Has anyone ever told you that almost all of your mortgage payments in the first few years go to paying interest and very little towards paying off the principal balance? If you’ve ever heard this, chances are the person saying it remembers what mortgage rates were like in the 1980s and 1990s.

Back then, high rates meant that very little principal was paid off in the first few years. But low interest rates today mean that a greater share of your mortgage payment goes to paying off principal and building equity right off the bat and less goes to paying the bankers.

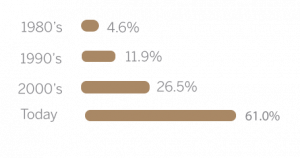

In fact, at prevailing interest rates, 61 % of the average homeowner’s very first mortgage payment goes to paying off principal. This was just 4.6% in the 1980s and only 11.9% in the 1990s:

TO PUT THIS IN PERSPECTIVE

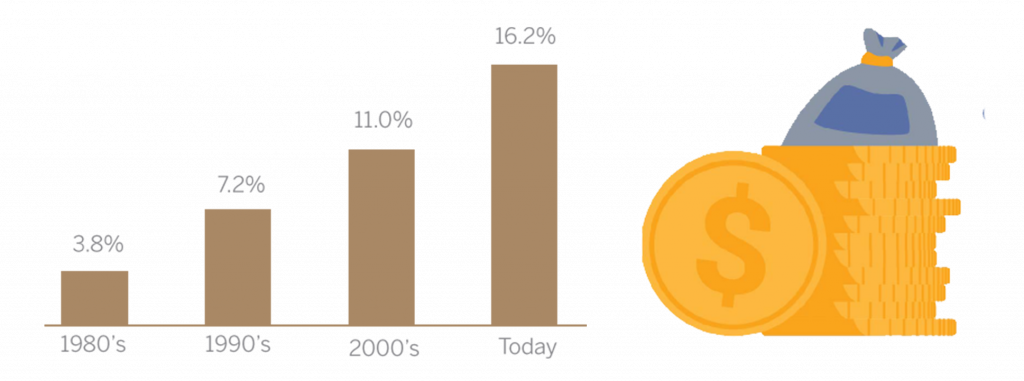

At the end of a standard 5-year term, homeowners in the 1980s had paid off just 3.8% of the outstanding mortgage (assuming a 25-year amortization). At today’s ultra-low rates, homeowners pay off 16.2% of their total mortgage in the first 5 years on average.

This means that no matter what happens to house prices, the average homebuyer today will have paid off an unprecedented 16% of their mortgage in just 5 years.

TODAY’S LOW INTEREST RATES – are an incredible and underappreciated mechanism for building wealth.

We’d welcome an opportunity to discuss this important report or if you have any questions about our services, please contact our team today.

We’d welcome an opportunity to discuss this important report or if you have any questions about our services, please contact our team today.

Comments