Key Highlights from Bank of Canada’s June 5th Announcement:

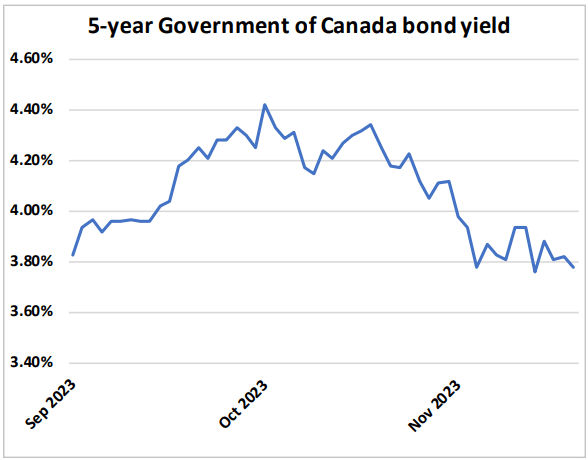

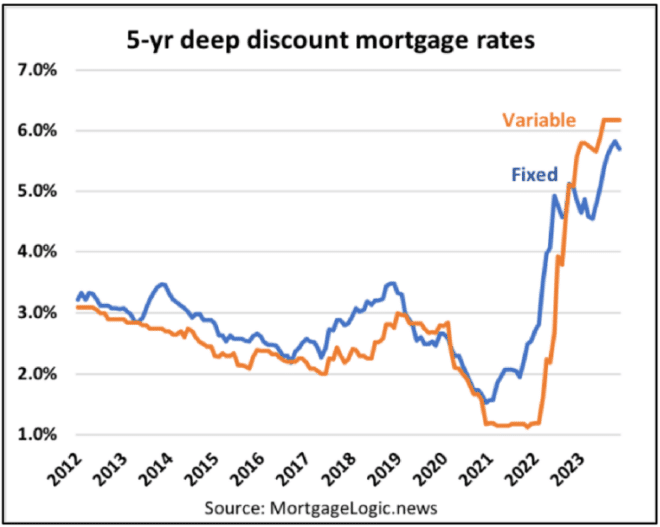

- Interest Rate Cut: The Bank of Canada has reduced its key overnight rate by 25 basis points to 4.75%, marking the first rate cut in four years. This decision comes after maintaining a 5% rate since July 2023. The cut aligns with market expectations and signals the beginning of a shift towards more normal interest rate levels.

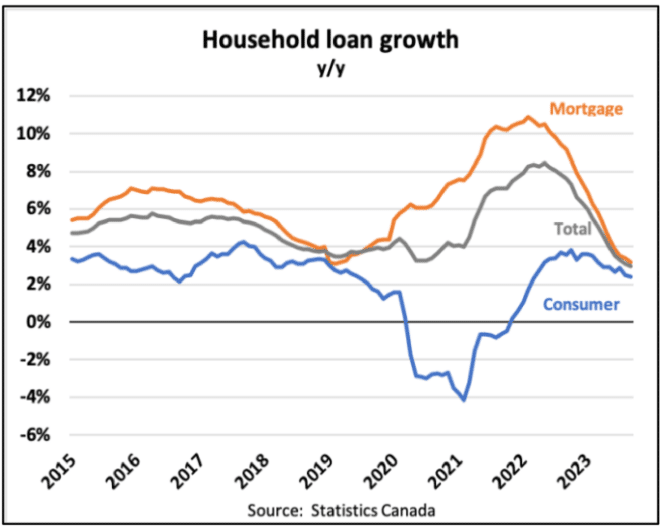

- Monetary Policy Shift: This move indicates the central bank’s easing stance after a prolonged period of battling inflation. Although the policy remains restrictive, it represents a step towards lessening the financial burden on borrowers.

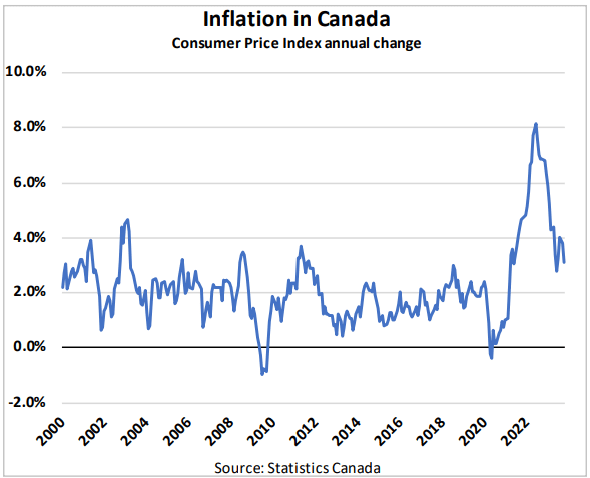

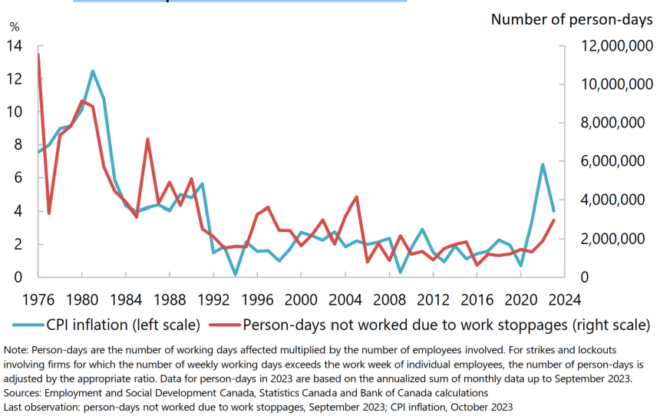

- Lower Inflation: Persistently lower inflation over the past year has enabled this rate cut. The Bank of Canada’s core CPI measures, including CPI trim, CPI median, and “supercore,” have shown significant easing, averaging 1.85% on a three-month annualized basis as of April 2024.

- Labour Market Conditions: The BoC highlighted softening labour market conditions, with employment growth lagging behind the working-age population, and wage pressures moderating gradually.

- Future Rate Cuts: The Bank of Canada forecasts continued easing of price pressures and expects headline CPI to reach the 2% target by 2025. While no specific pace for future rate cuts was provided, it is anticipated that there will be three more rate cuts this year, potentially bringing the overnight rate to 4% by the end of 2024.

The next scheduled date for announcing the overnight rate target is July 24, 2023. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR at the same time.

We’d welcome an opportunity to discuss the perspectives presented in this Bank of Canada Reduces Policy Rate by 25 Basis Points. Please contact our team today at (416)925-3140 or (613)366-8525 or by e-mail.