Distinctive Real Estate Advisors Inc., Brokerage is pleased to present, in collaboration with Ben Rabidoux, Founder of Edge Realty Analytics, this timely research and insight into the market influencers to our residential, commercial and mortgage fundamentals.

Key Takeaways:

- The war on Ukraine has completely upended previous assumptions around the state of the Canadian consumer. Recession risks are rising. The silver lining: 6 rate hikes looks even more unlikely this year.

- Definite shift in the resale market in Toronto.

Economic Commentary: War and recession risk

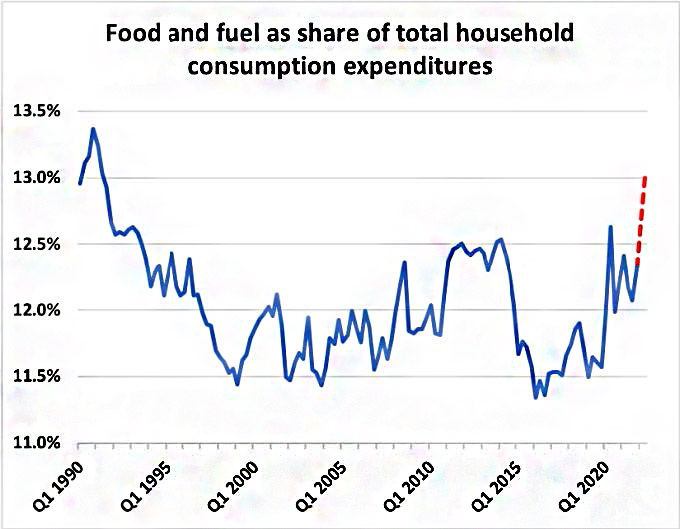

- Expenditures on food and fuel are set to hit 30-year highs

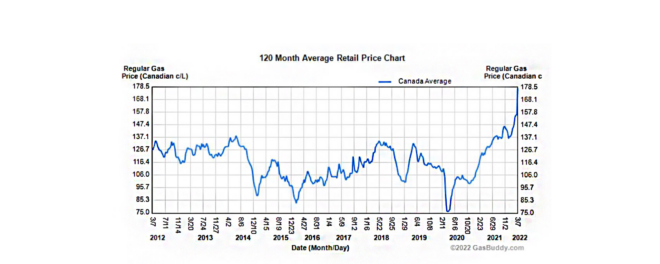

- Gasoline prices have hit record highs in Canada in recent weeks at just under $1.80/L nationally. That’s right in-line with the inflation-adjusted peak from 2008.

- Based on gasoline futures priced in Canadian dollars, it’s not outside the realm of possibility that we hit $2.20/litre nationally within a few weeks.

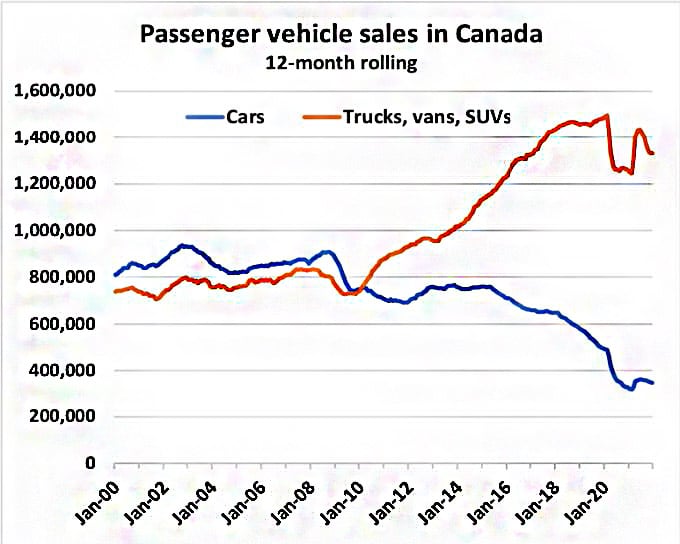

- The typical Canadian vehicle is far more fuel efficient than it was 14 years ago, but Canadians by and large have taken advantage of better fuel efficiency and relatively cheap gas to make a massive pivot into trucks and SUVs since 2010:

Surging Food Prices

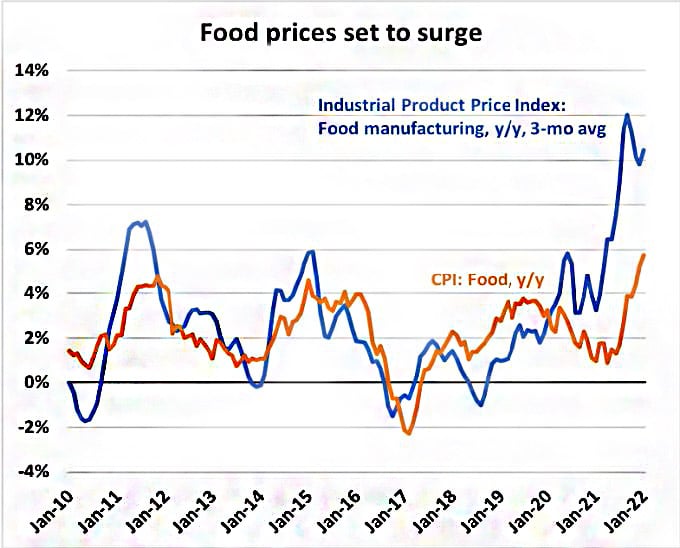

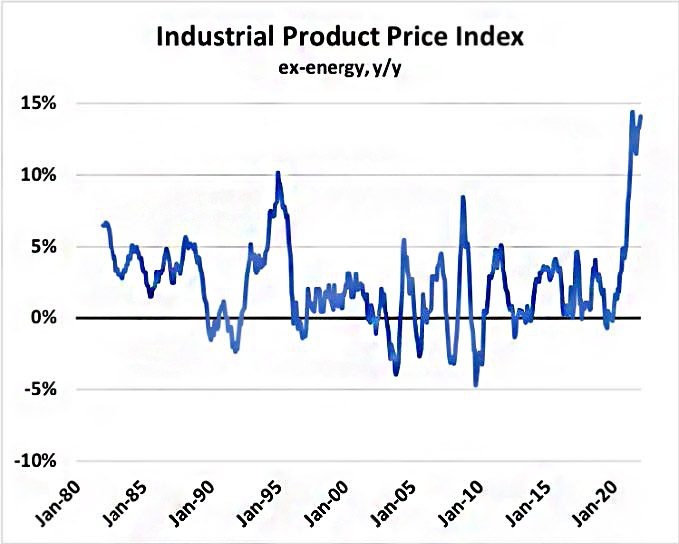

- On the food front, even before the runup in agricultural commodities and fertilizer prices, there was reason to believe that food inflation in the consumer price index (CPI) was set to hit double digits:

- The Ukraine conflicts have yet not impacted the grocery stores. As Ukraine accounts for 10% of global wheat exports. With planting season just around the corner, if this conflict does not end soon, we risk a massive hit to global wheat production.

- In addition, almost 20% of global exports come from Russia. The consequences of this could potentially turn into a global food security issue. Which in return can result in a higher increase on food prices, possibly endangering emerging economies.

- The latest household expenditure data for Q4 shows that the share of spending on food and fuel expenditures has risen sharply off levels from 2015-2020.

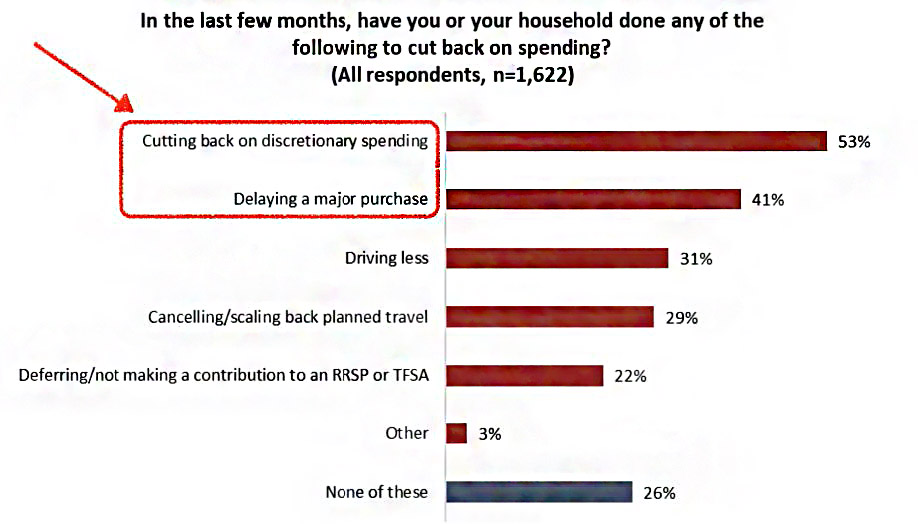

- Related,Angus Reid released the results of a survey this week looking at inflation in Canada. Half of respondents report cutting back on discretionary spending in recent months:

This aligns with the December retail sales report which was particularly weak.

- Declines were widespread across Canada including in regions where there were no new public health measures.

- E-commerce sales plunged 10.3% month-over-month, which is the opposite of what happened during prior waves.

- Declines were most pronounced in highly discretionary segments like furniture and home furnishings 11.3%), building materials and garden equipment (-5.0%), clothing and accessories (-9.5%), and sporting goods and hobby retailers (-2.5%).

Disposable incomes decline, real wages negative

- The latest current and capital account data for Q4 showed the second consecutive quarterly decline in aggregate household disposable income which fell 1.3% quarter-over-quarter and is now down 1.7% over the past 2 quarters.

Household effective interest rates rise, up 50bps over last year

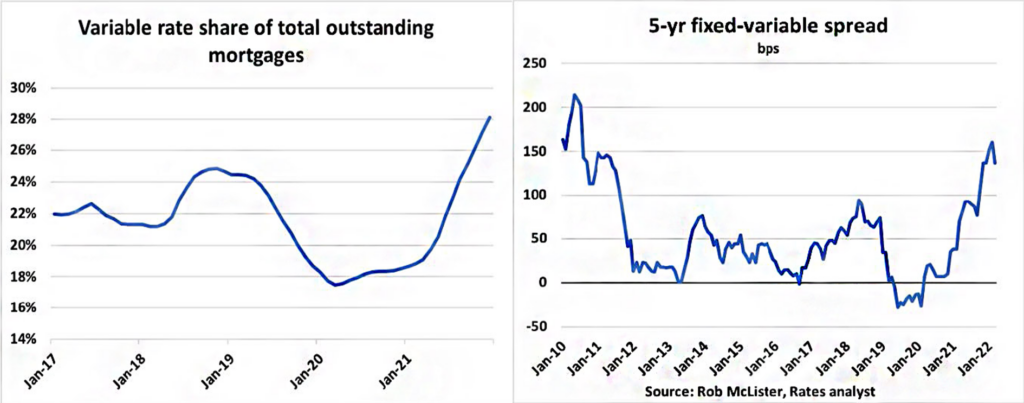

- The Bank of Canada bumped the overnight rate to 0.50% last week, a 25bp increase. Variable rate loans are already being repriced as banks raise the prime lending rate to 2.7%.

Fixed & Variable Remains Near the Highest in 10 Years:

Savings still high but falling quickly

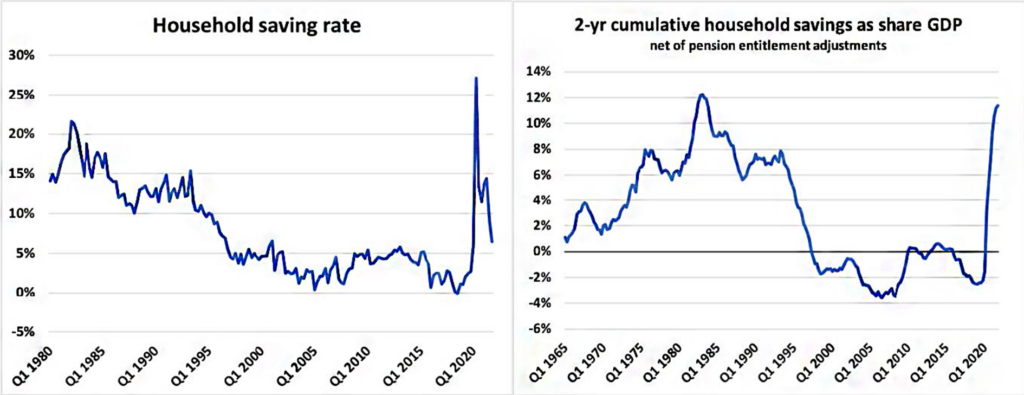

- The headline household savings rate slipped to 6.4% in Q4, but once pension entitlement adjustments are stripped out it fell to just 3.3%. Still, that leaves cumulative 2-year savings at over $280B, which represents over 11% of GDP the largest since 1980:

- The bottom line is that households are under pressure which could matter a lot to an economy like ours which has relied on housing and consumer spending to drive 85% of GDP growth over the past 5 years.

Subtle Signs of Change in Toronto Housing as Inventory Levels Surge

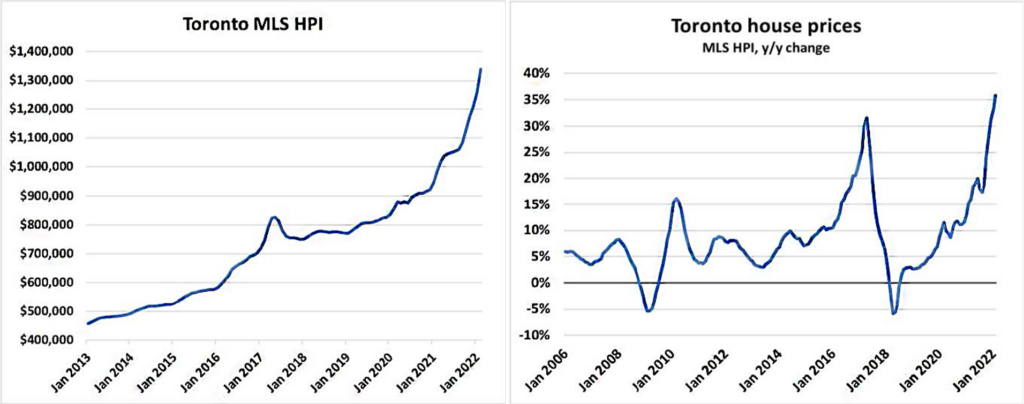

- The Toronto Regional Real Estate Board MLS® Housing Price Index (HPI) just posted the largest monthly increase. On record at 6.5% m/m, and it’s averaged an absurd 4% monthly gain over the past 6. That’s helped push the y/y increase to a record 35.8%, which represents an increase in value of $354,000 for the typical home.

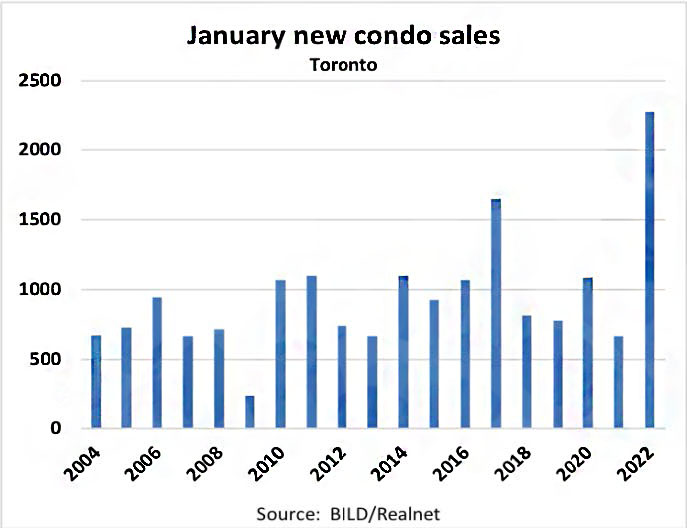

- Pre-construction condo sales are always a good barometer of speculative demand since as much as 80% of these sales go to investors and not end users. It’s telling that January sales set a record by a wide margin, significantly eclipsing the prior record from 2017.

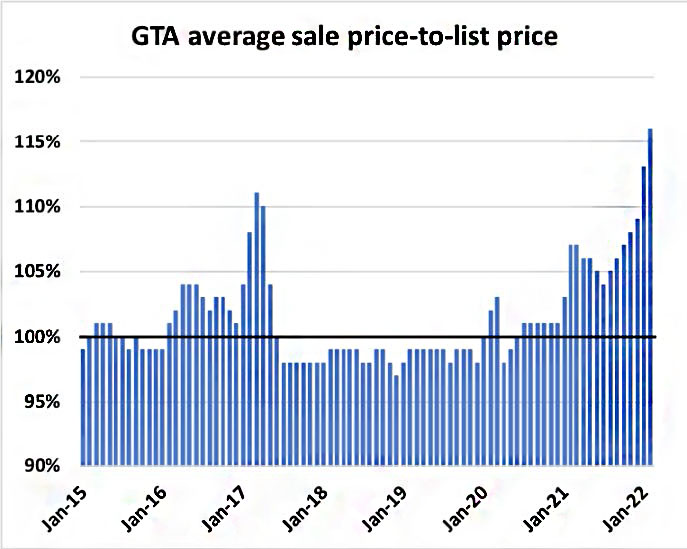

- The average home is selling for a record 115% of list price last month.

- Active listings at the end of the February were 2,800 higher than at the end of January. Nearly double the typical monthly build for this time of year.

Demand remains artificially inflated (home sales per 100,000 Canadians remains at record highs) and supply has been constrained via new listings kept artificially low. Both of those dynamics look set to reverse.

We’d welcome an opportunity to discuss this perspectives presented in this Deep Dive into War, Recession, Risk & Housing or if you have any questions about our services, please contact our team today.

Comments