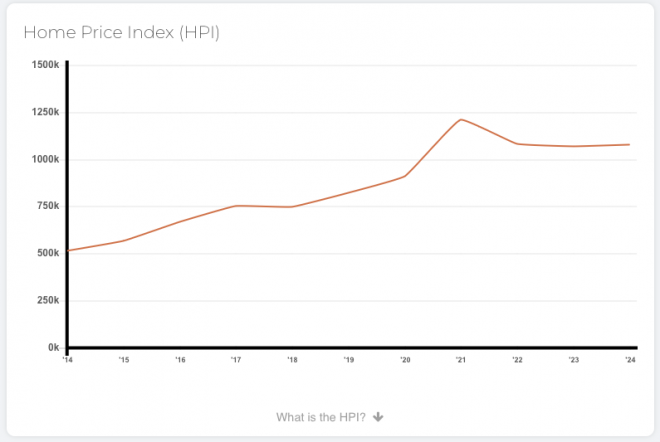

Despite a slight decline in the MLS® Home Price Index Composite and average selling price year-over-year, the outlook remains optimistic with anticipated policy rate cuts by the Bank of Canada. However, addressing policy issues at federal, provincial, and municipal levels, including the mortgage stress test and housing supply, is crucial for sustained market improvement and affordability.

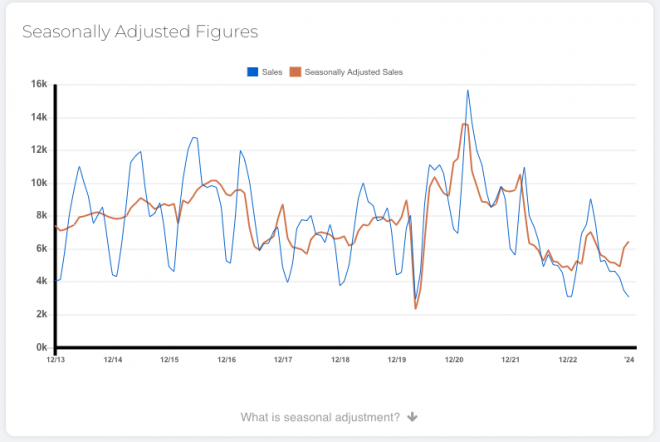

What is seasonal adjustment? Seasonality refers to a monthly (or quarterly) pattern that occurs in roughly the same manner from one year to the next, e.g., sales are highest in the spring and lowest in the winter each year.

What is seasonal adjustment? Seasonality refers to a monthly (or quarterly) pattern that occurs in roughly the same manner from one year to the next, e.g., sales are highest in the spring and lowest in the winter each year.

HPI provides a price growth measure for a benchmark home with the same characteristics over time, allowing for an apples-to-apples comparison from one year to the next.

COMMERCIAL STATS

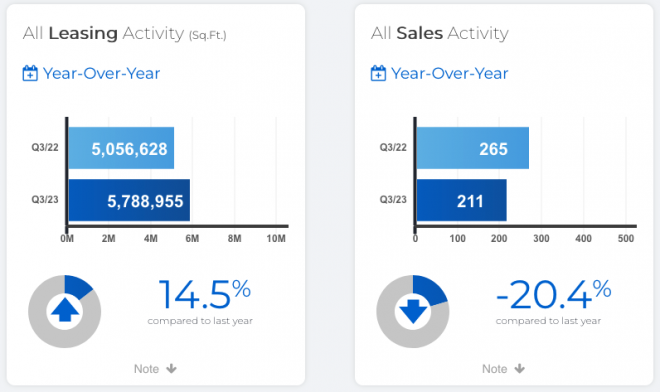

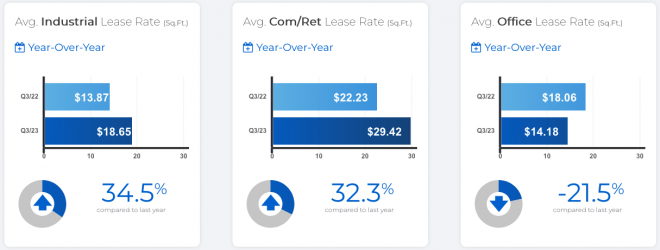

In Q3 2023, TRREB Commercial Network Members reported a significant leasing activity with nearly 5.8 million square feet of space leased across industrial, commercial/retail, and office sectors, marking an increase from Q3 2022. Notably, the average lease rates for industrial and commercial/retail spaces saw a year-over-year rise, with industrial rates jumping to $18.65 per square foot from $13.87, and commercial/retail rates to $29.42 from $22.23. Conversely, the average office lease rate decreased to $14.18 per square foot from $18.06, reflecting the evolving dynamics of the market and the varied mix of properties leased.

Commercial sales, however, experienced a downturn, totaling 211 transactions in Q3 2023, down from 265 in the same quarter the previous year. This decline was observed across all sectors, with industrial sales dropping to 97, commercial/retail to 90, and office sales to 50.

The commercial real estate market continues to be influenced by the lingering effects of the COVID-19 pandemic, such as the rise in remote working and shifts in retail trade, alongside the broader economic implications of higher borrowing costs. These factors collectively shape the demand and transaction dynamics in the commercial real estate landscape.

The “All Leasing Activity (Sq. Ft.)” chart summarizes total industrial, commercial/retail and office square feet leased through Toronto MLS®regardless of pricing terms.

The “All Sales Activity” chart summarizes total industrial and commercial/retail and office sales through Toronto MLS® regardless of pricing terms.

RESIDENTIAL CONDOMINIUM SALES STATS

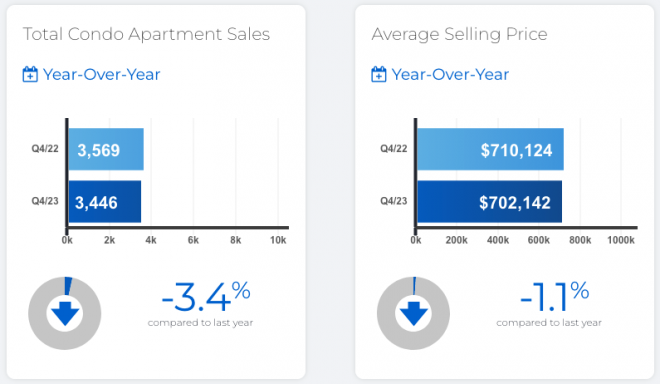

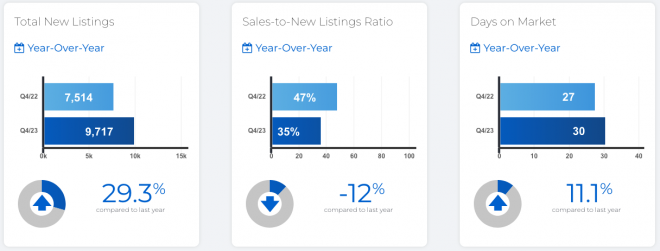

As as January 31, 2024, the Greater Toronto Area (GTA) witnessed a historic low in condominium apartment sales for the fourth quarter of 2023, influenced by high borrowing costs affecting affordability. Despite this, active buyers enjoyed a wide selection, leading to slightly lower average selling prices compared to the same period in 2022.

Condo sales totaled 3,446 in Q4 2023, a 3.4% decrease year-over-year, while listings surged by over 29%. This discrepancy resulted in a more balanced market. The average condo selling price in the GTA stood at $702,142, a 1.1% decline from $710,124 in Q4 2022. In Toronto, the average price fell to $720,456, marking a 2.4% decrease from the previous quarter.

TRREB Chief Market Analyst Jason Mercer noted that condo prices have remained stable over the past year, with buyers wielding significant negotiating power due to abundant supply. With anticipated lower borrowing costs and high rents, demand for condos is expected to rise in 2024, positioning them as a vital entry point to homeownership.

RESIDENTIAL CONDOMINIUM RENTAL STATS

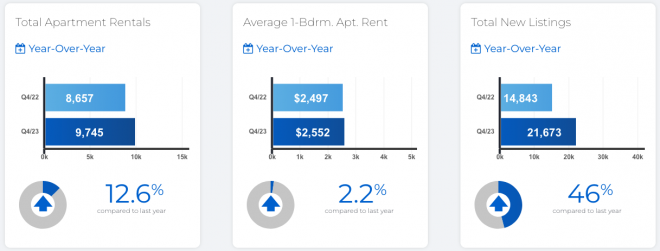

Condominium apartment leasing in the GTA saw robust activity in Q4 2023, with lease transactions via TRREB’s MLS® marking a significant 12.6% year-over-year increase, totaling 9,745. Listings for rent also rose, but at a faster rate of 46%, offering renters more options and moderating rent growth compared to earlier in the year.

TRREB President Jennifer Pearce highlighted the sustained demand for rental housing, fueled by population growth from immigration and non-permanent migration. Despite high borrowing costs deterring potential homebuyers, the rental market remains tight. Yet, an increase in rental listings in the latter half of 2023 has somewhat eased the pace of rent increases.

Average rents for one-bedroom and two-bedroom condominium apartments in Q4 2023 climbed to $2,552 and $3,267, respectively, marking rises of 2.2% and 3.7%. The GTA’s rental market is expected to stay competitive due to continued population growth, though the recent uptick in listings has provided some relief.

In conjunction with the Toronto Regional Real Estate Board (TRREB) redistricting project, historical data may be subject to revision moving forward. This could temporarily impact per cent change comparisons to data from previous years.

Distinctive Real Estate Advisors Inc., Brokerage is pleased to present a recap of the latest market forecast release and January highlights from the Toronto Regional Real Estate Board (TRREB).

We’d welcome an opportunity to discuss the Tighter Market Conditions in Jan-2024 Compared to Previous Year. If you have any questions about our services, please contact our team.

Comments