Key Takeaways June 2022:

- Recent comments from the Bank of Canada suggest that they may have to raise rates more aggressively than previously believed. Bond yields surged and now risk another round of fixed rate hikes.

- The housing market in Toronto continues to weaken at the margins, but we’re still waiting for distressed sales to clear before getting a better read on the true state of the market.

- Steep decline in rental economics on new condo purchases is something to observe as it could portend a much steeper slowdown in demand going forward.

- The Bank of Canada hiked rates by 50bps as expected last week, but the more interesting takeaway was the tone in the press release on Wednesday and Deputy Governor Beaudry’s speech on Thursday.

Quote from Deputy Governor’s Beaudry’s speech:

” Price pressures are broadening and inflation is much higher than we expected and likely to go higher still before easing. This raises the likelihood that we may need to raise the policy rate to the top end or above the neutral range to bring demand and supply into balance and keep inflation expectations well anchored ”

Housing Prices

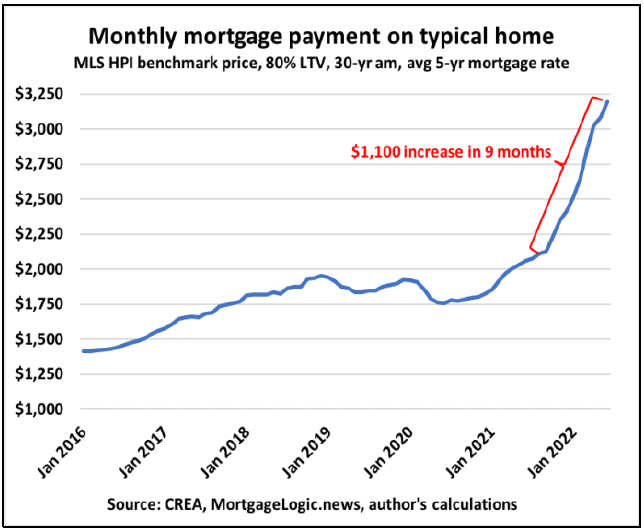

- Holding house prices flat at April levels and using prevailing rates, the monthly mortgage payment required to purchase the typical home in Canada has surged by $1,100 in the past 9 months.

- Residential real estate assets have never accounted for such a large share of household balance sheets, and they’ve also never been higher when compared to GDP (318% in Canada vs 176% in the US).

More price pressure in Toronto as sales tumble again, condo market weakens

- Rising interest rates continue to slam the brakes on housing markets in Ontario and BC….and that’s even with some residual rate holds still active in the market.

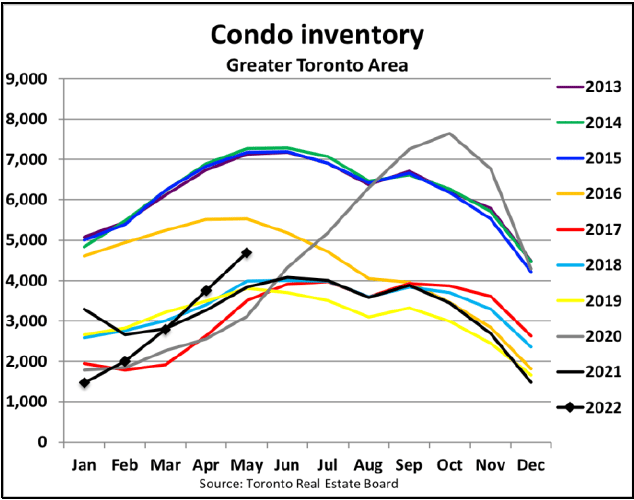

Condo Inventory rises as Home sales Deteriorate

- Home sales in Toronto plummeted another 9.3% m/m seasonally adjusted in May and are now down a whopping 34% in the past 3 months. On a y/y basis, sales were down 39% led by a 43% drop in detached sales in the suburbs.

- Condo inventory continues to build rapidly even though new listings are still at normal levels. Active listings were up 26% y/y and have now surged by 270% since the start of the year…the largest percent increase to start the year since the 1990s.

- Prices continue to slide with the seasonally adjusted average down another 3.1% on the month making the cumulative 3-month decline nearly 9%. This is the first time we’ve had 3 consecutive monthly declines since 2017

- Big price declines from peak are now being seen across southern Ontario. As an example, a home in Orangeville. This home sold conditionally in March for $995,000 but failed to close and was resold in late May for just $799,000.

Distinctive Real Estate Advisors Inc., Brokerage is pleased to present, in collaboration with Ben Rabidoux, Founder of Edge Realty Analytics, this timely research in today’s job market and economic insight on the current housing trends.

We’d welcome an opportunity to discuss the perspectives presented in this Bank of Canada Rising Interest Rates & Deteriorating Condo Sales. If you have any questions about our services, please contact our team.

Comments