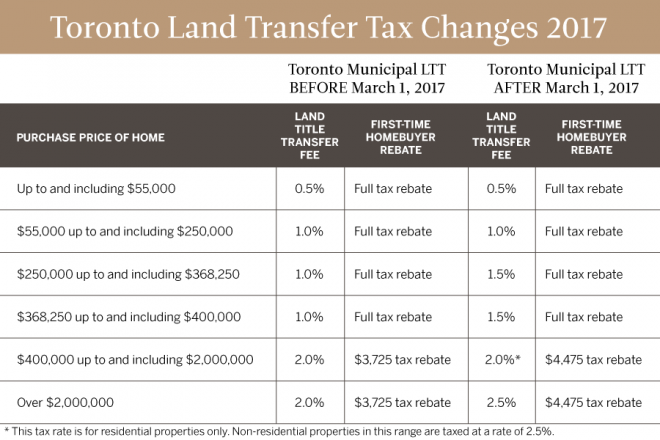

On February 15, 2017 the City of Toronto Council approved changes to the Toronto Land Transfer Tax that mean additional Land Transfer Tax (LTT) costs for some home buyers with a closing date on or after March 1, 2017.

The changes are:

- Added an additional LTT of 0.5% of the value of a residential or non-residential property from $250,000 to $400,000 (an additional $750)

- Added an additional LTT of 0.5% of the value of a residential property above $2 million

- Added an additional LTT of 0.5% of the value above $400,000 of a non-residential property

- Increasing the maximum allowed First-Time Home Buyer Rebate to $4,475, up from $3,725

- Amended the first-time home buyer rebate program eligibility rules to restrict rebate eligibility to Canadian citizens or permanent residents of Canada

TREB Efforts Achieved Significant Concessions — First-Time Buyers Protected

Toronto Real Estate Board (TREB) undertook a comprehensive campaign to oppose the proposed changes. As a result of these efforts, significant concessions were made to the proposals that went forward for City Council’s consideration as follows:

- Under the original proposal, first-time buyers would have been forced to pay an additional $475 in Toronto LTT. However, TREB pushed for an increase in the rebate from $3,725 to $4,475, meaning first-time buyers will not face an increase.

- Many first-time buyers would have lost eligibility for the first-time buyer rebate entirely, meaning a total LTT increase of $4,475. TREB pushed back and all first-time buyers will be eligible for a rebate.

- As a result of TREB’s efforts, first-time home buyers will NOT see any change.

Do you have the full picture of how municipal and provincial land transfer tax impacts Toronto real estate? Click here to view the breakdown of land transfer tax for Toronto homeowners.

Comments