HIGH INFLATION MAKES LIFE HARDER FOR EVERYONE

Distinctive Advisors is pleased to provide you with the highlights from the Wednesday, November 22nd speech by Governor Tiff Macklem, Bank of Canada (“BoC“), outlining how high inflation is hurting Canadians and how monetary policy is working to bring it down. He also explains why the Bank of Canada must stay the course in its inflation fight.

The economy and job market have done quite well since the worst of the COVID-19 pandemic.

But Canadians aren’t happy—and high inflation is a major reason why.

Almost 9 out of 10 people responding to BoC‘s Canadian Survey of Consumer Expectations (“CSCE“) said high inflation has made them feel worse off. BoC can see the impacts of high inflation in other ways too:

- Labour strikes have increased, with employers and workers struggling to agree on fair pay.

- Businesses have been raising their prices more often than usual, and by larger amounts.

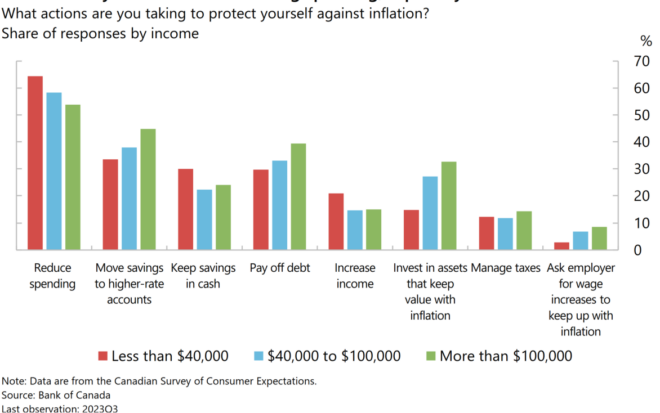

- The CSCE survey show families are spending less and trying to find cheaper goods and services.

High inflation is particularly hard for lower-income Canadians. They have little savings to buffer higher prices, and necessities—food, rent, gasoline—have had some of the fastest price increases.

LOW UNEMPLOYMENT IS NOT BOOSTING CONSUMER CONFIDENCE

INFLATION WAS ESPECIALLY HIGH AND HARMFUL IN THE 1970s

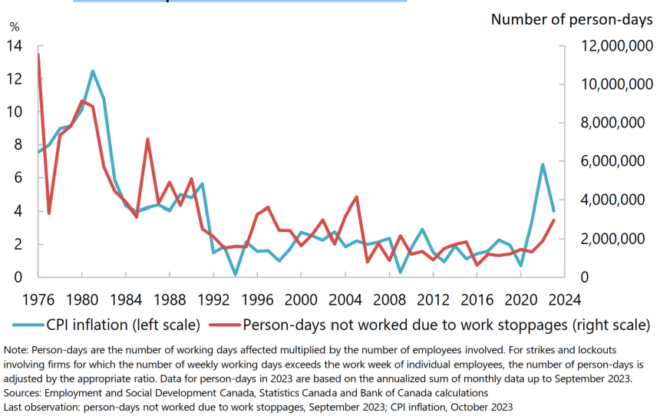

Back in the ‘70s, just as now, global economic forces caused prices to climb around the world. However, inflation rose higher then, and remained high for longer, peaking at almost 13% and averaging more than 7% for the decade.

With such high inflation throughout the ‘70s, that decade also had a lot of strikes— many of which were long and heated. People felt ripped off because they’d get raises but prices would keep on rising.

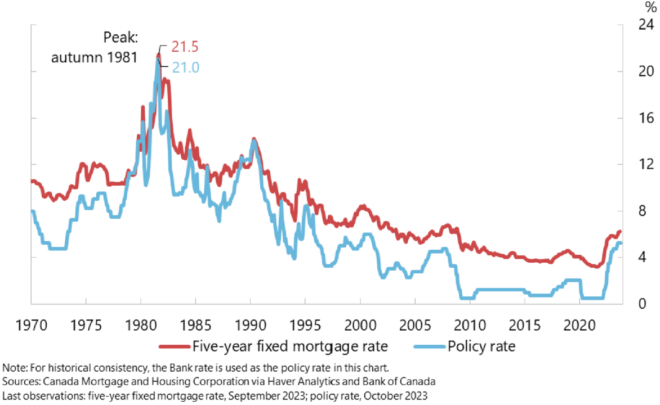

Policy-makers tried to get inflation down, but their measures were either ineffective or too timid. Eventually, it took very high interest rates and a deep recession with high unemployment to lower inflation.

IN 1981, THE POLICY RATE AND MORTGAGE RATES CLIMBED ABOVE 20%

ADVANTAGES WE HAVE THIS TIME AROUND — WHAT’S DIFFERENT TODAY?

Tiff Macklem expressed confidence that we will get back to low inflation more quickly and at lower economic cost than we did in the 1970s. In his opinion, we have learned the bitter lessons from that time. And we’ve got some distinct advantages this time around: an inflation target with a strong track record and a forceful and sustained response.

BoC began targeting inflation more than 30 years ago. Since 1995, their inflation target has been 2%, the middle of the band of 1% to 3%. Between then and when the pandemic hit in 2020, inflation averaged 1.9% and was within that band 80% of the time — BoC’s expressed view is a remarkable success compared with the 1970s and 1980s.

Click here for a transcript of the full remarks from November 22nd, 2023 by Tim Macklem, Governor of the Bank of Canada.

Is your mortgage renewal coming up? Call us to discuss your options and to:

- Evaluate your current market position and help you assess your future market position based on your plans and goals;

- Walk you though the impacts of your next mortgage renewal on your real estate portfolio; and to

- Help assess your options including holding real estate, disposing of it, acquiring it or leasing it.

Call us at 416-925-3140 or 613-366-8525, or e-mail us today.