Distinctive Real Estate Advisors Inc., Brokerage is pleased to present, in collaboration with Ben Rabidoux, Founder of Edge Realty Analytics, this timely research and insight into the Bank of Canada rate increase, inflation rising, and a national home sales update.

Inflation in Canada

- Markets and economists are expecting the Bank of Canada to embark on one of the most aggressive tightening cycles in the central bank’s history as officials race to bring inflation back under control.

- The Bank of Canada raised the overnight rate at the March 2nd, 2022 meeting to 0.5% from 0.25%. The Bank noted that, “As the economy continues to expand and inflation pressures remain elevated, the Governing Council expects interest rates will need to rise further.”

- Headline inflation came in at 5.7% in February, a new 30-year high.

- Their measures of core of inflation continue to spike and now average 3.5%. Well above their target band of 1-3%.

National home sales update – Largest increase in active listings since 2010

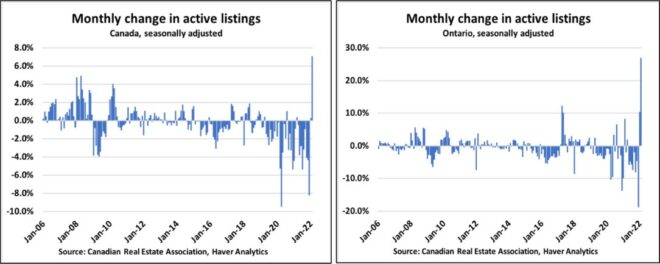

- Active resale inventory across the country ended February, 7% higher than January on a seasonally adjusted basis. The largest increase since data is available back to 2003.

- Inventory jumped by over 6,000 in one month. The largest jump since April 2010.

- There are still fewer than 100,000 active listings nationally, roughly 50% below pre-COVID levels.

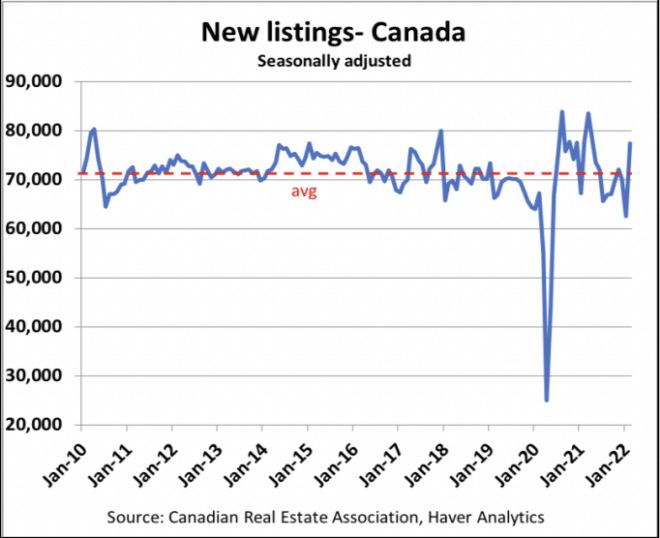

- The sudden increase in inventory is primarily due to a massive 23.7% month over month (m/m) surge in new listings coming to market.

- 205,000 new homes have been completed in the past year with a record 310,000 still under construction.

- Construction activity is very high. Anticipating completions to remain near record levels right through the year, this means more supply to enter into the resale market.

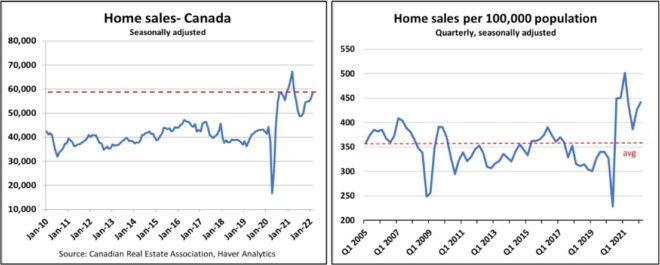

Pullback in demand still likely as sales remain 25% above normal levels

- Home sales nationally jumped 4.6% m/m last month. They remain 25% above average levels on a population- adjusted basis.

- Evident that we are still seeing significant demand pulled forward, likely as buyers attempt to front-run further Bank of Canada rate hikes.

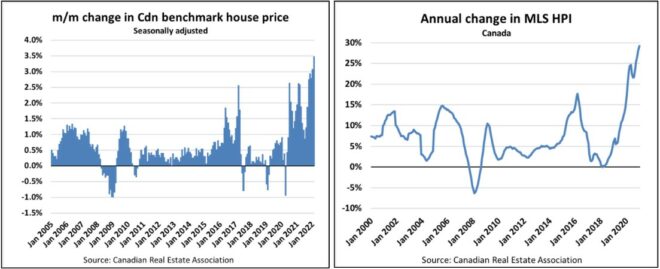

Market still extremely tight, record jump in price

- With the significant supply build, months of inventory remained stable at a record low of 1.6 where it’s hovered now for 3 months.

- February saw the single largest monthly increase in the seasonally adjusted national HPI on record at 3.5% m/m and 29% year over year (y/y).

- The typical home in Canada is now $200,000 more expensive than a year ago.

A massive misallocation of capital or the new normal?

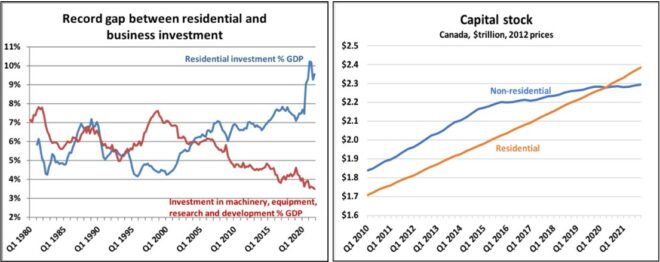

- Housing and household consumption, these two components have accounted for 85% of real GDP growth over the past 5 years.

- Arduous for the Bank of Canada to rein these in without causing significant collateral damage. Likely that we’ll see 8 hikes by the end of 2023.

- Total residential investment is now nearly 3 times as large as business investment in machinery, equipment and R&D.

- Residential investment in Canada remains north of 40% of all investment in the country.

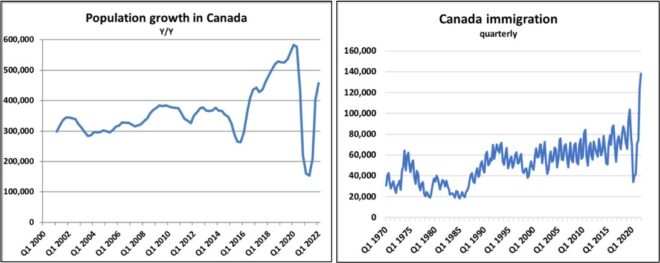

Immigration hits new highs just as housing starts slow

- Population growth continues to recover from the COVID lows, hitting 460k y/y last quarter.

- With potential to increase if the feds hit their 432,000 target this year.

- Housing has started to cool in recent months, with the 6-month trend falling to 252,000 annualized from a high of 291,000 in the middle of last year.

- Dwellings under construction hit fresh all-time highs in February. Plenty of condos and rentals, not enough single-family.

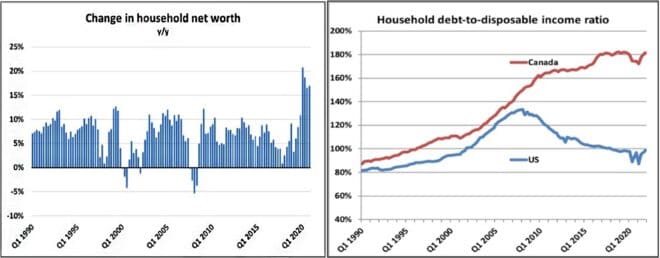

Household credit update: Insolvencies stable, balance sheets look solid

- Homeowner equity hit new all-time highs at nearly 77%. Indicating the average homeowner has a mortgage worth 23% of the value of the home.

- Household net worth surged by nearly 17% y/y. Real estate hit a record share of household asset.

- Debt-to-income ratios increased to 180%, but Canadians have nearly $7 in assets for every dollar of debt owed, and that figure keeps rising.

- The debt service ratio ticked up to just under 14% but remains well above pre-pandemic levels.

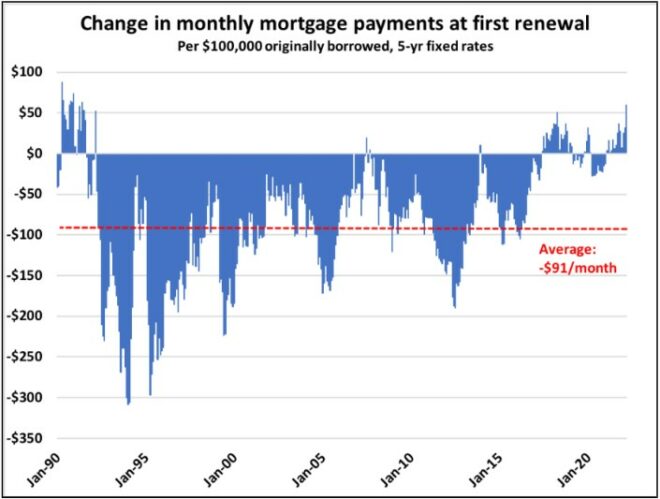

Borrowers are beginning to feel the pressure of rising rates

- The mortgage renewal gap has hit the highest level since the early 1990s. This metric measures the change in monthly payments on fixed rate mortgages at first renewal for every $100,000 originally borrowed.

- The latest reading puts the gap at $60, which means a borrower who took out a $400,000 fixed rate mortgage in March 2017 is facing an increase in payments of $240 per month if they opt for the same term today.

- The household effective interest rate. Is now seeing the steepest annual increase since 2005.

- 5-year bond yields are surging and have now seen the sharpest 1-month increase in over 20 years.

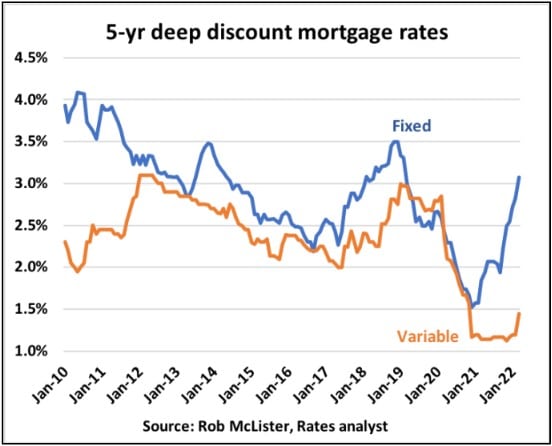

- The best discounted 5-year fixed mortgage rate available today is 3.07%, up 113bps from the September 2021 lows.

- The best discounted variable is 1.44% with most big banks closer to 1.95%.

The popularity of variable rate products continues to rise even with the threat of further rate hikes. Variable originations surged 97% y/y in January. They accounted for 57% of new mortgages and are now nearly 30% of all mortgage balances outstanding. Although the recent runup, mortgage rates remain way below the rate of inflation.

We’d welcome an opportunity to discuss the perspectives presented in this Bank of Canada hikes, signalling more to come as inflation rages. If you have any questions about our services, please contact our team today.

Comments