Highlights:

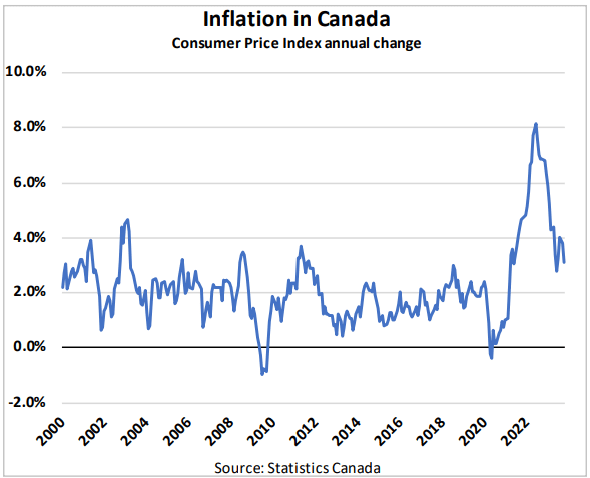

- Inflation slows: October inflation slowed more than expected to 3.1%, contributing to a pause in Bank of Canada rate hikes

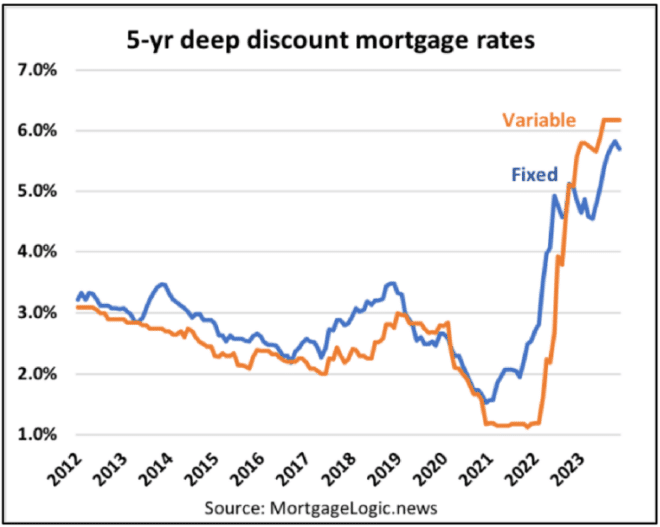

- Mortgage rates remain high: Despite lower bond yields, fixed mortgage rates are high, but expect rates to come down another 10 – 20 basis points (“bps”) over the next couple weeks if bond yields hold

- Home sales slide across the country: Home sales were down across the country in October, led by Alberta (-8.3%)

Canada’s headline inflation rate slowed more than expected in October, coming in at 3.1% annually compared to expectations of 3.2%. The slowdown was due primarily to a 6% monthly decline in gasoline prices.

Slowing inflation—together with weakening GDP growth (Q3 is shaping up to be flat or slightly down) and a rising unemployment rate (up 0.7% in the past 6 months) —paints a compelling picture of an economy shifting into a lower gear.

It certainly looks at this point like the Bank of Canada is done hiking for the foreseeable future. Markets are now pricing in a Bank of Canada pause until April 2024, followed by 75 bps of rate cuts by the end of next year.

Mortgage Market Update

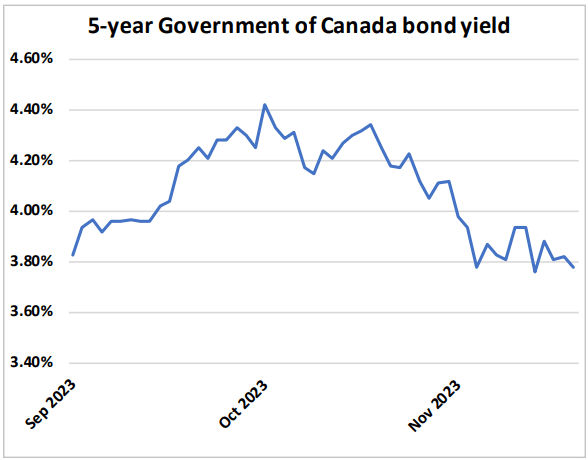

Government bond yields are a major determinant of fixed mortgage pricing. The bellwether 5-year Government of Canada bond yield is reflecting the likelihood of rate cuts in 2024 and has fallen by roughly 50 bps, or 0.5%, over the past six weeks.

Meanwhile, fixed mortgage rates—which are heavily influenced by bond yields —have remained stubbornly high, with average deep-discounted rates down by just 10 bps from the recent peak.

Lenders have a long history of quickly raising mortgage rates to match bond yields on the way up, but being slow to pass on cost savings when bond yields fall. We should expect rates to come down another 10 – 20 bps over the next couple weeks if bond yields hold here.

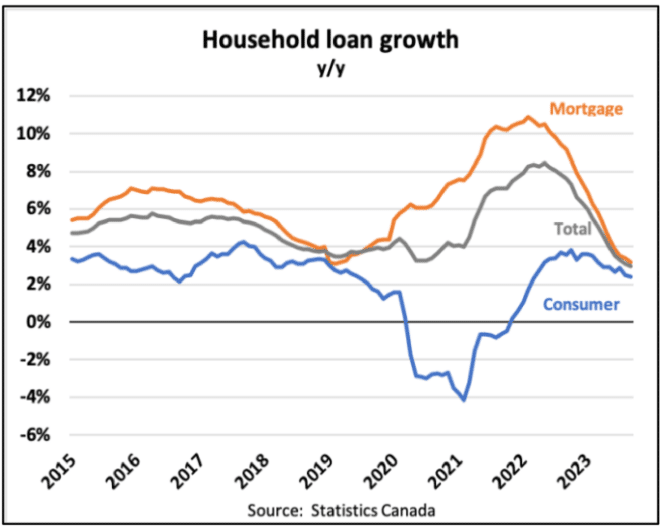

Household loan growth falls below 3%

With rates still elevated, household borrowing remains tepid. Loan growth fell to just 2.9% year-over-year in September…the first sub-3% “print” since 1983. Mortgage growth slowed to just 3.2% year-over-year and 0.2% on a monthly basis. It would be even lower were it not for the impact of negatively amortizing static-payment variable rate mortgages at several big banks.

Mortgage originations remain roughly 40% below peak and will likely remain below normal levels for the next year before the wave of mortgages originated in the 2020-to-early 2022 boom era begin to renew in 2025.

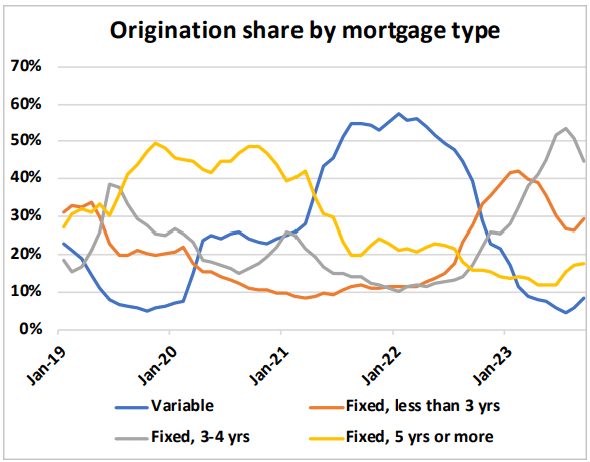

New originations continue to be heavily skewed to shorter-term fixed rate loans, but we are seeing some signs that that popularity of variable rate loans is beginning to rise again, having grown from 5% of originations to closer to 10% in the past two months.

Affordability eases slightly

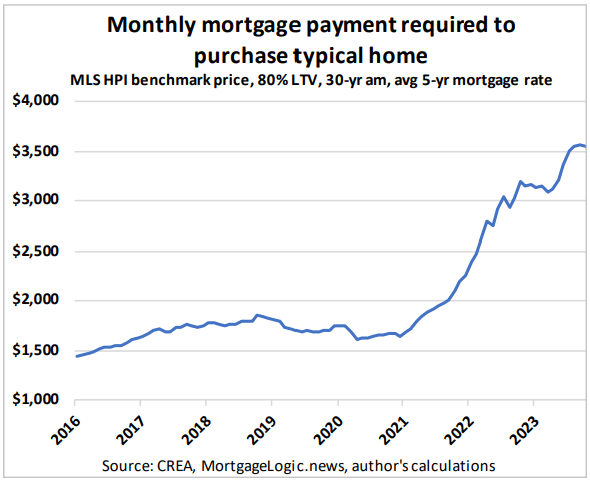

Any improvement in affordability, however modest, is welcome news these days. The monthly mortgage payment required to purchase a typical home in Canada fell by $59 in October as a function of a slight decline in both interest rates and house prices.

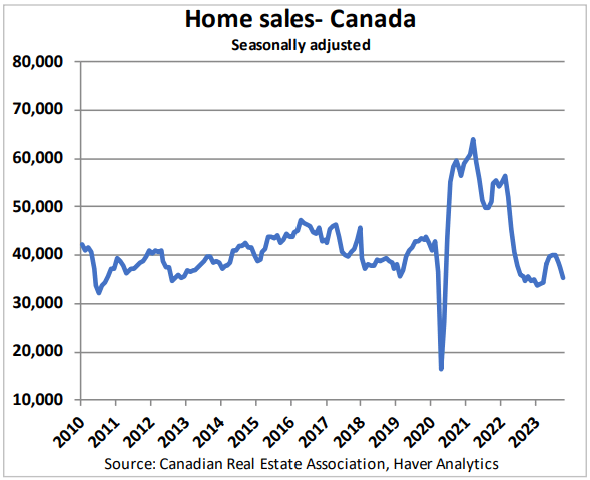

With affordability still deeply strained, demand remained under considerable pressure in October. Seasonally adjusted home sales nationally posted the largest monthly decline since June of last year, falling 5.6% month-over-month. All big provinces posted substantial declines led by Alberta (-8.3%) and British Columbia (-6.9%). Ontario saw a 5.5% decline while Quebec saw a sales drop of 5.1%.

The market balance continues to tilt towards buyers with the sales-to-new listings ratio falling below 50% nationally for the first time since 2012.

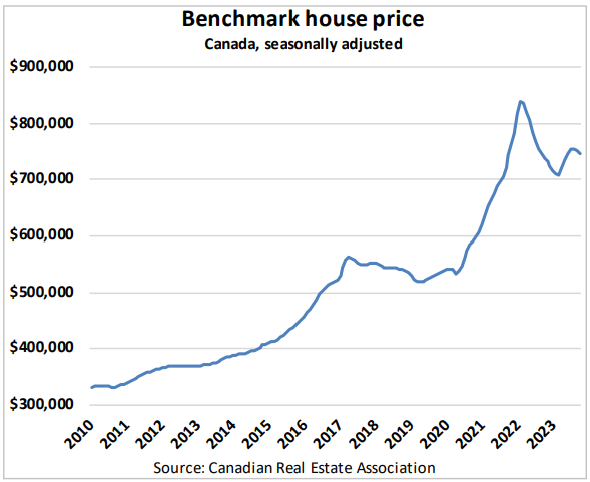

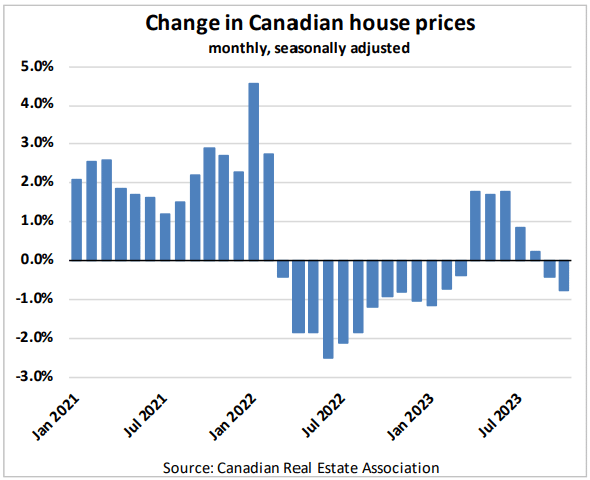

Consequently, house prices have come under renewed pressure with the MLS House Price Index posting a 0.8% monthly decline in October.

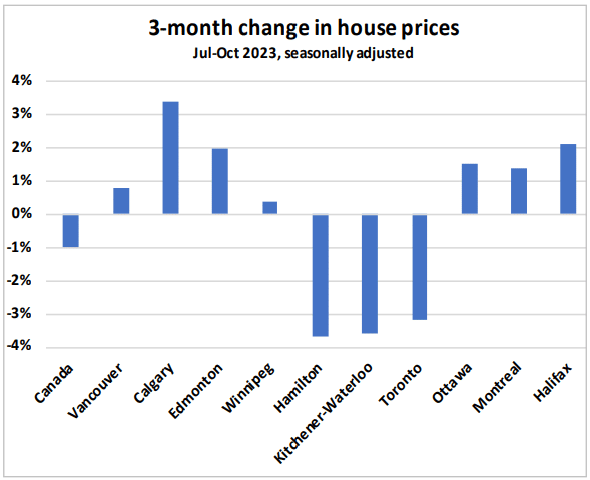

It’s important to remember that there is no single “Canadian” real estate market. Regional dynamics vary widely, and this becomes abundantly clear when we look at the change in house prices over the past three months in major Canadian cities. It’s clear that major metros in southern Ontario are driving the national weakness, while Alberta and eastern Canada continue to perform well for now.

*Any forecasts contained in this report are accurate as of the date indicated

We’d welcome an opportunity to discuss the perspectives presented in this Q3-2023 Housing and Mortgage Market Review. Please contact our team today at (416)925-3140 or (613)366-8525 or by e-mail.